Fine Beautiful Deferred Revenue Expenditure In Balance Sheet

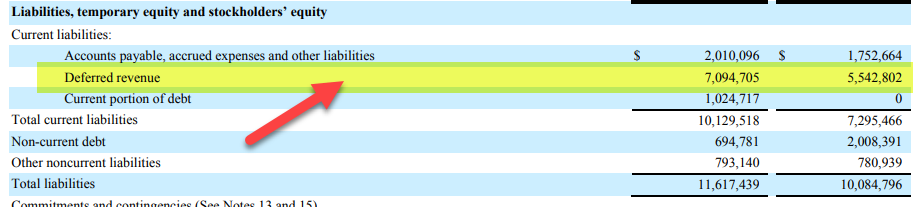

You will record deferred revenue on your business balance sheet as a liability not an asset.

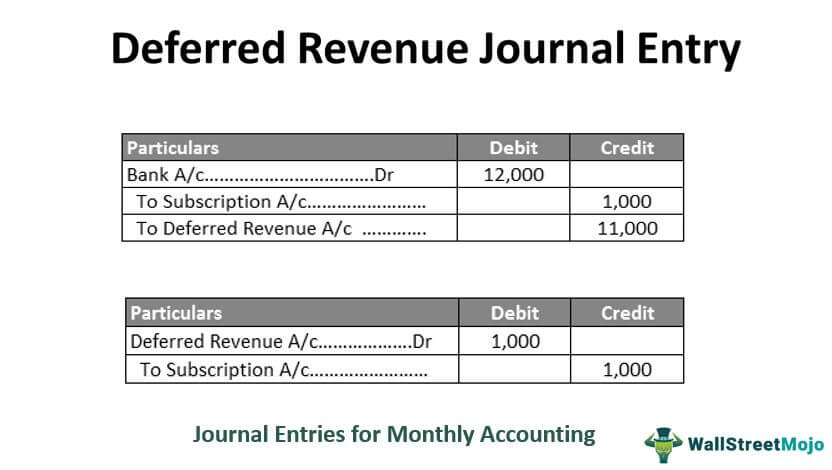

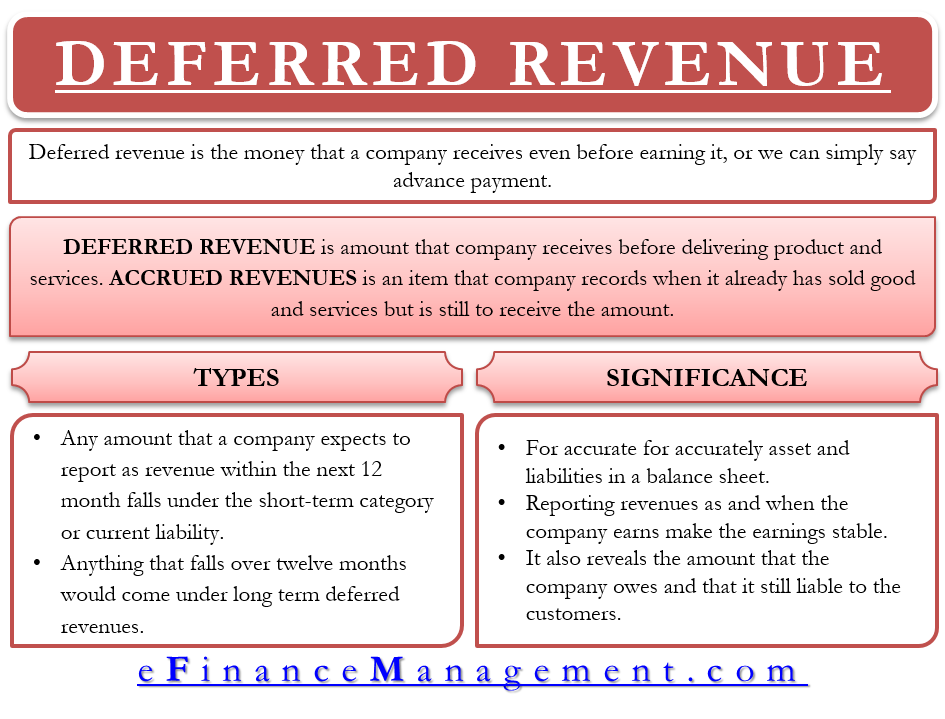

Deferred revenue expenditure in balance sheet. The difference between the two terms is that deferred revenue refers to goods or services a company owes to its customers. In its most raw form the entry is debit cash credit Deferred Revenue balance sheet - liabilities. Deferred revenue which is also referred to as unearned revenue is listed as a liability on the balance sheet because under accrual accounting the revenue recognition process has not been.

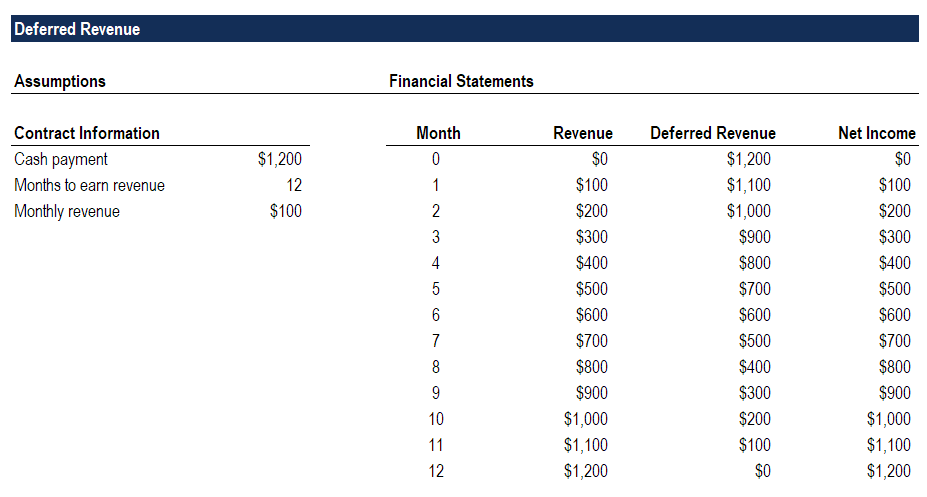

Recording deferred revenue applies to the companys balance sheet. What is a deferred expense. Deferred Revenue arises when you receive revenue that you have not yet earned but obviously expect to earn at a future date.

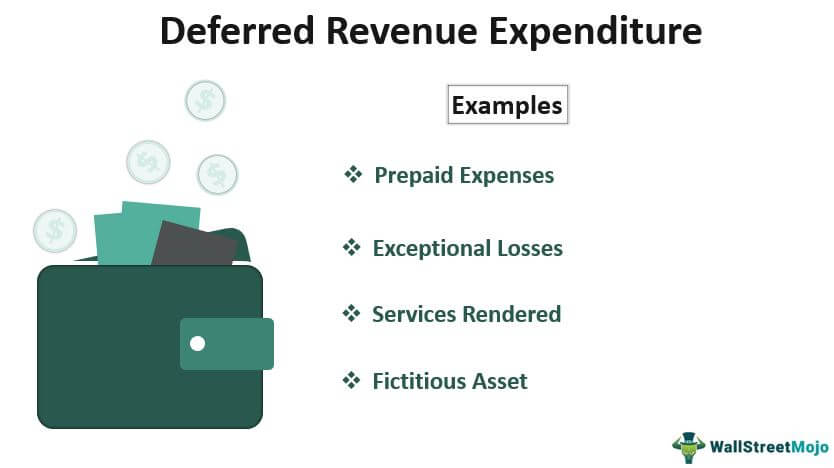

Deferred revenue is a liability on a company s balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. Deferred Revenue advertising expenditure. It is when the firm derives a portion of the benefit in the current accounting year and will reap the balance in the future years.

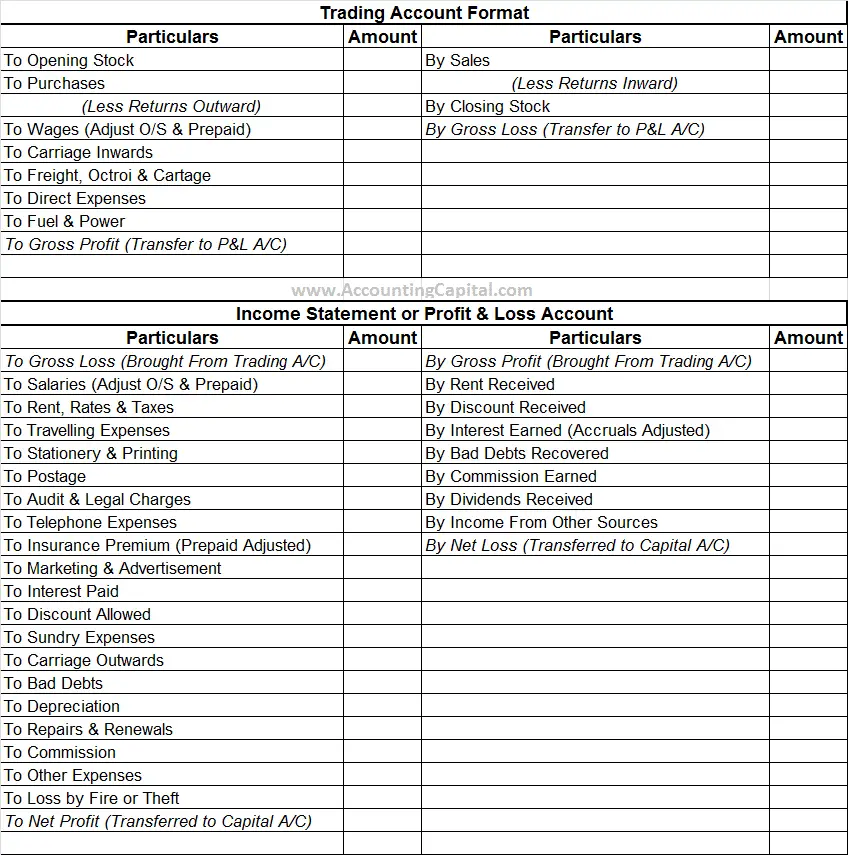

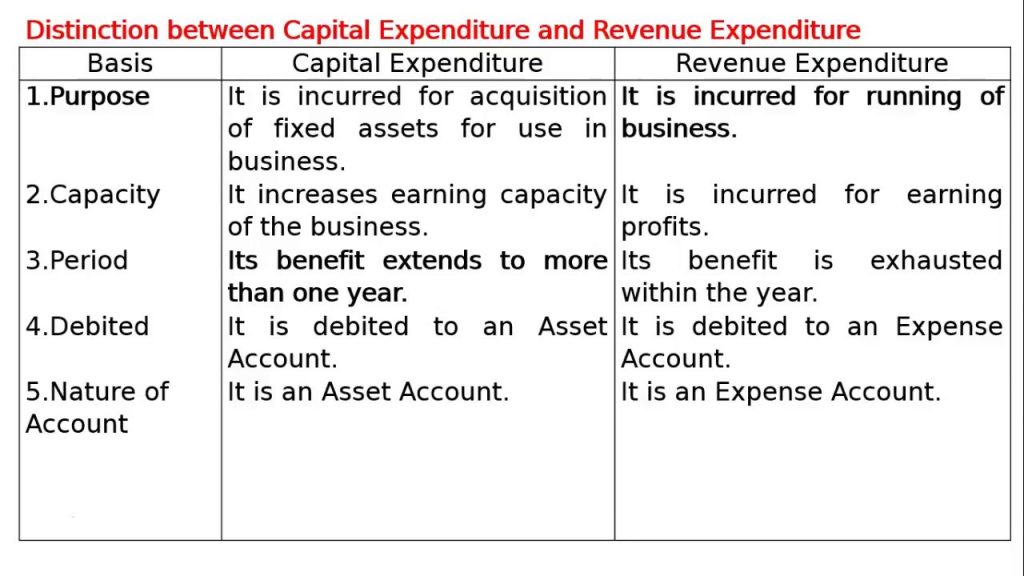

All assets are capitalized however the cost is eventually matched with its future revenue till then it is only a deferred expense waiting to be expensed. Deferred Revenue Expenditure Meaning. Deferred revenue is often mixed with accrued expenses since both share some characteristics.

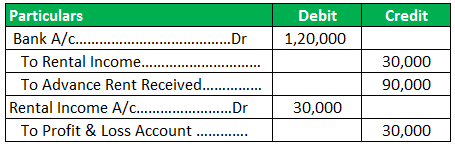

The two examples of deferred revenue expenditure and their treatment in final accounts are as explained below. Deferred Revenue Expenditure is an expenditure which is revenue in nature and incurred during an accounting period however related benefits are to be derived in multiple future accounting periods. Receiving a payment is normally considered an asset.

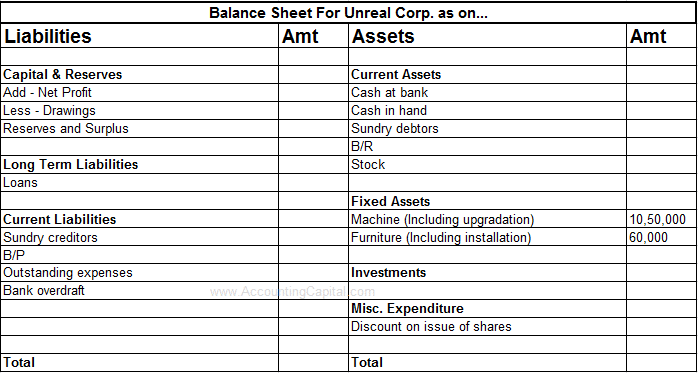

Deferred revenue is recognized as. Part of the amount is shown in profit and loss account and is reduced from total expenditure and rest is shown in balance sheet. A deferred expense refers to a cost that has occurred but it will be reported as an expense in one or more future accounting periodsTo accomplish this the deferred expense is reported on the balance sheet as an asset or a contra liability until it is moved from the balance sheet to the income statement as an expense.