Out Of This World Contingent Liabilities In Bank Balance Sheet

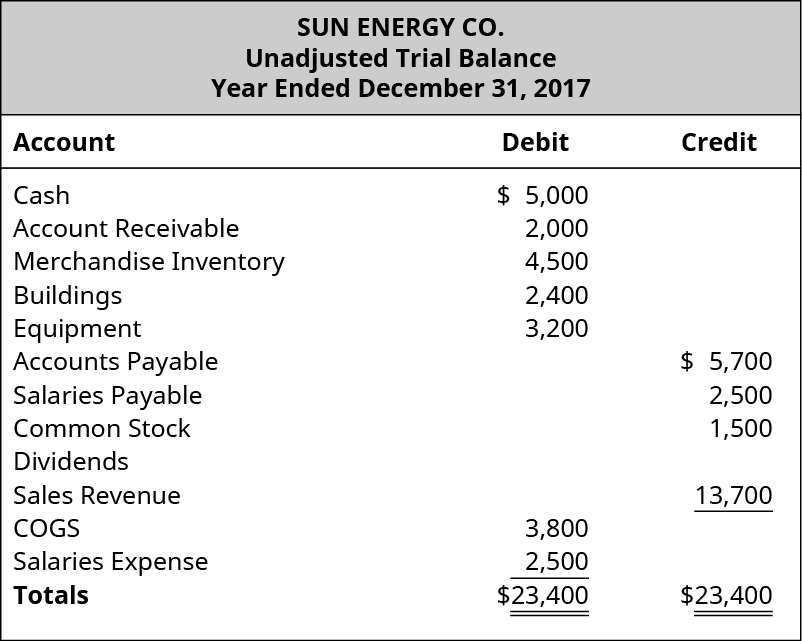

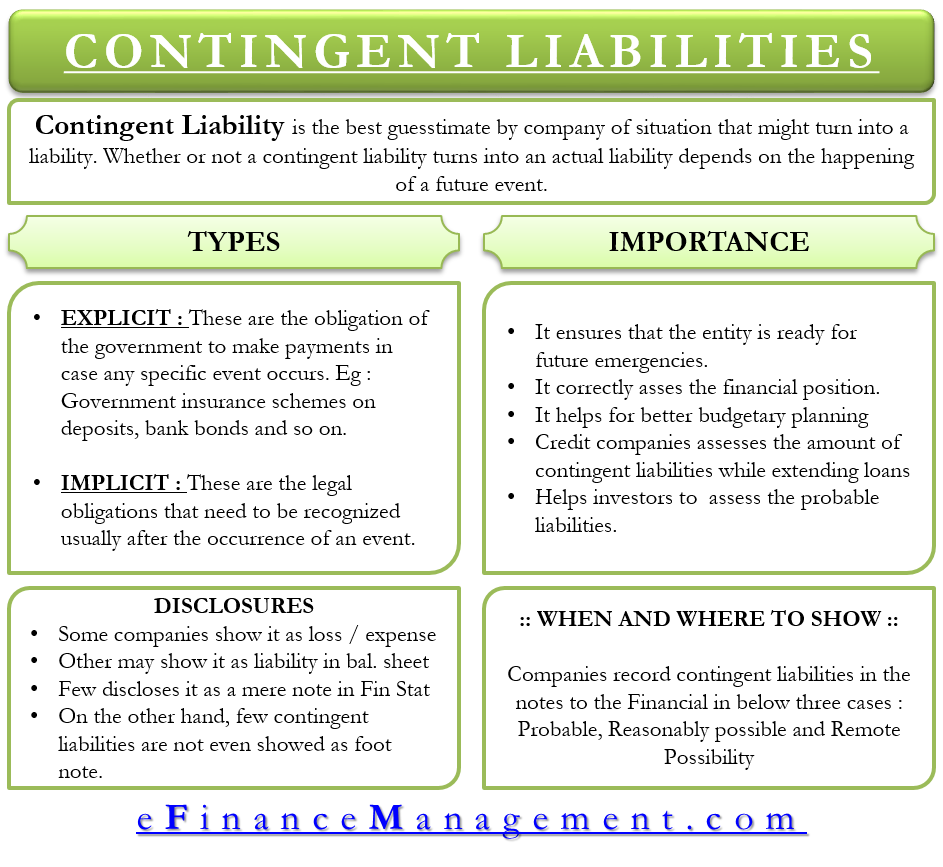

Contingent liabilities are those liabilities which may or may not arise in the future for payment.

Contingent liabilities in bank balance sheet. The losing or settling in the future is referred to as the possible outcomes in the definition. The auditors duty is to see that all known and unknown liabilities have been brought into the accounts at the date of the Balance Sheet and have been shown in the Balance Sheet separately as such. Disclosing a Contingent Liability A loss contingency which is possible but not probable will not be recorded in the accounts as a liability and a loss.

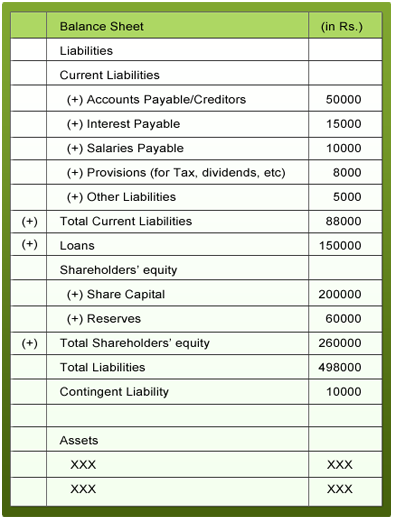

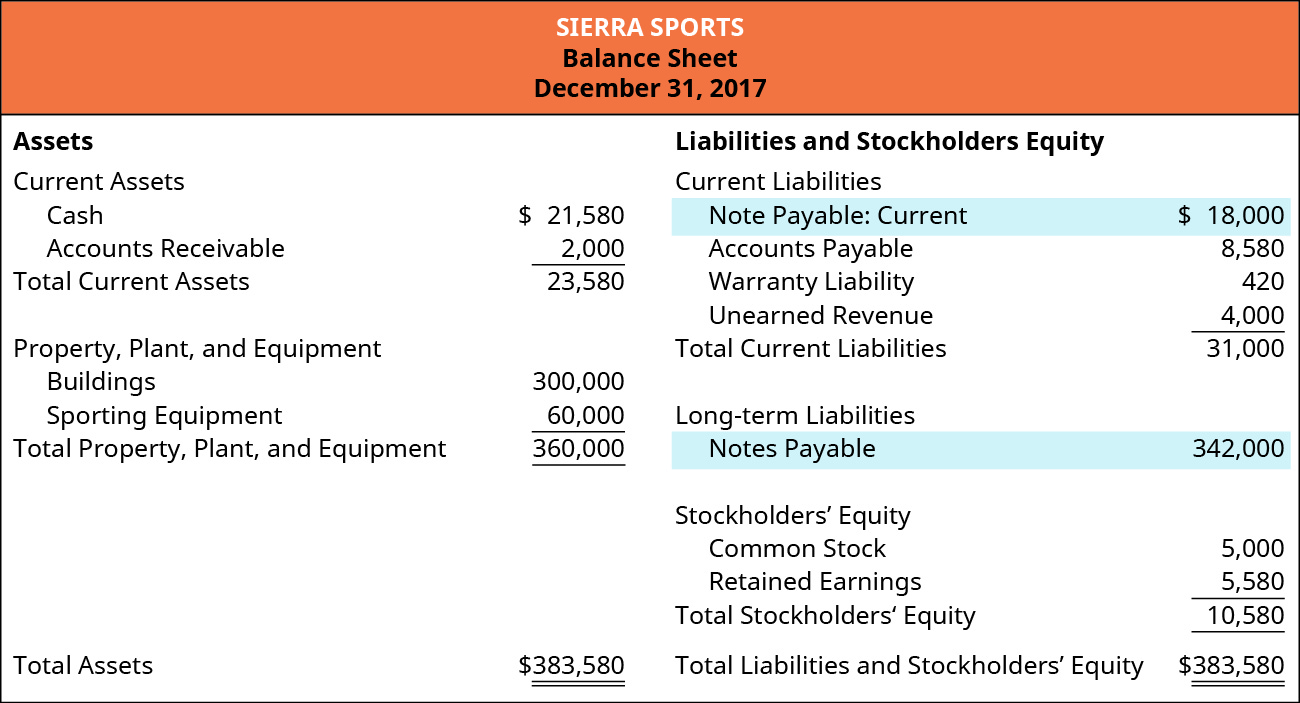

The table below shows the contract or underlying principal amounts and risk weighted amounts of unmatured off-balance sheet transactions at the balance sheet date. Examples of contingent liabilities. Instead the contingent liability will be disclosed in the notes to the financial statements.

That amount will stand as a contingent liability in your balance sheet as you need to pay that amount only if you lose or settle. Contingent liabilities Where the Group undertakes to make a payment on behalf of its customers for guarantees issued such as for performance bonds or as irrevocable letters of credit as part of the Groups transaction banking business for which an obligation to make a payment has not arisen at the reporting date those are included in these financial statements as Contingent liabilities. These three core statements are if the contingency is probable and the related amount can be estimated with a reasonable level of accuracy.

Contingent liabilities are indicated by way of foot note in the balance sheet as they are prima facie not crystallized liabilities affecting the overall liability position of the company. Contingent liabilities are liabilities that may be incurred by an entity depending on the outcome of a future event such as a court case. Contingent liabilities liabilities that depend on the outcome of an uncertain event must pass two thresholds before they can be reported in financial statements.

These liabilities are recorded in a companys accounts and shown in the balance sheet when both probable and reasonably estimable as contingency or worst case financial outcome. A potential or contingent liability that is both probable and the amount can be estimated is recorded as 1 an expense or loss on the income statement and 2 a liability on the balance sheet. A contingent liability is a liability that may occur depending on the outcome of an uncertain future event.

The problem with contingent liabilities however is that they are recognized only after they materialize. Qualifying contingent liabilities are recorded as an expense on the income statement and a liability on the balance sheet. What is needed is a way to track how these contingent liabilities are changing whether they materialize or not.

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)