Formidable True And Fair View Ifrs

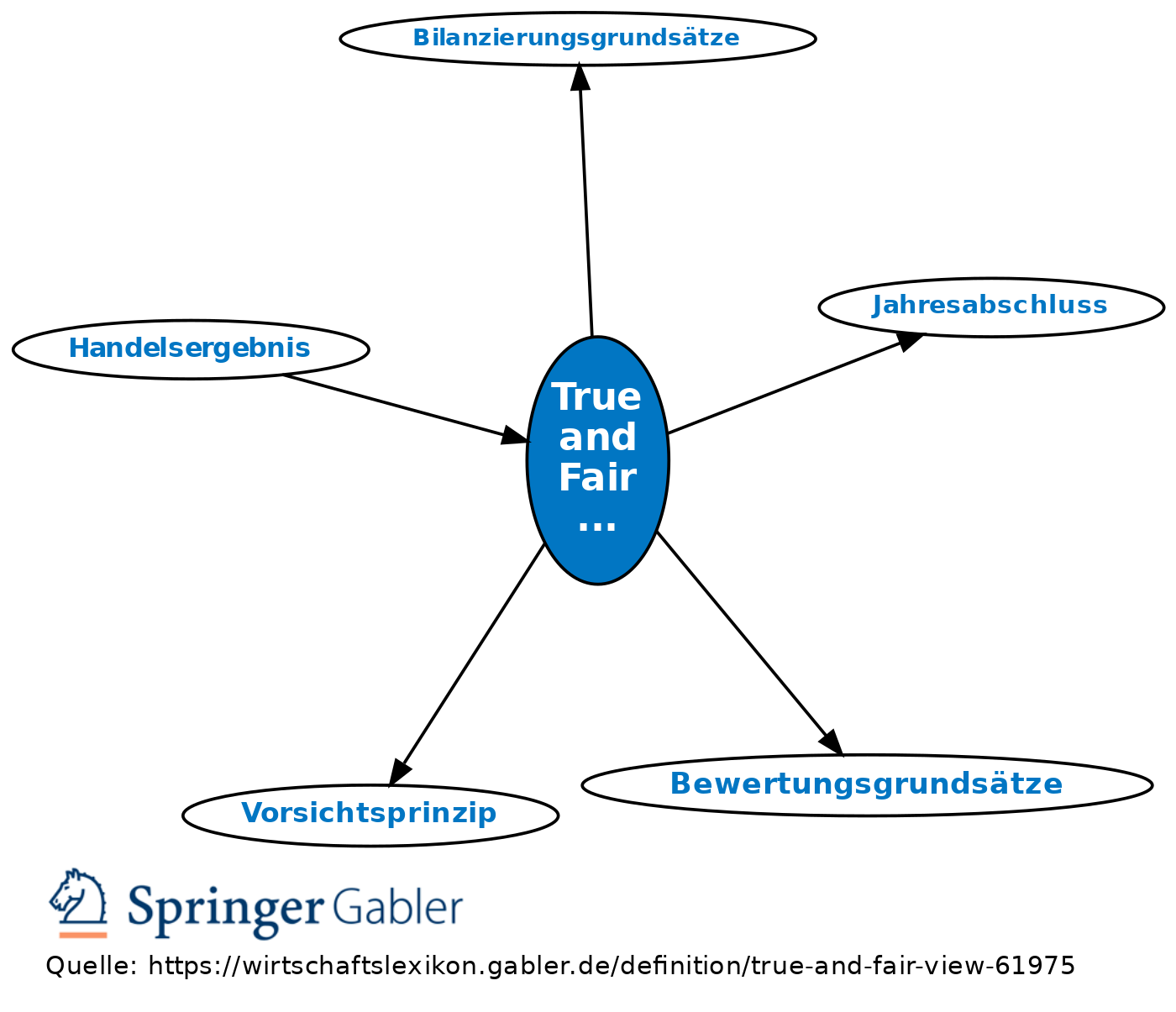

The true and fair requirement has been fundamental to accounting in the UK for many years.

True and fair view ifrs. FRS 102 para A330. Financial statements are described as showing a true and fair view when they are free from material misstatements and faithfully represent the financial performance and position of an entity. Appendix III to FRS 102 on legal requirements refers to use of the true and fair override for some group reconstructions if an entity considers that this is necessary in order to apply merger accounting in circumstances other than those set out in the company law.

This broadly means that the application of an IFRS must result in numbers that are. On the back of such true and fair shortcomings Mr Bompas also concludes that IFRS do not allow a route to a true and fair override specifically IAS 1 and that if the adopted international standards fail to provide a true and fair view and the directors are not allowed to pursue a true and fair override to depart from misleading standards. Accounting Policies Fair Presentation and Faithful Representation for IFRS March 19 2015 What does fair presentation mean.

There is an extensive literature on what this may mean and one view is that it is an overriding quality that the financial. The most authoritative statements as to the meaning of true and fair have been legal opinions written by Lord Hoffmann and Dame Mary Arden in 1983 and 1984 and by Dame Mary Arden in 1993 the Opinions. In the IFRS true and fair view paradigm found most faithfully in the UK preparers and auditors ask whether a proposed accounting treatment is consistent with a foundational IFRS principle and fairly provides material information to users.

True and Fair is the term using in the audit report of financial statements to express the condition that financial statements are truly prepared and fairly presented in accordance with the prescribed accounting standards. Copyright 2008 Kurt S. The true and fair view TFV and fair presentation FP concepts continue to be corner-stone objectives of financial reporting in the context of International Financial Reporting Standards IFRS and European Union EU legislation.

There has been no statutory definition of true and fair. Banks Financial Statements IFRS application in Greek banks True and Fair View Principle JEL Classification. In 1997 IFRS moved from using the.

As you all know first standard must fulfil the true and fair view criteria set out in the accounting directives. It is a requirement of both UK and EU law1 The introduction of IFRS in the UK did not change the fundamental requirement for accounts to give a true and fair view and the concept remains paramount in the presentation of UK. True and fair view in auditing means that the financial statements are free from material misstatements and faithfully represent the financial performance and position of the entity.