Heartwarming Direct Method Cash Flow

The indirect method used in calculating cash flow from operations starts with the net income from the income statement and uses adjustments to convert the income into cash flow.

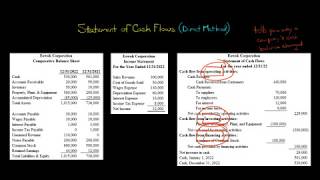

Direct method cash flow. Direct Cash Flow Method. Typically the direct method cash flow statement discloses gross cash receipts and payments for each of the following line items. The direct method is one of two accounting treatments used to generate a cash flow statement.

The direct method only takes into consideration the cash. The Financial Accounting Standards Board FAS recommends the direct cash flow method because it is a more transparent cash flow view. The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow.

The direct method is also known as the income statement method. Direct cash flow refers to the direct method which is one of the two accounting methods used to create a detailed statement of cash flow that shows the changes in cash over the period. The Direct Method or the Indirect Method only apply to the Cash Flow from Operations and do not effect the Cash Flow from Investing or Cash Flow from Financing sections of the Cash Flow Statement.

The direct method uses actual cash inflows and outflows from the companys operations. Cash Flow Statement - Direct Method. The direct method cash flow differs from accrual accounting in that the direct method determines changes in cash receipts and payments as a result of the companys operations whereas accrual accounting recognizes revenue in the period it is earned.

A statement of cash flows can be prepared by either using a direct method or an indirect method. The advantage of the direct method over the indirect method is that it reveals operating cash receipts and payments. With the direct method also referred to as the income statement method you identify all sources of cash receipts plus all cash payments.

Using the direct method the cash flow from operating activities is calculated using cash receipts from sales interest and dividends and cash payments for expenses interest and income tax. Money coming into the business usually from customers are listed under cash inflows. The cash flow indirect method makes sure to convert the net income in terms of cash flow automatically.