Beautiful Work Automated Bank Statement Analysis

We can also recognise each cheque number presented on the bank statement additionally identifying and presenting missing cheque numbers.

Automated bank statement analysis. Financial spreading automation will significantly improve the scrutiny and analysis of financial statements enabling banks and financial services firms to better manage operational risk. Contains functions for processing and analizing. The system analyzes businesses individuals and properties for a comprehensive global picture of multi-entity relationships.

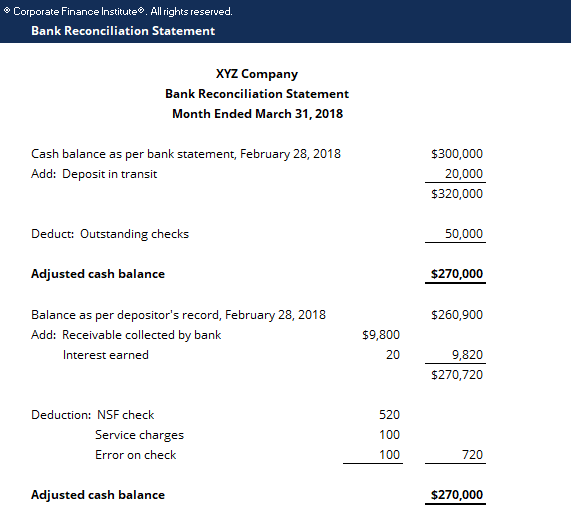

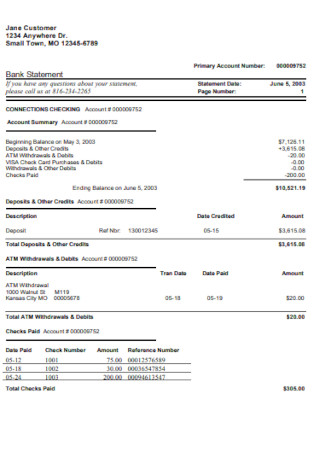

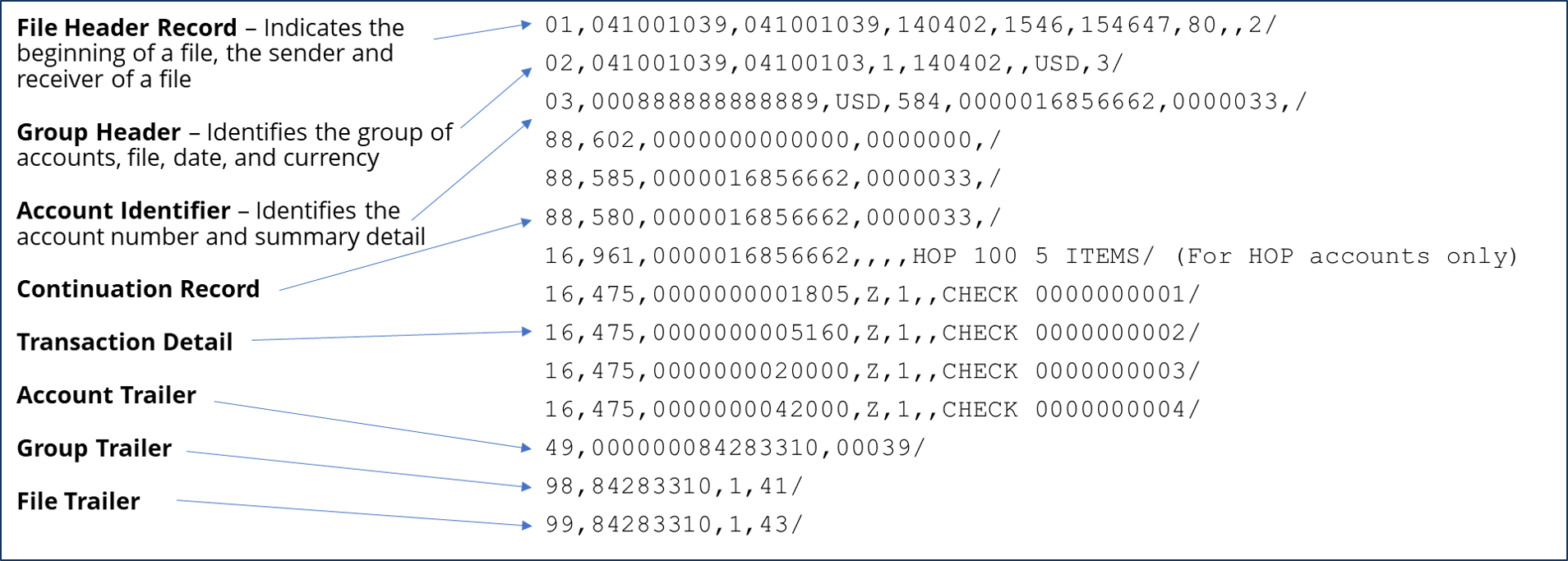

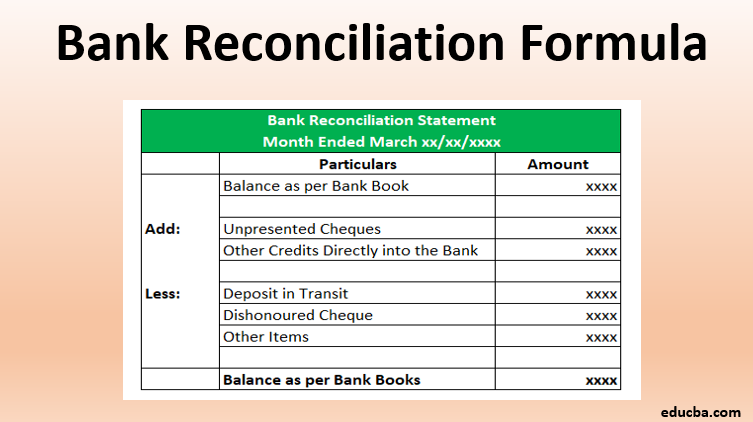

Electronic bank statements are the cornerstone of automated bank reporting. This time Im going to talk about BankClassify a tool for classifying transactions on bank. These statements are then automatically reconciled against data from the accounts payable ledger.

Bank statement analysis and segregation is time consuming task for many accoutnants banks and financial institutionsOur AI RPA solution analyse the statm. TAC CREDIT features a comprehensive approach to analyzing and monitoring financial information of borrowers with a focus on small and middle market business banking. Businesses need to import and reconcile bank statements for multiple accounts on a regular basis.

AutoRec will read each page image automatically detecting what bank statement type it is. Simple automatic classification of bank statement entries May 14 2018 May 14 2018 Robin Wilson Data Analytics This is another entry in my Previously Unpublicised Code series explanations of code that has been sitting on my Github profile for. Automating Statement reconciliation with RPA.

We are a financial and bank data aggregation and analytics platform supporting our bank statements analyzer with credential based aggregation PDFs and Scanned statements for 200 Banks in India Malaysia Hong Kong and South Africa. Increased Accuracy and Productivity Our software serves as your first set of eyes automatically processing bank statements empowering underwriters with a transaction review complete with insights and calculations dramatically increasing the speed and accuracy of the human underwriting process. Contains functions for extracting data from pdfs of diffetent banks currently Yes Bank and Allahabad Bank analysispy.

Ocrolus is a fintech automation platform that helps customers make faster and more accurate lending decisions. Also contains a categorical breakdown of. DXC Eclipse Fact Sheet.

/bank-statement-87307795-4b61119c58474303a82123818e7c72cf.jpg)