Cool Deferred Tax Expense On Income Statement

Deferred Tax Expense Money that an individual or company owes for taxes but has not yet paid.

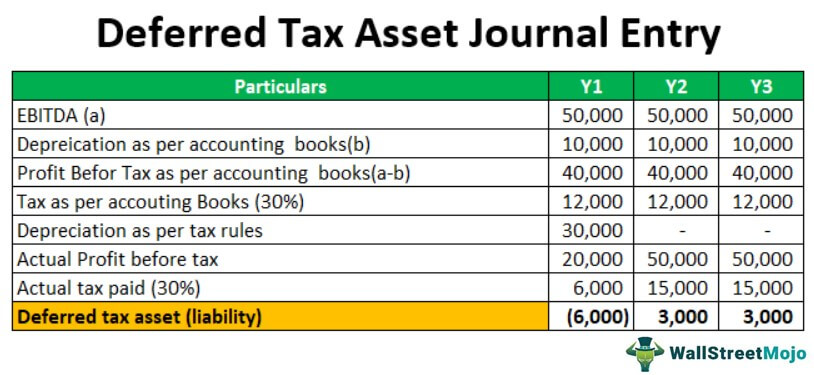

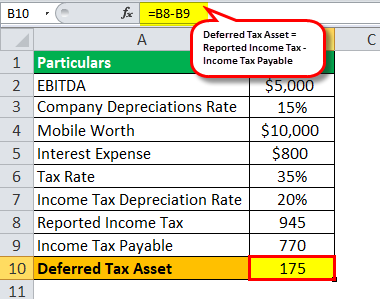

Deferred tax expense on income statement. Similarly deferred tax assets are defined as the amount of advance tax payment made by the company. Deferred tax assets and deferred tax liabilities can only be offset in the statement of financial position if the entity has the legal right to settle current tax amounts on a net basis and the deferred tax amounts are levied by the same taxing authority on the same entity or different entities that intend to realise the asset and settle the liability at the same time. However it is.

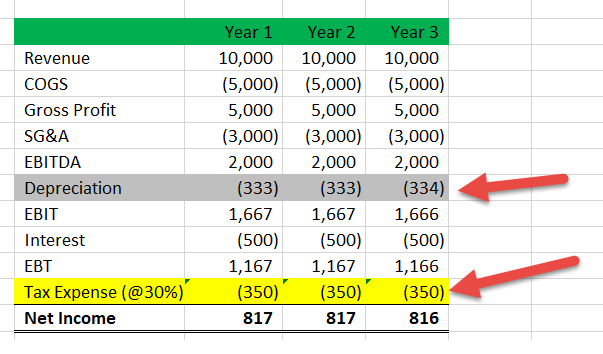

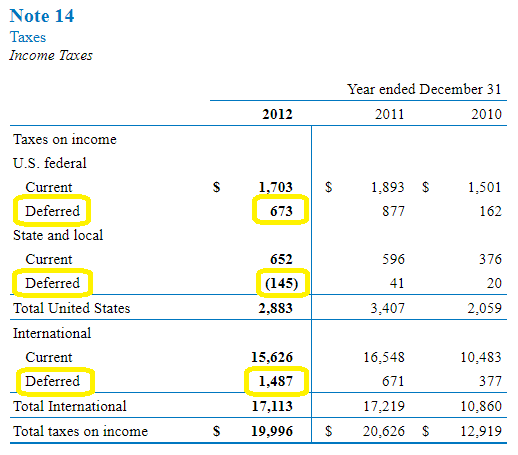

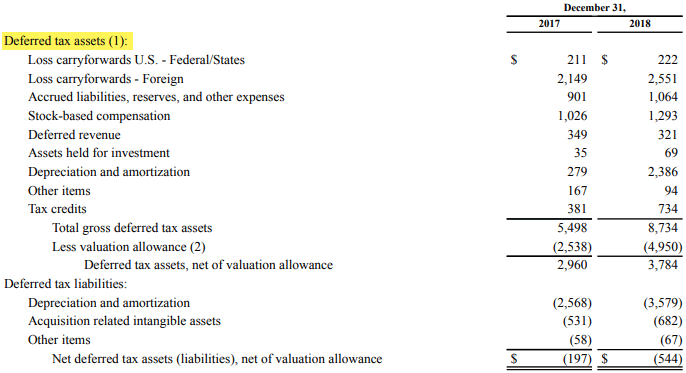

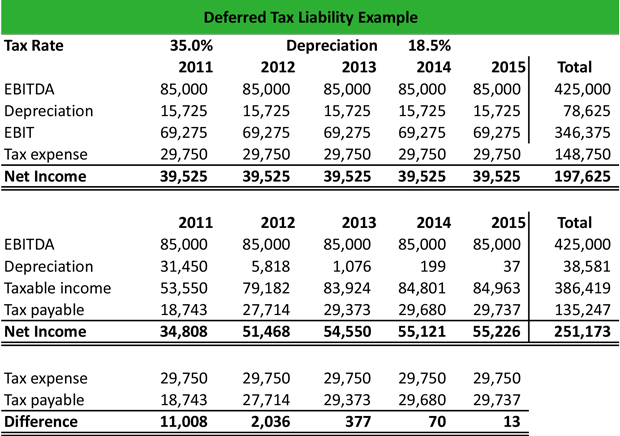

The effect of accounting for the deferred tax liability is to apply the matching principle to the financial statements by ensuring that the tax expense 2000 is matched against the pre-tax income for the accounting period 8000 while still recognizing that only 1850 is. Deferred income tax and current income tax comprise total tax expense in the income statement. In Paper F7 deferred tax normally results in a liability being recognised within the Statement of Financial Position.

Deferred Tax IAS 12 Last updated. Deferred tax must be recognised on all timing differences with certain exceptions when modified requirements apply. However as youll learn in the course that is not always the case.

And income or expenses from a subsidiary associate branch or. Accounting for Deferred Expenses. In contrast the IRS tax code specifies.

Or in the income statement if it is recognized as income or expense in this year in the accounting base but not in the tax base. 3 April 2020 Deferred income tax is recognised under IAS 12 to account for differences between tax base of an asset or a liability and its carrying amount. Deferred tax assets are often created due to taxes paid or carried forward but not yet recognized on the income statement.

As the expenses are incurred the asset is decreased and the expense is recorded on the income statement. A deferred tax of any type is recorded in. The main exceptions are.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)