Glory Unrealised Profit In Manufacturing Account

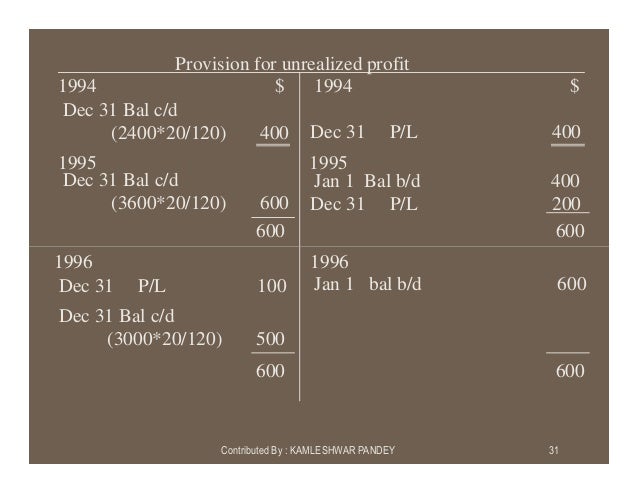

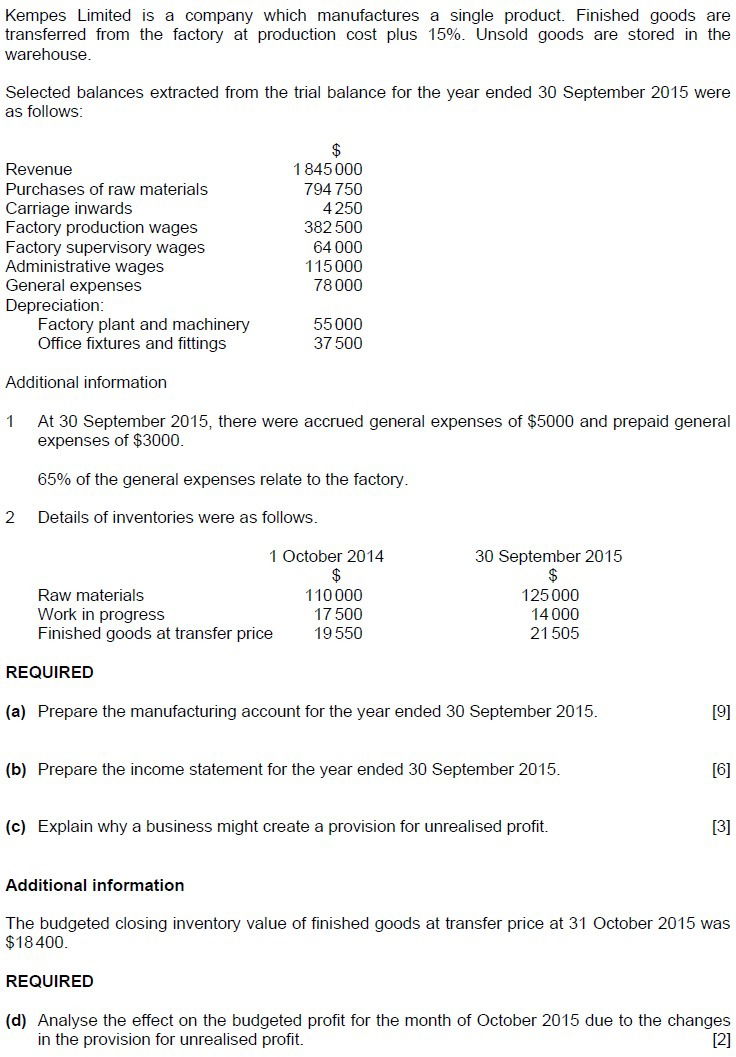

22 Example 1 23.

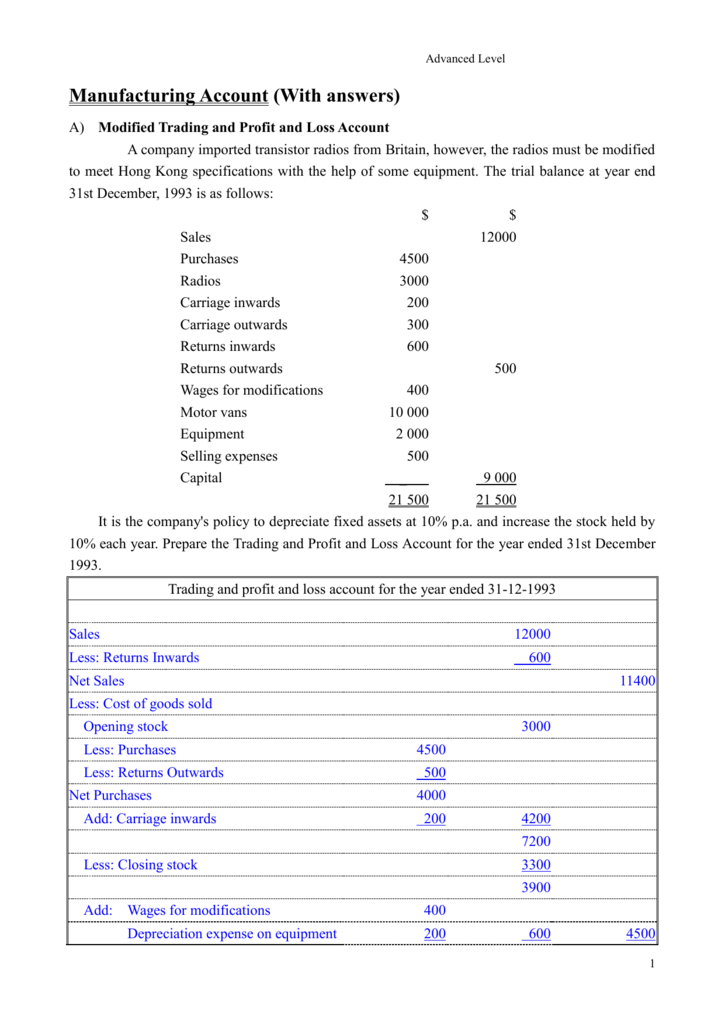

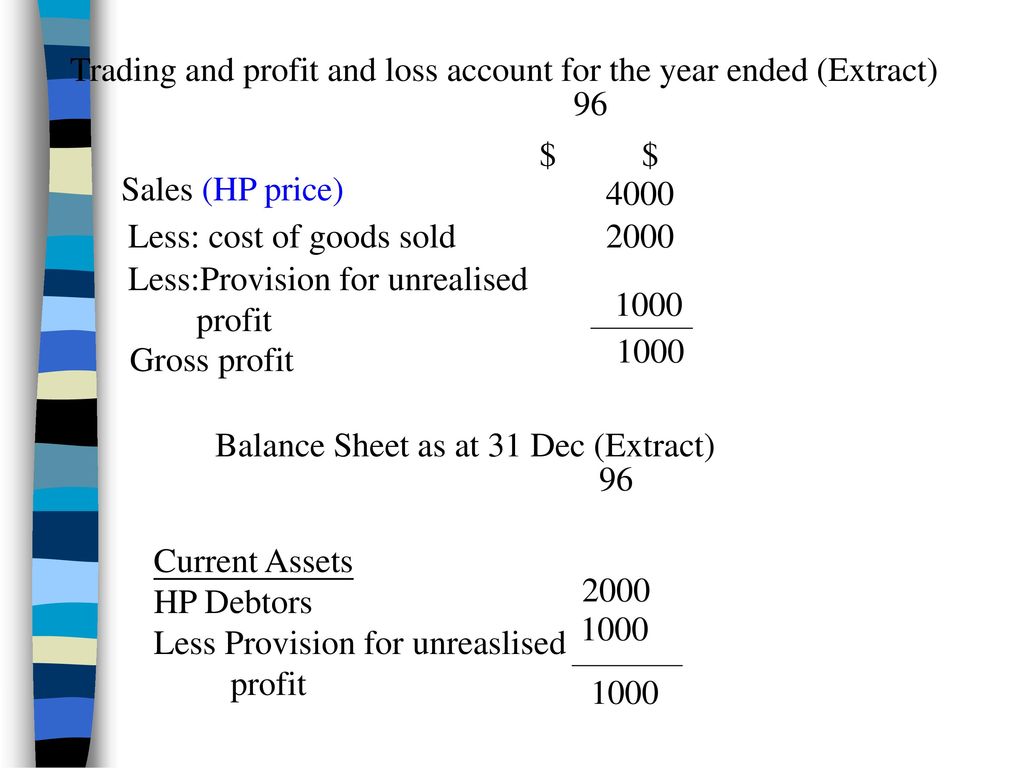

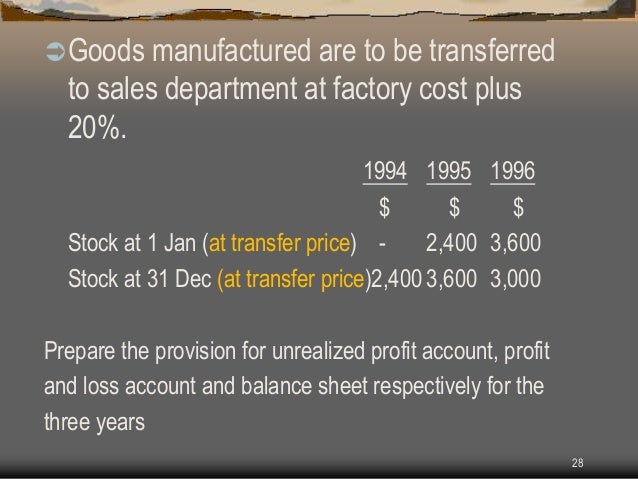

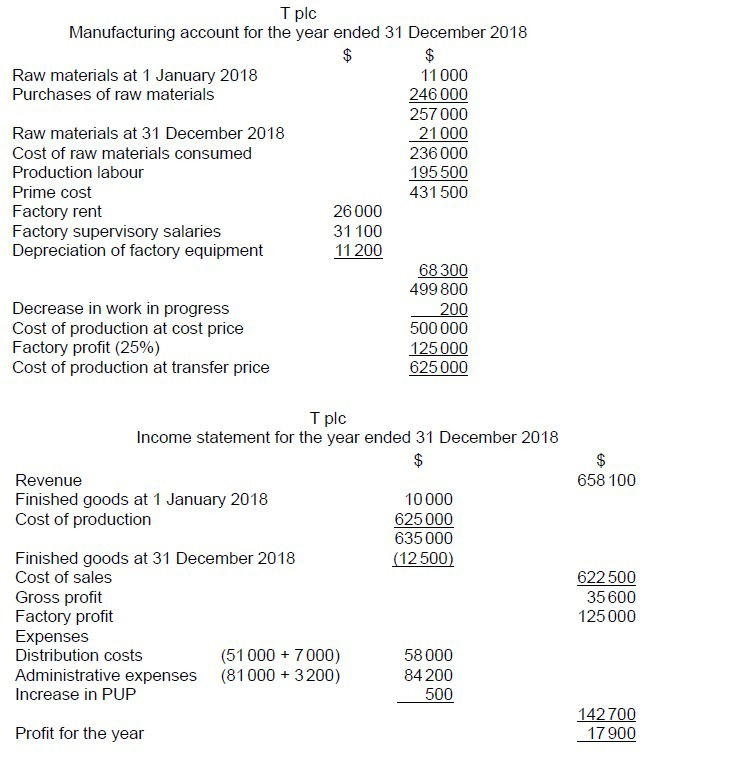

Unrealised profit in manufacturing account. The trading profit and loss account of a manufacturing business is similar in format to that of a merchandising business except that purchases is replaced by the manufacturing cost of goods completed. A sample Income statement showing this is shown below. 33 rows Why do you have to adjust for unrealised profit.

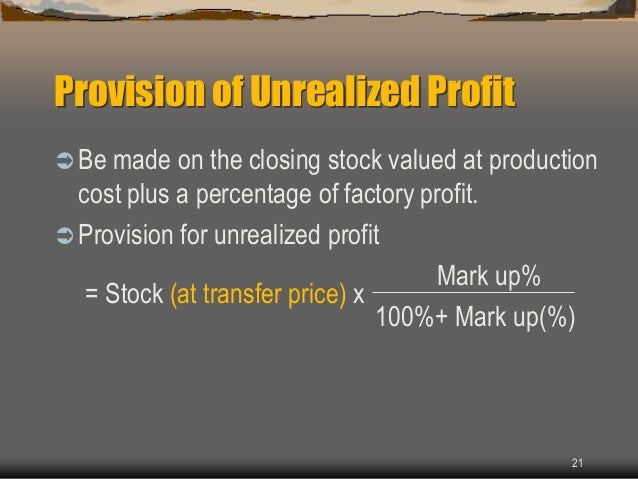

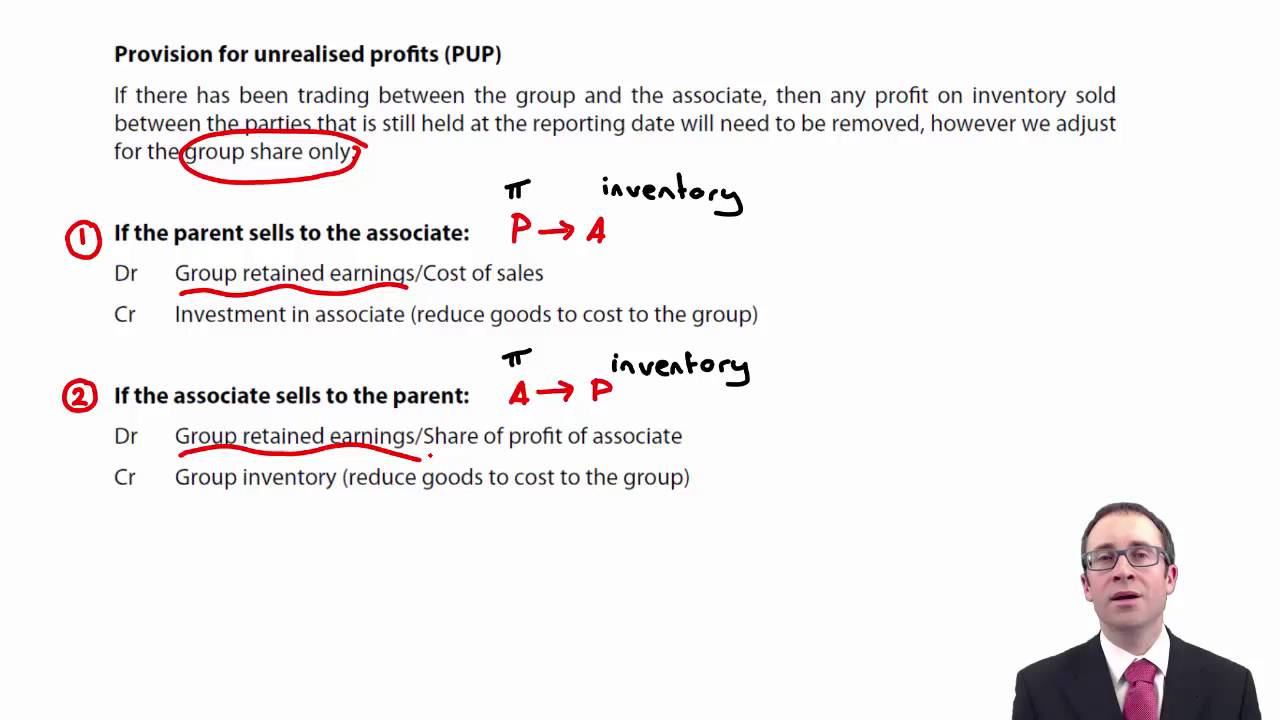

What is an Unrealised profit. If inventory of finished goods is at cost. Unrealised profit - more detail Profit is only unrealised if it remains within the group.

Goods at market value rather than at cost. Here is the video about trading and Manufacturing Account Simple explanation with solved problem. Provision for unrealised profit on stock is calculated.

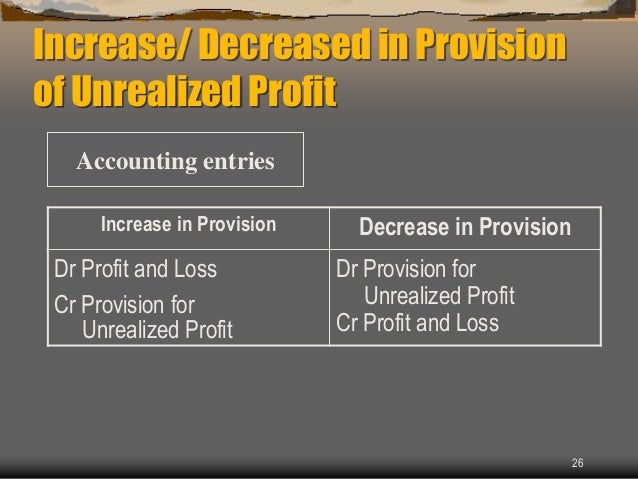

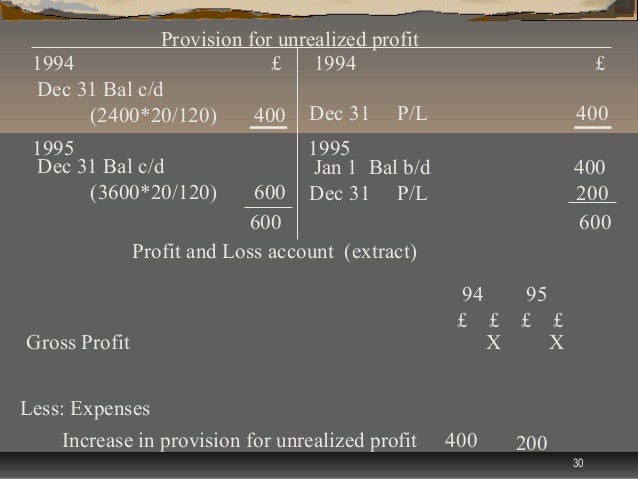

Profits made by transacting within the group are unrealised. This means that the change in the provision should appear in the profit and loss account as a debit if it is increased or as a credit if it is decreased which means this. Published on Sep 18 2015.

Cost of production Finished good at cost At the beginning of the year At the end of the year Sales 10000 6000 2000 27000 The goods are transferred from factory to sales department at 10 mark-up. So Unrealised profit is profit made between group companies and REMAINS IN STOCK. An unrealized gain is a potential profit that exists on paper resulting from an investment.

Unrealized Profit occurs where it is the policy of the firm to value stocks of finished. Unrealised profits are essentially the profit element one company in a group for example subsidiary makes when it sells inventory to another company in the same group for example to the parent company. Adjustment for unrealised profit in the transfer of non-current assets Occasionally a non-current asset is transferred within the group say from a parent to a subsidiary.