Beautiful Work Accounting Treatment For Dividend Paid

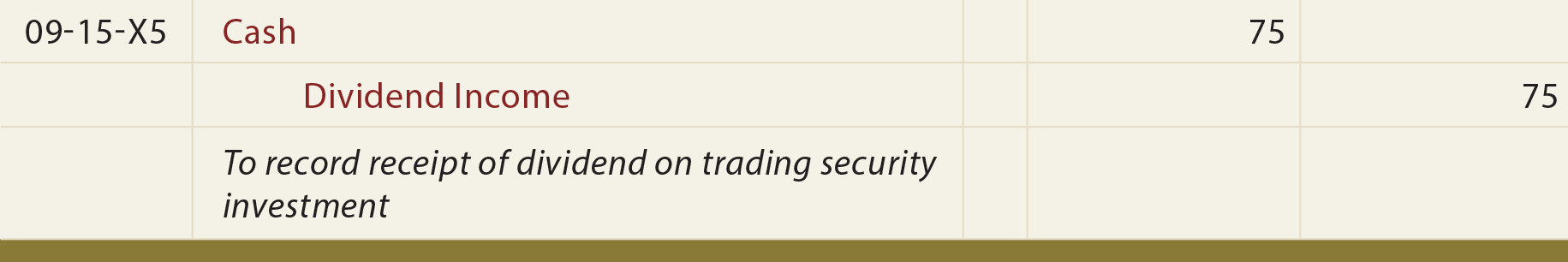

A general ledger account titled as dividends payable account is used to account for all declarations and payments of dividends to stockholders.

Accounting treatment for dividend paid. Penketh uses equity accounting in its consolidated financial statements for its investment in Ventor do we deduct 10000 6000 and then multiply this with our share of profits. Under consolidated accounting dividend payments are considered internal transfers of cash and are not reported on the public statements. Net profit after tax 72 will be a liability payable to shareholders.

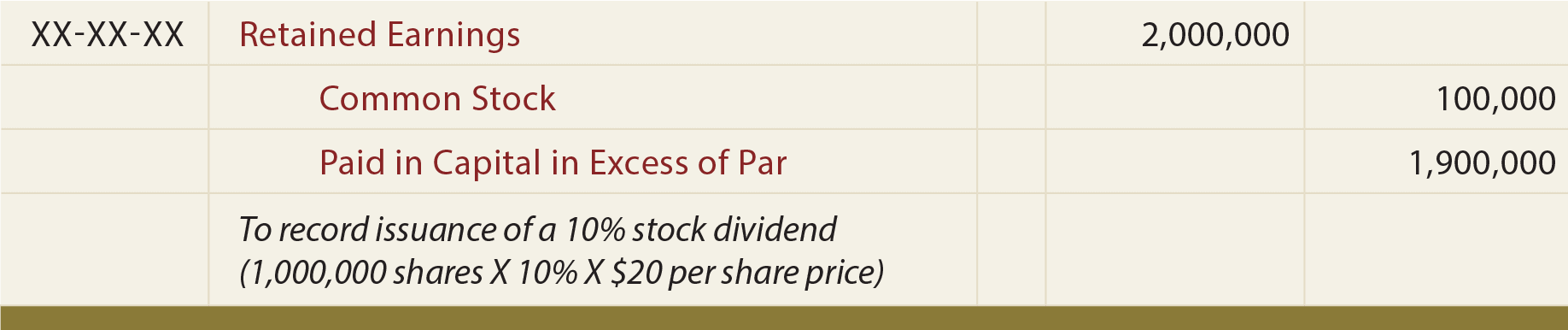

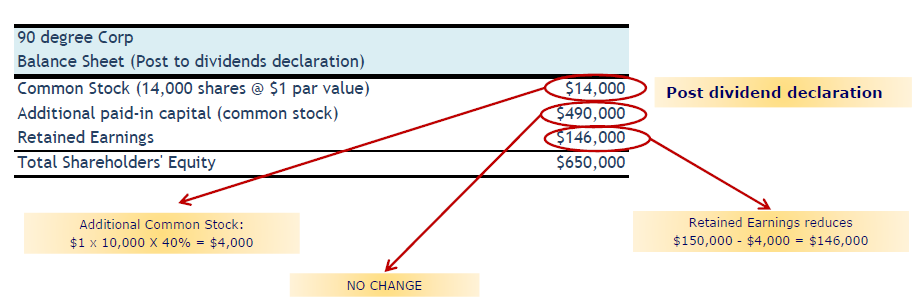

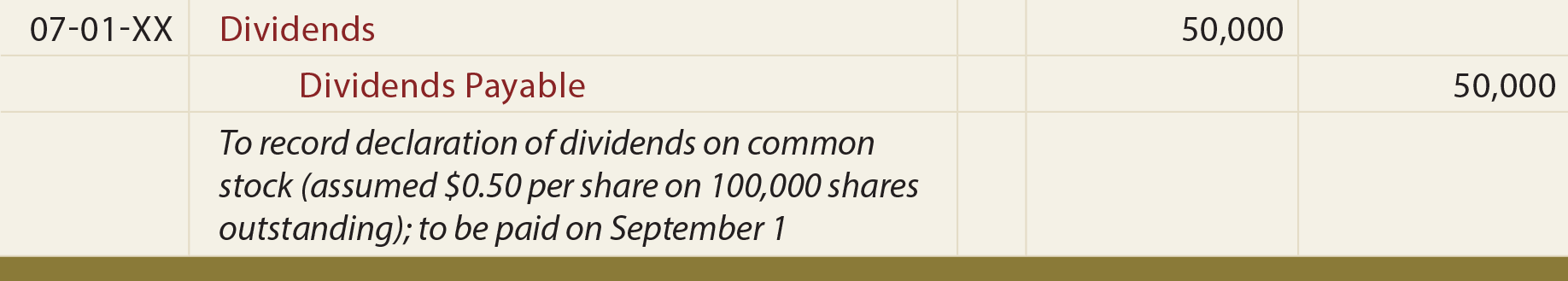

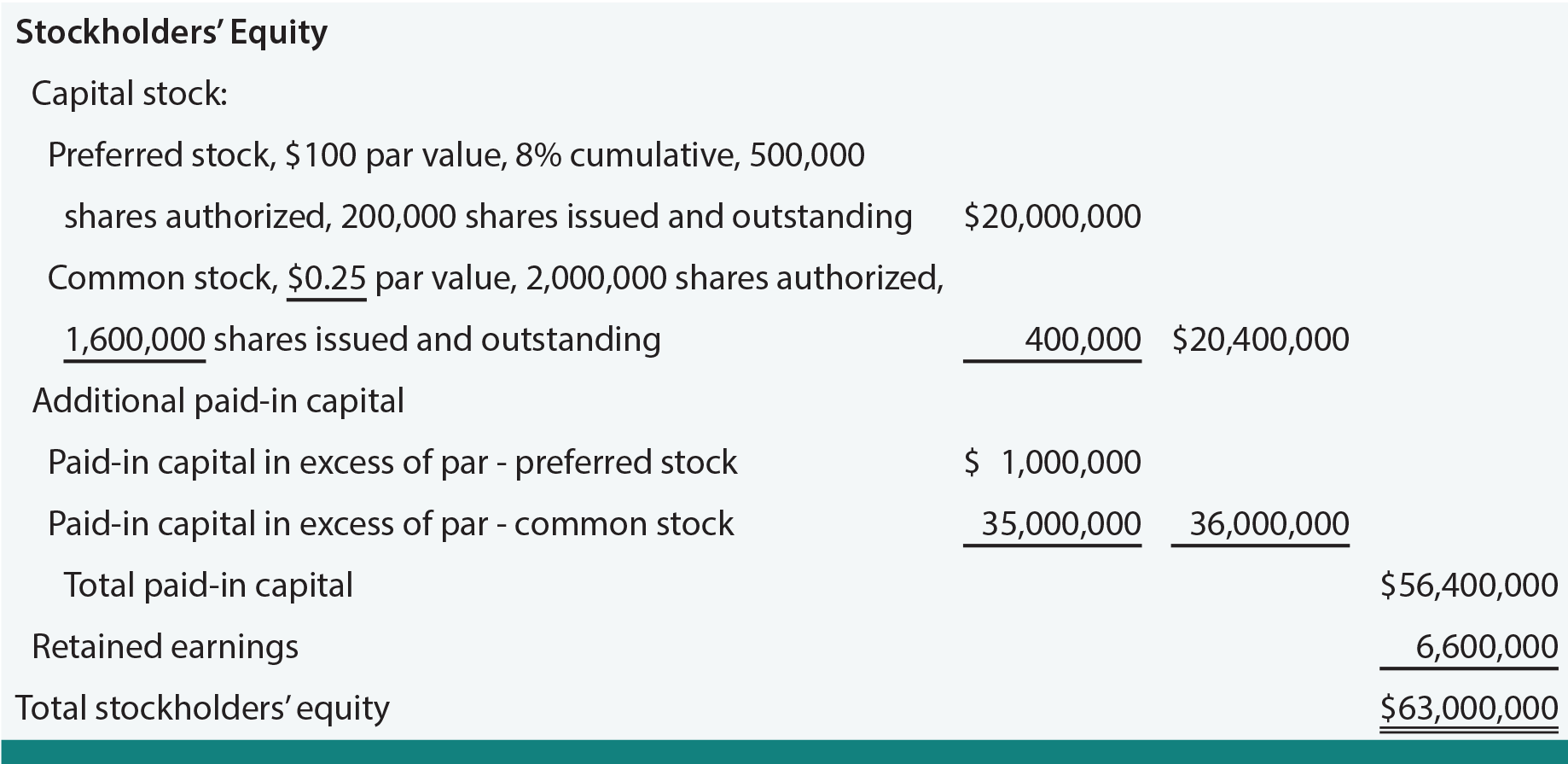

On the date that the board of directors declares the dividend the stockholders equity account Retained Earnings is debited for the total amount of the dividend that will be paid and the current liability account Dividends Payable is credited for the same amount. Consolidation is a complex accounting process that melds together all of the interaction between the parent company and the subsidiary. The dividends account is a temporary equity account in the balance sheet.

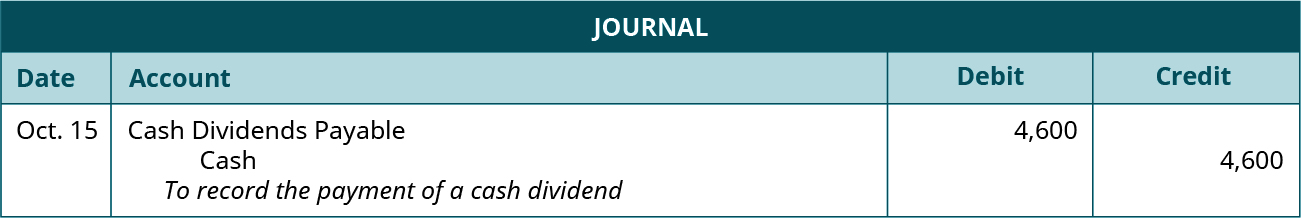

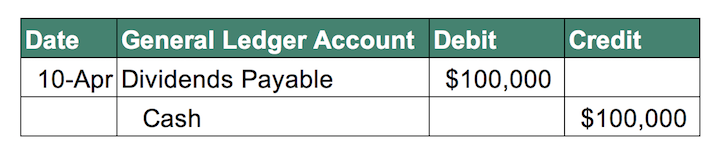

Dividend paid journal entry On the payment date of dividends the company needs to make the journal entry by debiting dividends payable account and crediting cash account. Tax and Accounting Treatment. When dividend is proposed by company out of net profit.

Whereas Final dividend is paid after AGM of particular year. When a dividend is later paid to shareholders debit the Dividends Payable account and credit the Cash account thereby reducing both cash and the offsetting liability. The credit entry to dividends payable represents a.

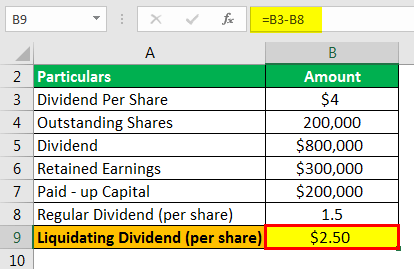

Instead such dividends must be accounted for as a deduction from the retained earnings presented in the statement of changes in equity. Paying the dividends reduces the amount of retained earnings stated in the balance sheet. 1Meaning Interim dividend is generally paid within the year itself.

Profit and Loss Appropriation Account Debit Proposed Dividend Account Credit 2. Hence if the dividend itself is charged to profit or loss DDT also should be charged to profit or loss. For example if company made a profit of 100 before tax 28 would be income tax.