Wonderful Minority Interest In Consolidation

The calculation of minority interest is relatively simple and requires the use of minority shareholders percentage ownership of a subsidiary.

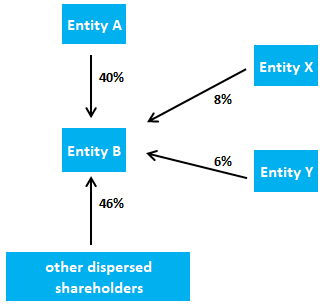

Minority interest in consolidation. Majority interest in an entity might not control the entity. Therefore NCI is a more accurate description than minority interest of the interest of those owners who do not have a controlling interest in an entity. The new thinking is that the minority stockholders arent owed anything.

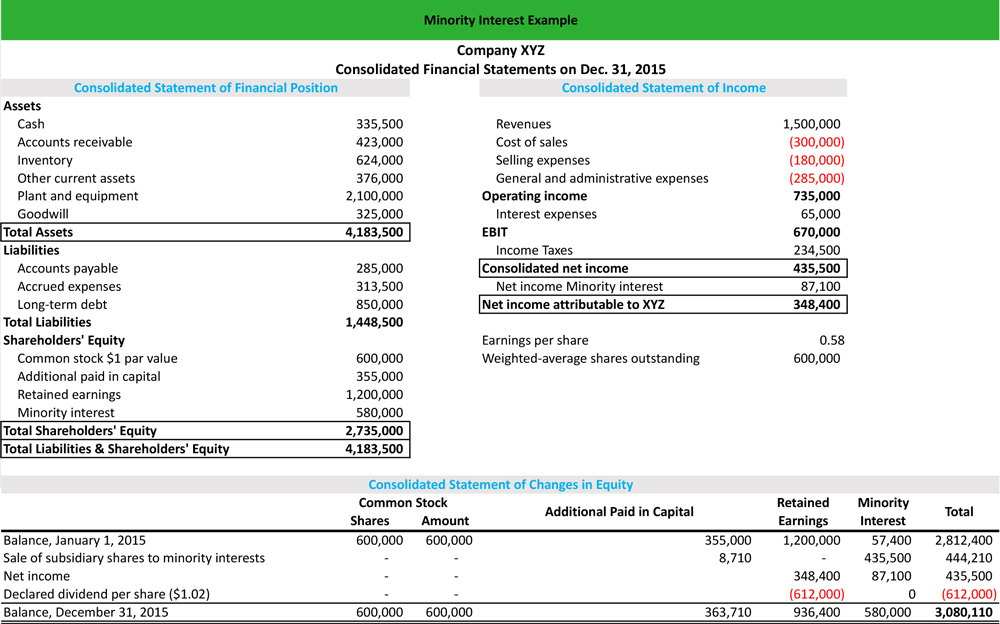

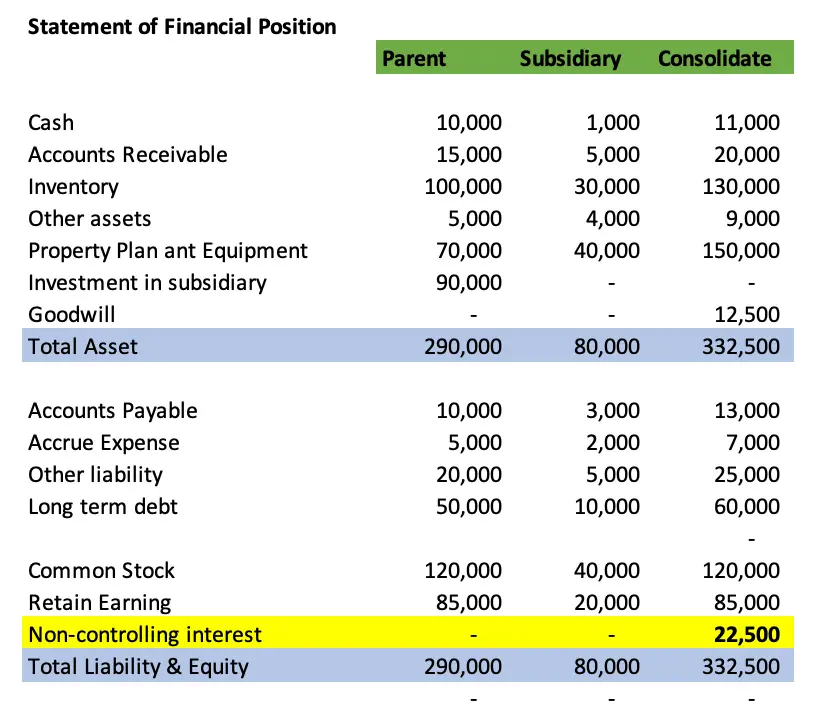

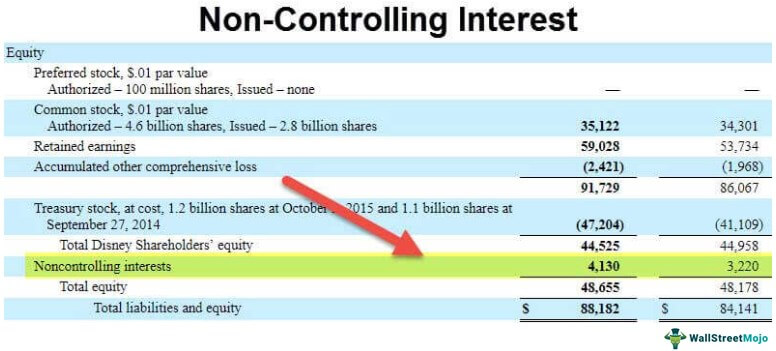

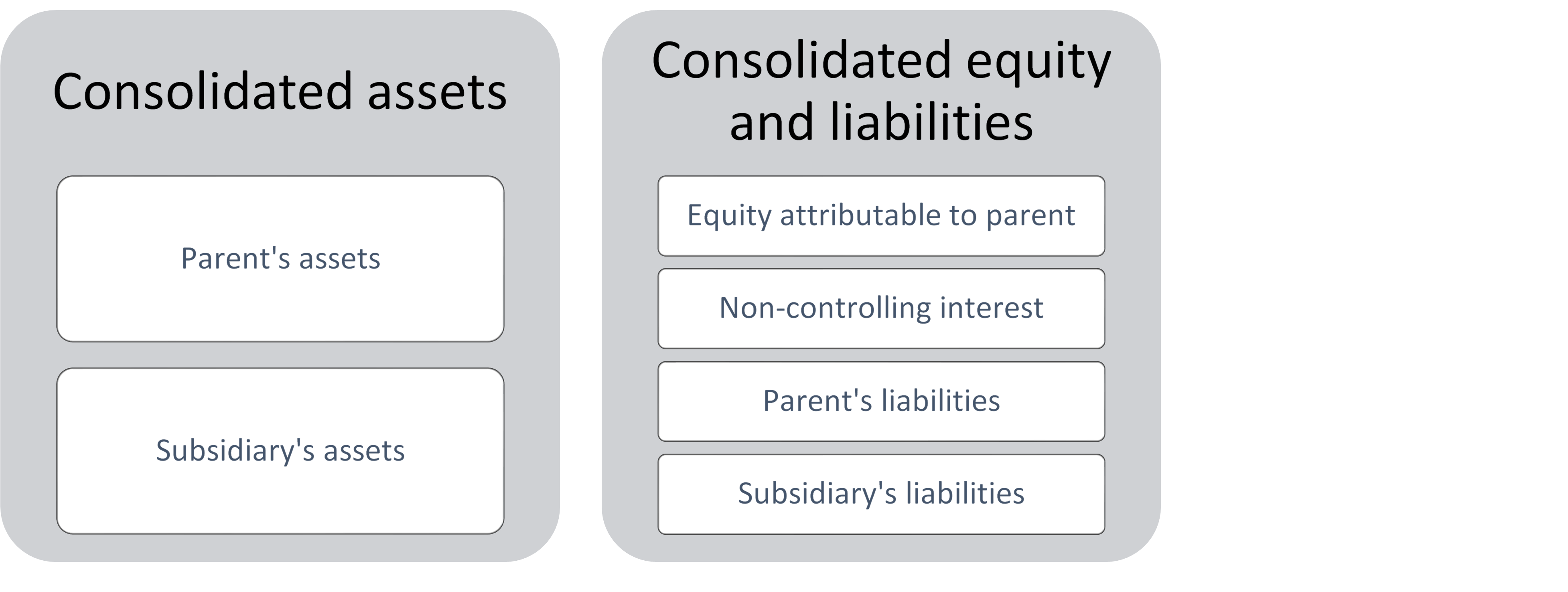

This is also sometimes called a noncontrolling interest The amount of interest held in the subsidiary or controlled company is often less than 50. A parent presents non-controlling interests in its consolidated statement of financial position within equity separately from the equity of the owners of the parent. 13 Purpose of Preparing the Consolidated Financial Statements Consolidated financial statements are the financial statements of a group presented as those.

Financial reporting has multiple ways to show minority interest depending on user preference. If it werent the company would no longer be a subsidiary of the parent company. Rather if Minority interest is an input value commenting the sub calculate part and giving line item detail to minority interest member consolidation happens 20.

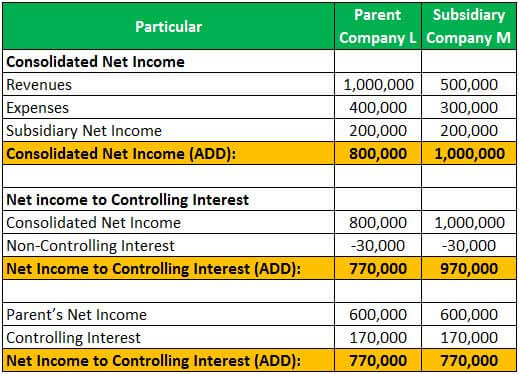

Holding Companys share of such dividend will appear with the Profit and Loss Account balance in the consolidated Balance Sheet and the share of such dividend belonging to Minority Shareholders will be added to Minority Interest. Profitloss of the minority interest should also be shown separately instead of leaving it to be deducted from the consolidated income statement. Accordingly proposed dividend need not appear in the consolidated.

The old thinking about minority interest was that it showed a financial liability that was owed to the minority stockholders. A company might own only a percentage of another company. IFRS 1022 A reporting entity attributes the profit or loss and each component of other comprehensive income to the owners of the parent and to the non-controlling interests.

Minority interest comes into play when consolidation accounting is applied to report 51 to less than 100 percent investment in a subsidiary. More than 50 less than 100 Consolidation NonControlling Interest Full Consolidation with Non Controlling Interest 100 Consolidation Wholly-Owned Subsidiary Full Consolidation When the firm has a simple financial investment Trading Security Available for Sale Balance Sheet Mark-to. Indian Accounting Standards Ind AS are converged with IFRS and therefore Ind AS 110 Consolidated Financial Statements defines.