Ace Non Going Concern Financial Statements

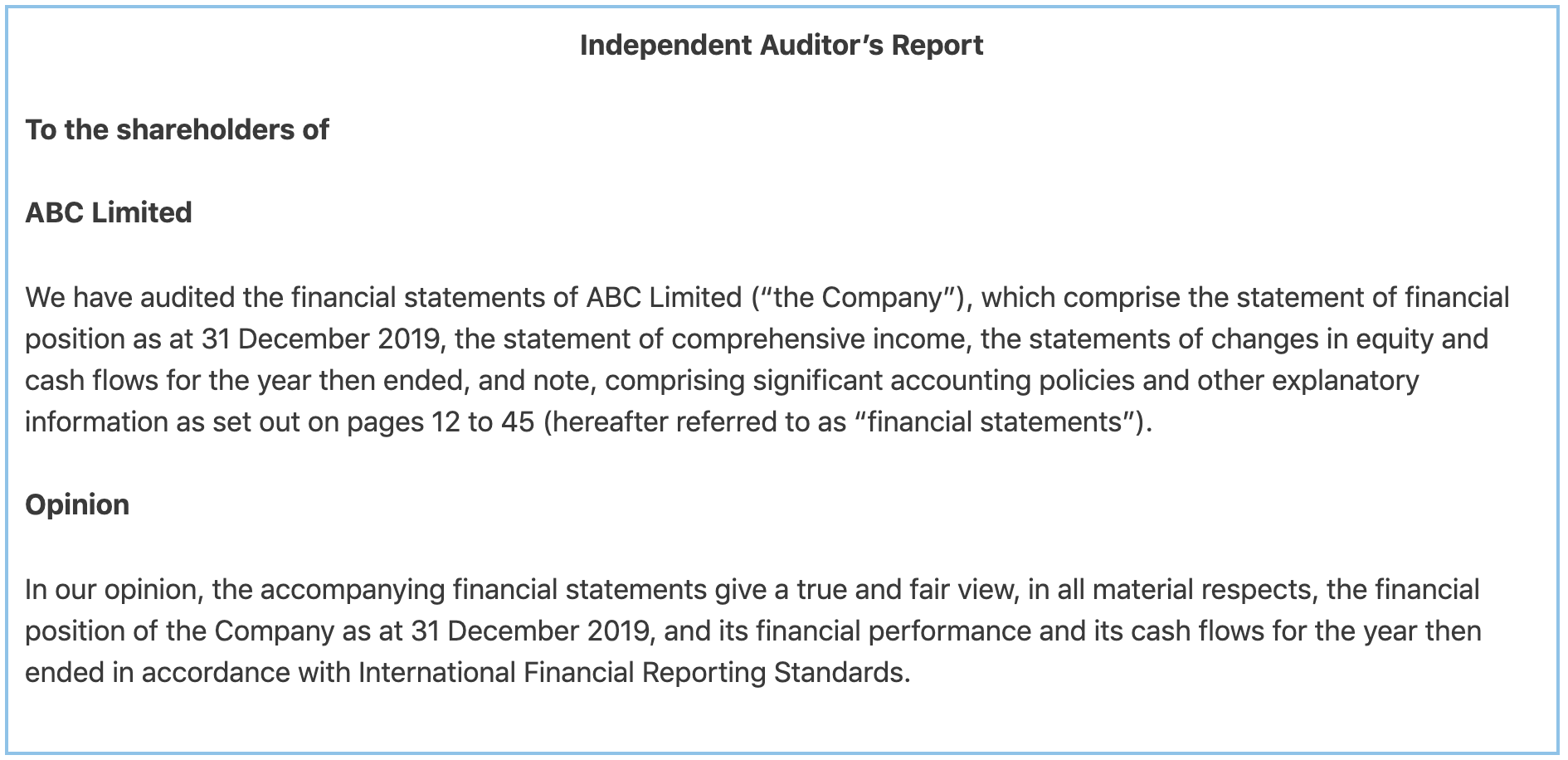

When an entity does not prepare financial statements on a going concern basis it shall disclose that fact together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern.

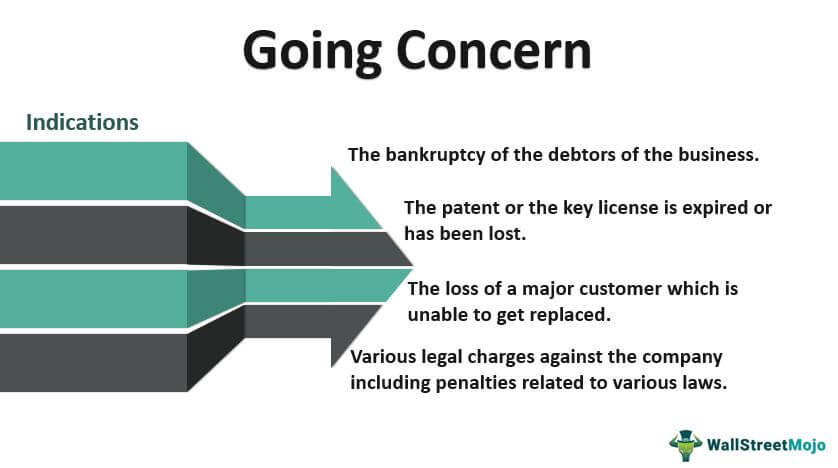

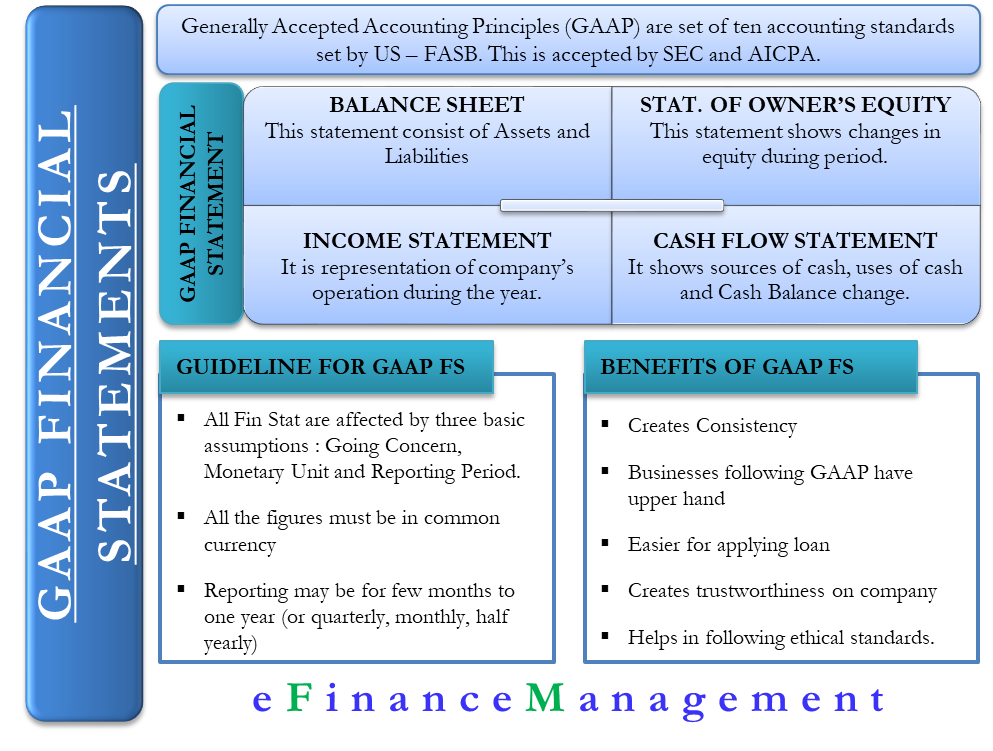

Non going concern financial statements. For instance when financial statements are prepared on a going concern basis a non-financial asset may be stated at an amount which is greater than its net realisable value provided that it is no greater than its recoverable amount. This includes circumstances where no issues are identified where issues are identified but resolved where there is a material uncertainty and where the entity is assessed as no longer a going concern. When an entity does not prepare its financial.

Financial statements on a non going concern basis. MFRS 101 Presentationof Financial Statementspermits an entity that is no longer a going concern to prepare financial statements on a. Our view The fact that a going concern basis is inappropriate does not automatically mean that a.

For instance when financial statements are prepared on a going concern basis a non-financial asset may be stated at an amount which is greater than its net realisable value provided that it is no greater than its recoverable amount. Get detailed data on venture capital-backed private equity-backed and public companies. The problem is that IAS 1 does not tell us how to prepare the financial statements when going concern does not apply.

Ad See detailed company financials including revenue and EBITDA estimates and statements. Get detailed data on venture capital-backed private equity-backed and public companies. The example wording in this Guide has been adapted from the company examples in the FRCs.

Financial statements on a non going concern basis 14 mrt 2017 Both IAS 1 Presentation of Financial Statements and IAS 10 Events after the Reporting Period suggest that a departure from the going concern basis is required when specified circumstances exist. Going concern paragraph financial statements 8 The financial statements should not be prepared on a going concern basis when events after the reporting date indicate that the going concern assumption is no longer appropriate. Much of the guidance covers the auditors responsibilities in reviewing the going concern assessment and disclosures in financial reports.

Non-going concern The going concern basis of preparation is no longer appropriate. It says that all entities have to prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so. If the financial statements have been prepared on a going concern basis but in the auditors judgment the use of the going concern assumption in the financial statements is inappropriate ISA UK 570 requires the auditor to express an adverse opinion.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)