Stunning Interest Receivable Balance Sheet

Loan amount interest rate number of due months 12 200000 12 312 6000.

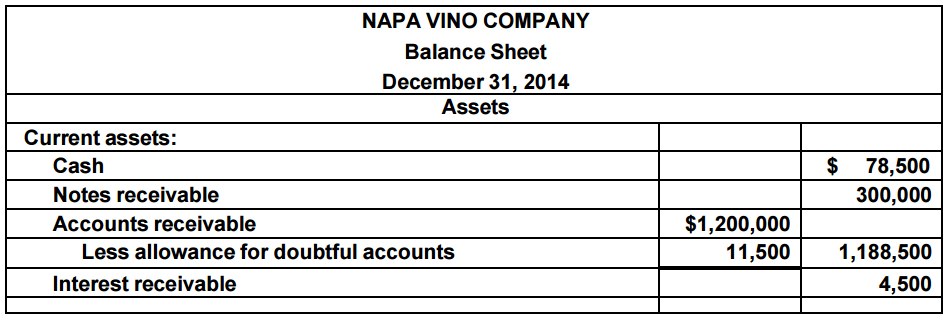

Interest receivable balance sheet. Lets look at a 10000 loan with 5 interest. Identify the principal balance due for the next 12 months. The calculation of the interest earned on a note receivable is.

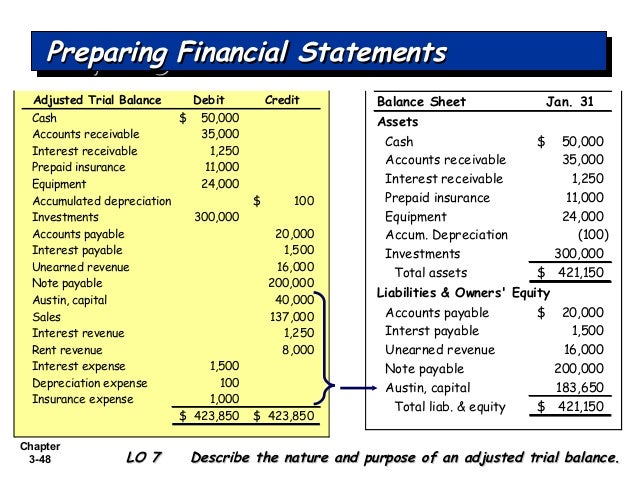

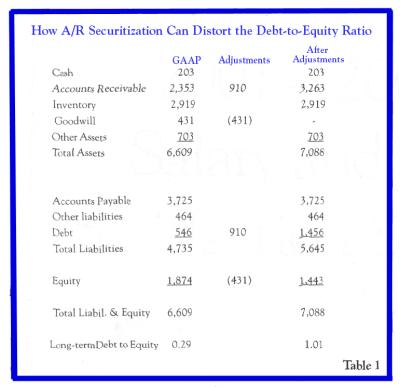

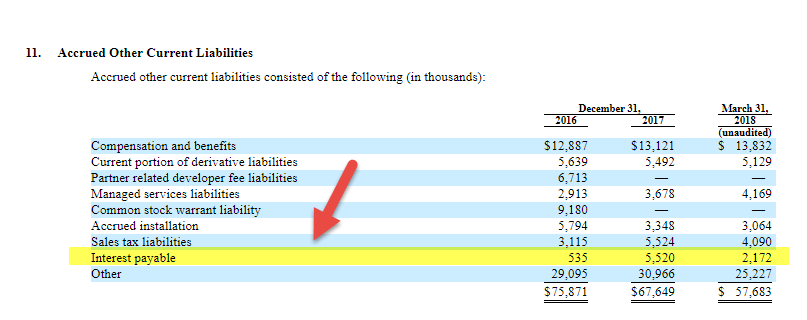

Future loan interest does not appear on the balance sheet while principal balances are classified according to when they are due. If its due date is more than a year in the future it is considered a non-current asset. The accrued interest receivable is a current asset if the interest amount is expected to be collected within one year of the balance sheet date.

Put another way interest receivable is the expected interest revenue a company will receive. You want to find out the accrued interest over 20 days. As long as it can be reasonably expected to be paid within a year interest receivable.

Invested funds or loan. Lets say that 15000 was used to buy a machine to make the pedals for the bikes. The interest income on notes receivable is.

The interest receivable account is usually classified as a current asset on the balance sheet unless there is no expectation to receive payment from the borrower within one year. Calculation of Interest income to be recognized in the accounting year ending in 2018. I would expect that even a long-term note receivable that is due in five years will require that the interest on the note be paid quarterly semiannually or annually.

Accrued interest receivable increases the current asset account on a companys balance sheet while interest revenue increases net income. Interest receivable definition The current asset that represents the amount of interest revenue that was reported as earned but has not yet been received. This increases your cash balance on your balance sheet and how much you have available to spend.