Breathtaking Treatment Of Accrued Income In Cash Flow Statement

Payment Interest Principal.

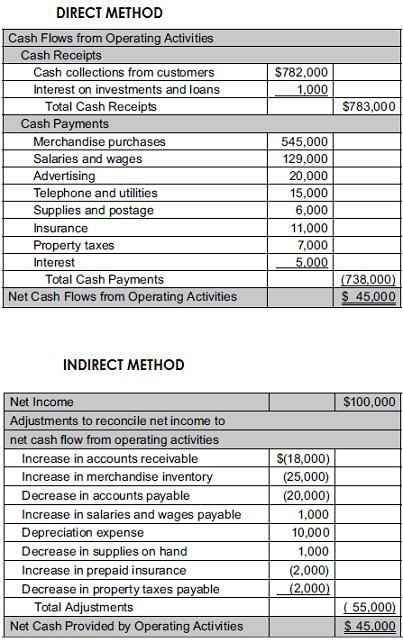

Treatment of accrued income in cash flow statement. This involves adjusting net income for items that have directly affected cash during the current time period. Under IFRS there are two allowable ways of presenting interest expense in the cash flow statement. This leads to a reducing effect on the income statement.

However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters. With accrual accounting you are declaring the full 2000 as income both the liquid 500 and the impending 1500 in that accounting period. Others treat interest received as investing cash flow and interest paid as a financing cash flow.

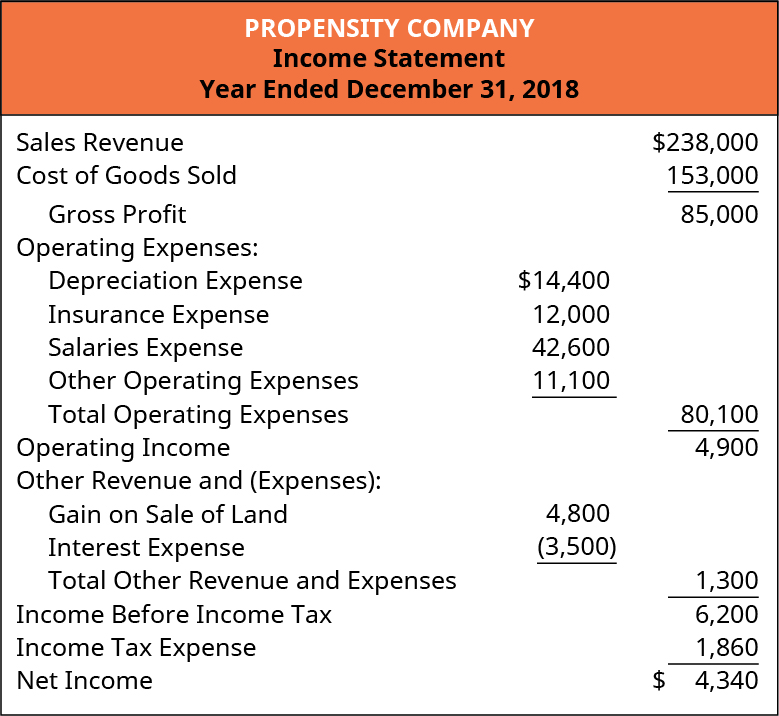

Companies may convert an accrual-basis income statement to a cash-basis method. The income statement one of three financial statements shows how much money a company made during a time period. Similarly youll be factoring in money you owe ahead of time as a debit.

There also are times when restructuring expense accrual shows up. Accruals are included in the expense amount on the income statement and reported as a current liability in the balance sheet. Added back to income.

How an increase in accrued liabilities. Any increase in accrued expense results in a corresponding increase in the expense account in the income statement. This shall be adjusted in the operating activities section of the cash flow statement by deducting the credit amount of 1000 from the net profit or loss in order to get one step closer to the net cash flow for the year.

On the other hand if there is a decrease in accrued expense or a company pays its outstanding accounts payable the company will credit the cash and debit accounts payable to lower the accounts payable on the liability. There are accounts such as revenue cost of goods sold operating expenses interest expense interest income and others on this statement. Heres a general rule of thumb when calculating the cash flow from Operations using the Cash Flow Statement Indirect Method.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)