Fun Financial Viability Ratios

Expendable net assets long-term debt.

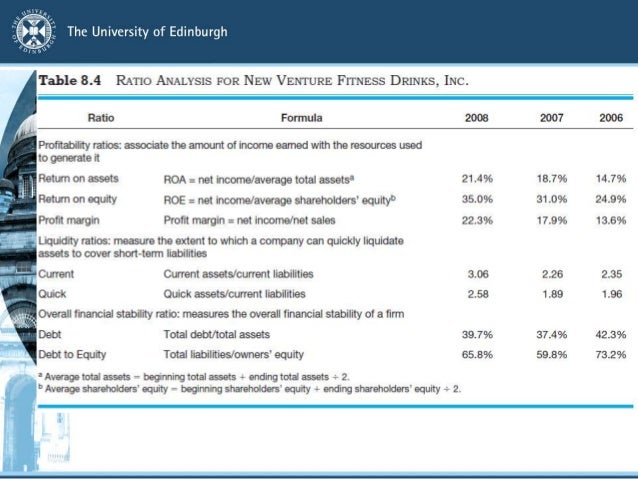

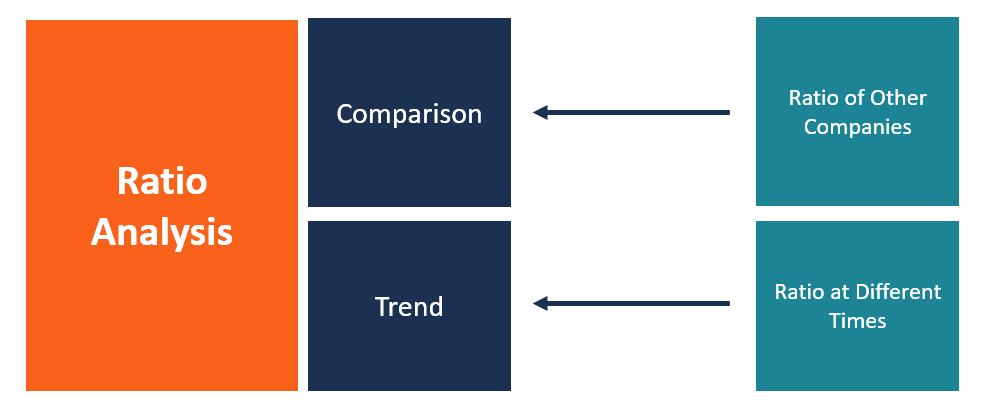

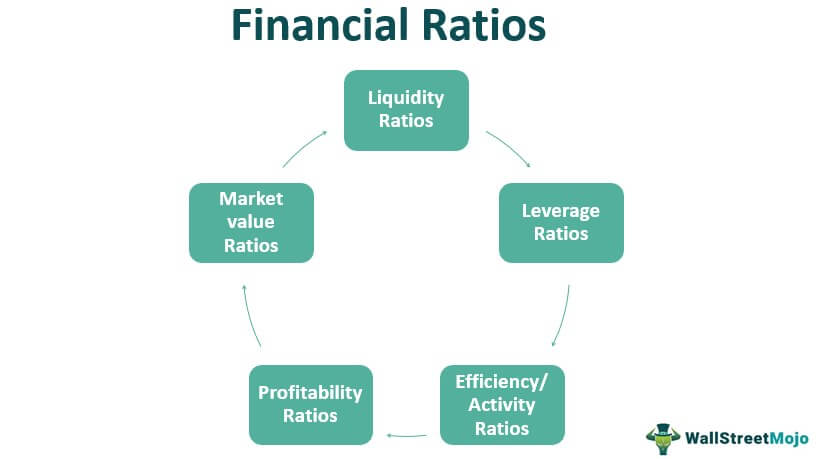

Financial viability ratios. The initial focus of the financial viability assessment is the audited financial statements for the previous financial year. While there are a number of KPIs you can choose to track financial ratios only use information that can be found on your financial statements. The recommended range of the ratio is between 125X and 200X.

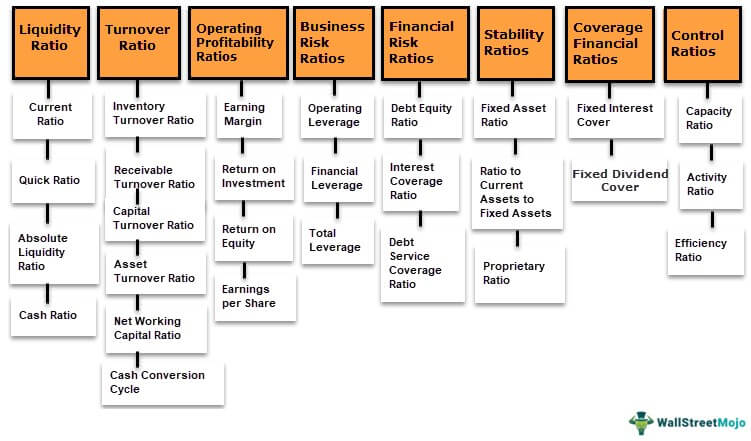

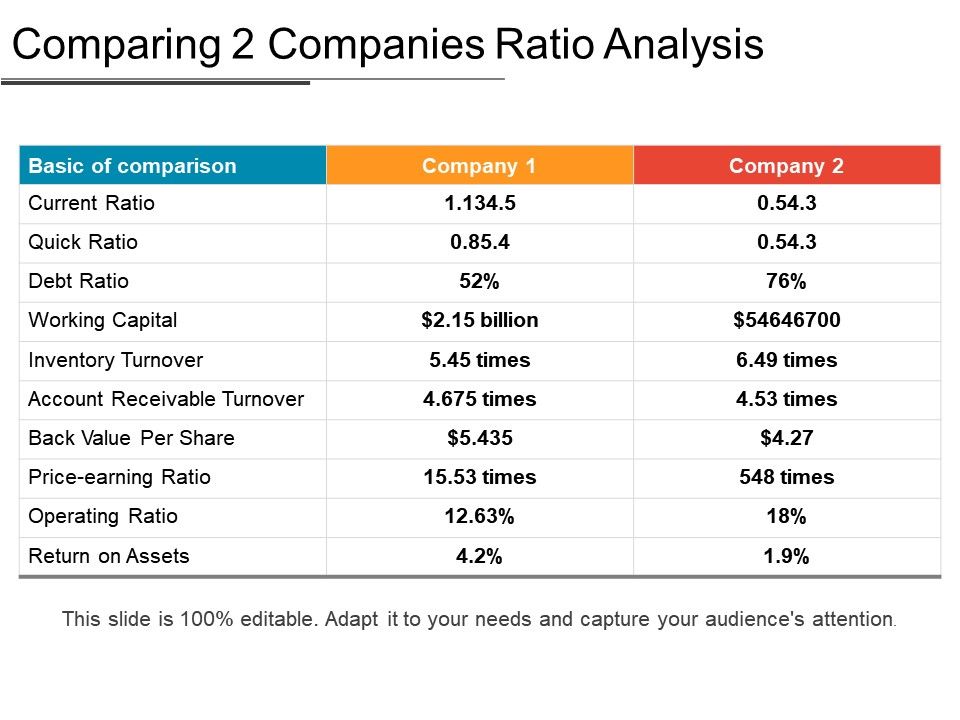

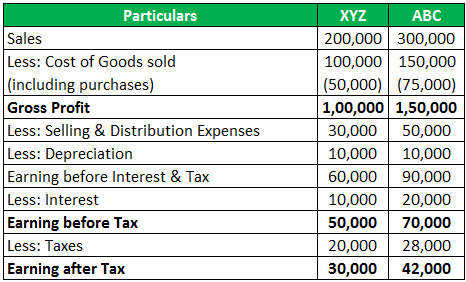

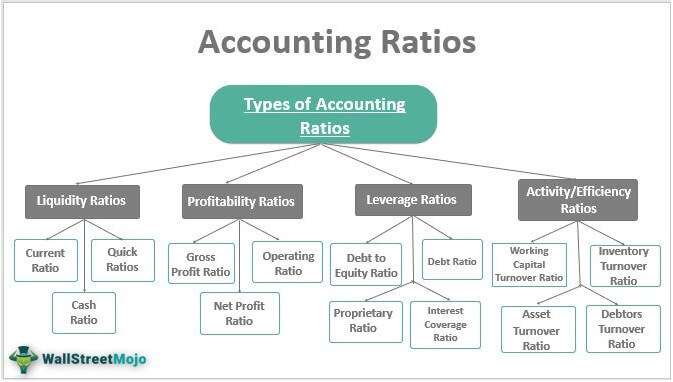

For legal persons there are five financial ratios. It is measured as follows. These ratios compare the debt levels of a company to its assets equity or annual earnings.

Compute all three ratios. The financial viability of LG that is transfer dependent. A quick ratio lower than 10 is often a warning sign as it indicates current liabilities exceed current assets.

These four ratios are combined into a single index score the Composite Financial Index CFI as described in the publication Strategic Financial Analysis for Higher Education Seventh Edition. These are a subset of the large range of potential ratios that an experienced practitioner could consider in any given procurement situation. The five steps are.

Solvency ratios measure a companys long-term financial viability. Equity Capital and reserves - 50 of intangible assets. Our final recommendation includes three ratios Viability Ratio Primary Reserve Ratio and Net Income Ratio.

The Problem with Traditional Financial Viability Analysis Most of us have been involved in the process of creating business cases or business plans just for the sake of justifying a decision already taken. The assessment of financial viability is an integrated process involving a review of the audited financial statements financial performance report business plan and other information that supports our financial analysis. Assign a threshold factor to each ratio.