Neat Cost Of Goods Sold For Nonprofits

For sole proprietors and single-member LLC owners on Schedule C For partnerships and multiple-member LLCs the cost of goods sold is part of the partnership tax return Form 1065.

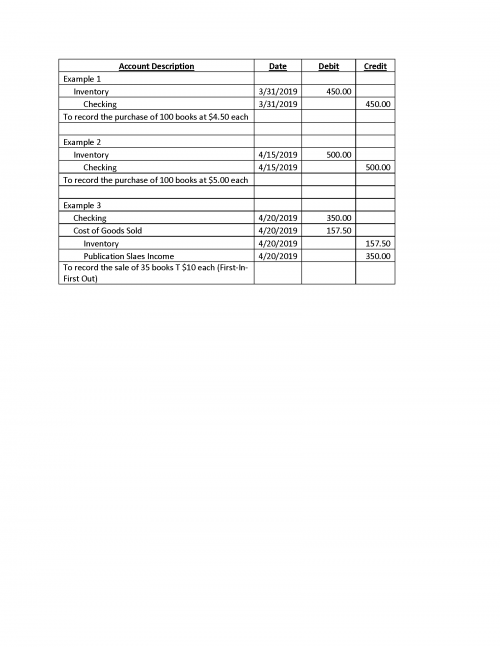

Cost of goods sold for nonprofits. A common form of inventory for nonprofits is publications. Plus Cost of Labor. This is referred to as the cost of goods sold and is the stores operating expenses such as rent and utilities.

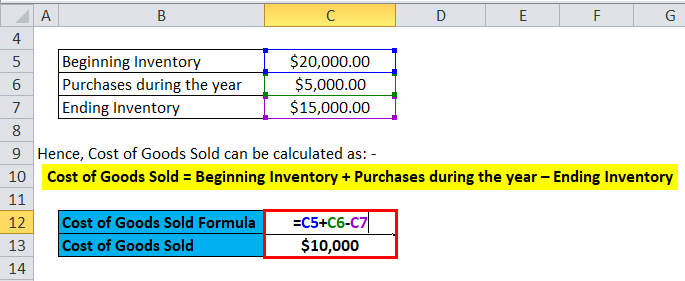

COGS can also inform a proper price point for an item or service. Minus Inventory at End of Year. Cost of Goods Sold on Schedule C.

Instead the accounting system for a non-profit is concerned with sources of income restrictions placed on use of funds and the categorical allocation of expenses between direct and indirect program costs. Cost of Mug Sales 2400 Gross Profit from Mug Sales 2600. Cost of Goods Sold per unit and Cost of Revenue per unit is the model we use with our ProjectionHub application.

Cost of goods sold COGS may be one of the most important accounting terms for business leaders to know. The net asset of a nonprofit organization is the equivalent of the income of a for-profit business. The formula below outlines the general flow of inventory.

Knowing the cost of goods sold can help you calculate your businesss profits. This amount includes the cost of the materials and labor directly used to create the good. Costs of goods sold include the direct cost of producing a good.

Nonprofit expenses usually include. Beginning Balance Purchases - Cost of Goods Sold Ending Inventory. That way you see a net number for sales minus cost of goods sold in the income section of the profit and loss report.