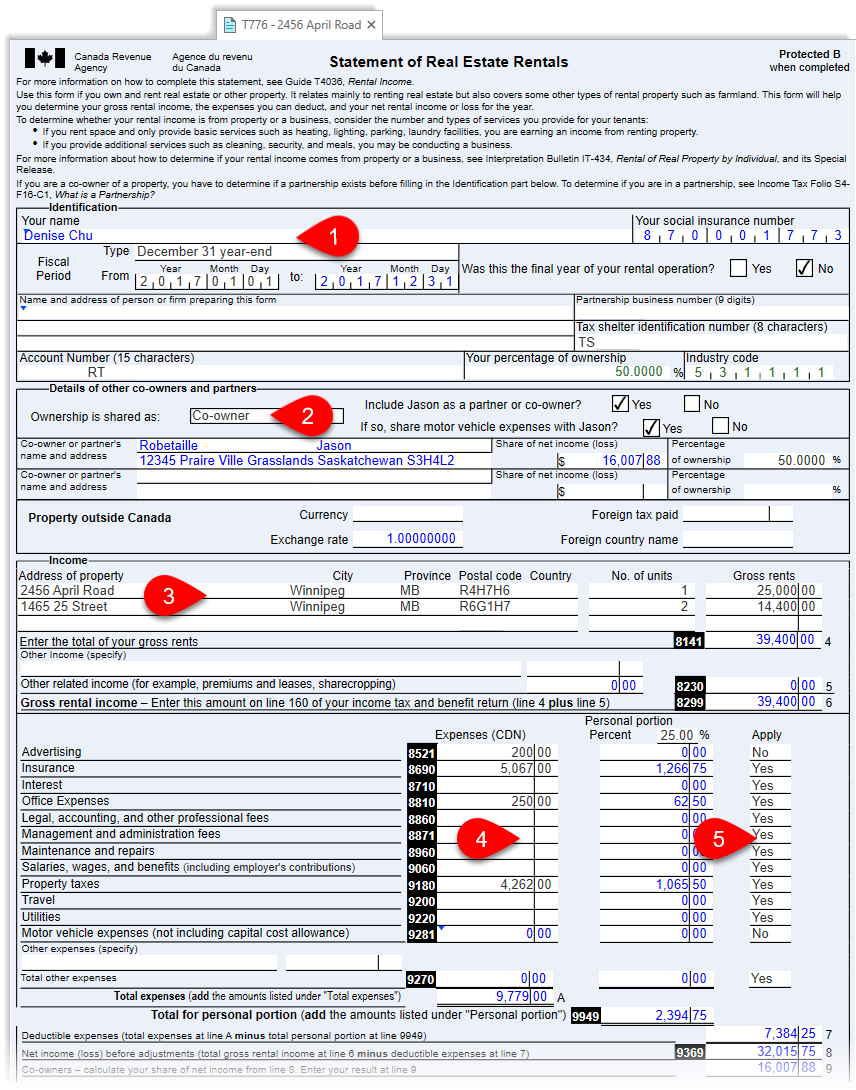

Looking Good Form T776 Rental Income

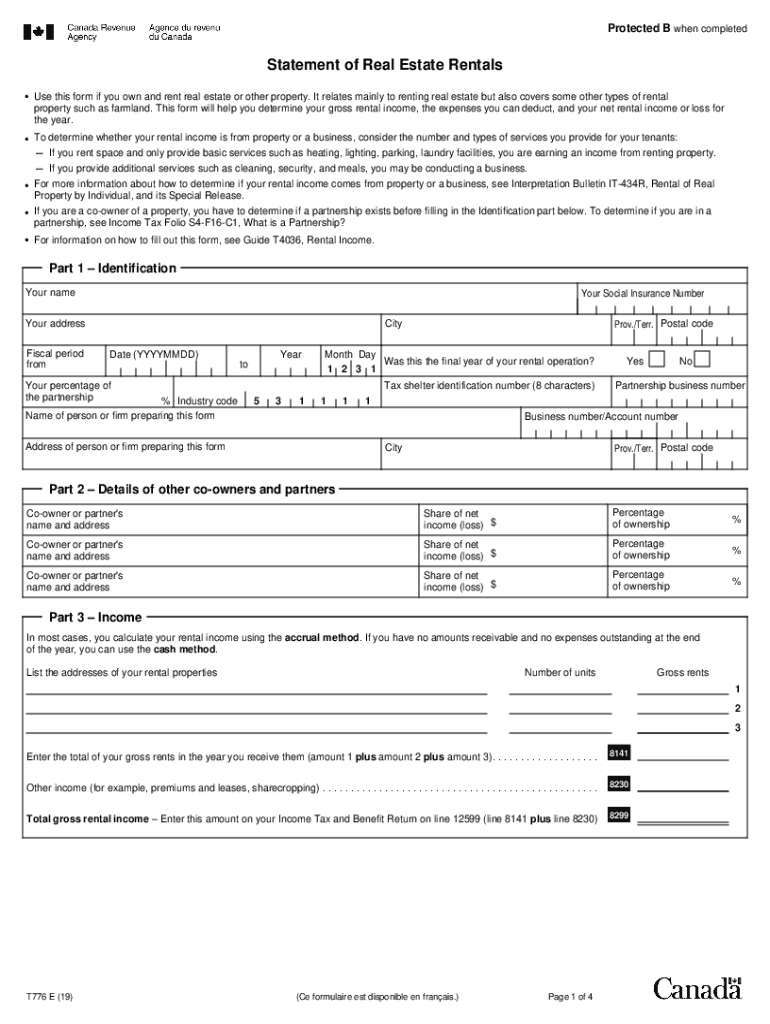

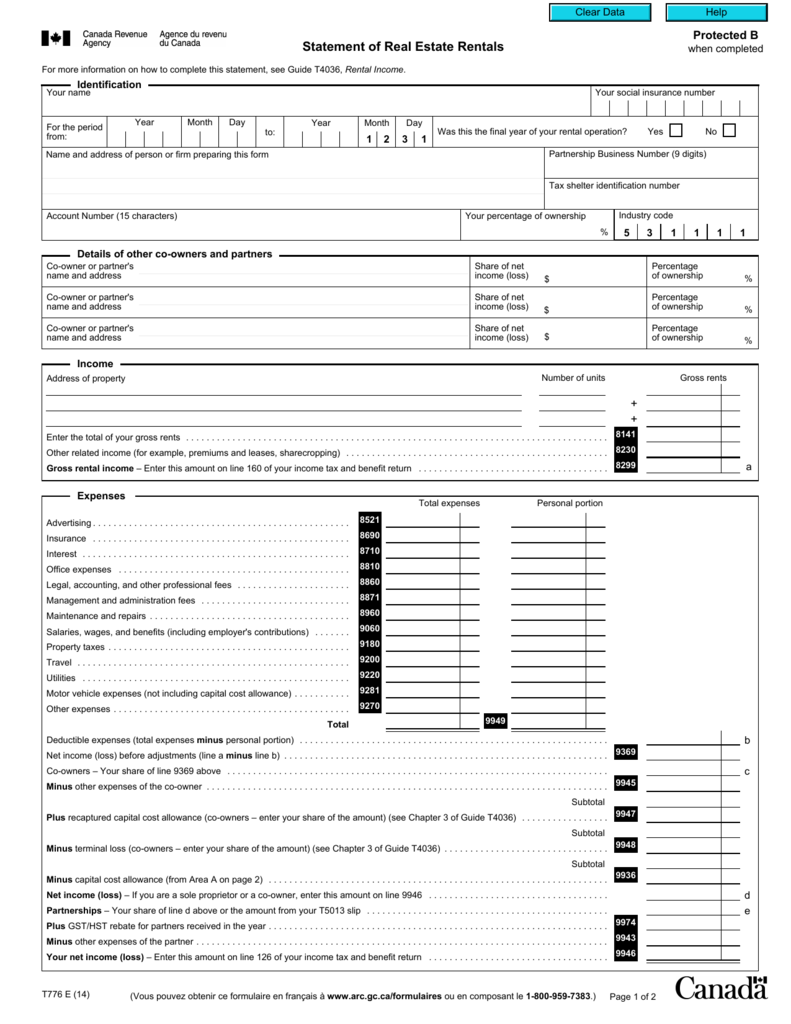

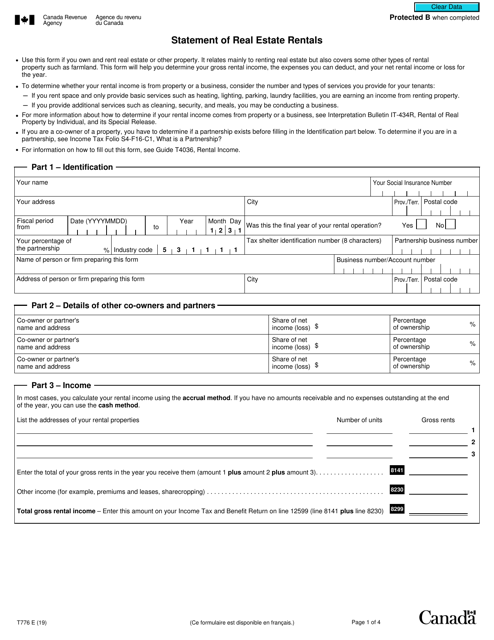

Rental Form T776 called the Statement of Real Estate Rentals must be completed for each rental property that you own in Canada.

Form t776 rental income. Click a timestamp below to jump to a topic- Create a T776 form set 241- When to group or se. To calculate your rental income or loss complete the areas of the form that apply to you. Who is the T776 tax form designed for.

On the right-hand side of the screen go to the Rental income group check the boxes for Rental property income and click Next at the bottom of the page. Even though we accept other types of financial statements we encourage you to use f orm T776. On the other hand if youre only looking to be a very part-time landlord you can avoid taxes on your rental income if you rent out your property for 14 or fewer days per year.

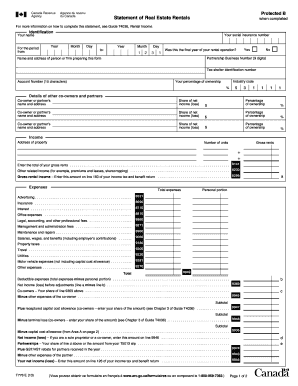

The income for loss from these forms flow. Learn how to enter rental income and expenses in TaxCycle T1. If you had rental income in 2019 from renting out a property that you own or co-own a house an apartment rooms space in an office building or other property youll need to use the T776 form to report your gross rental income expenses and any capital cost allowance for the year.

Guide T4036 Rental Income. The rental income you receive can be in the form of cash or cheque services or kind goods instead of cash and might include more than the rent you receive each month. Interpretation Bulletin IT-417 Prepaid Expenses and Deferred Charges.

See General information for details. For best results download and open this form in Adobe Reader. To be able to claim this deduction your tenants must owe.

T776 Statement of Real Estate Rentals. Fortunately the T776 and the TP-128-V forms are combined in HR Blocks tax software so you can complete both at the same time. Forms T776 federal and TP-128 Quebec will be generated by the program.