Sensational Bank Recognition Statement

Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss over a.

Bank recognition statement. A Statement on Recognition can assist you to. Importance of Bank Reconciliation. When you reconcile your bank statement you compare it with your bookkeeping records for the same period and pinpoint every discrepancy.

Typical Income Statement for Banks. A bank reconciliation statement is a document that compares the cash balance on a companys balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. What is bank reconciliation.

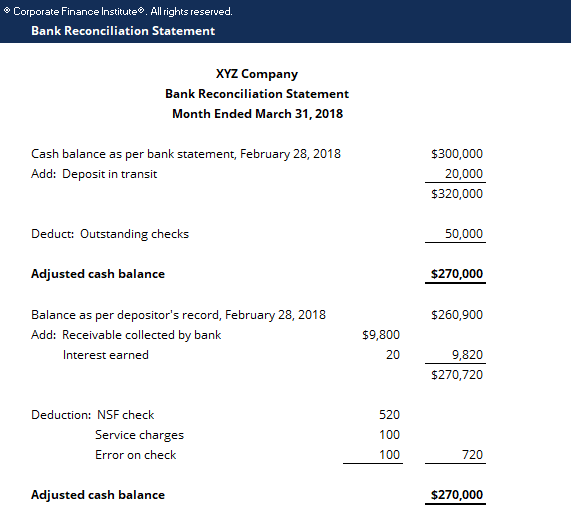

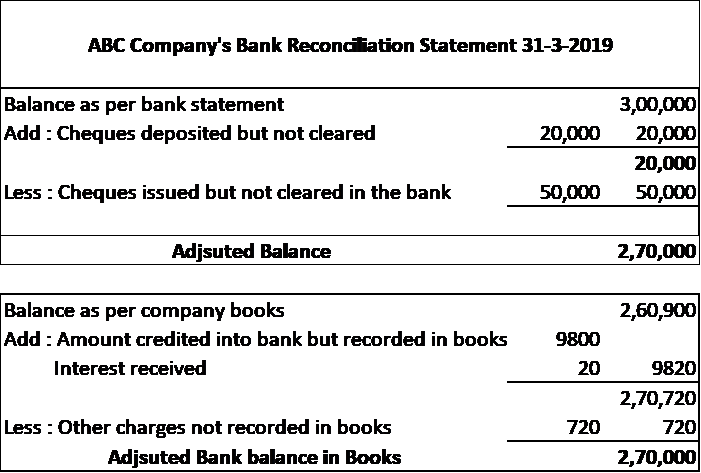

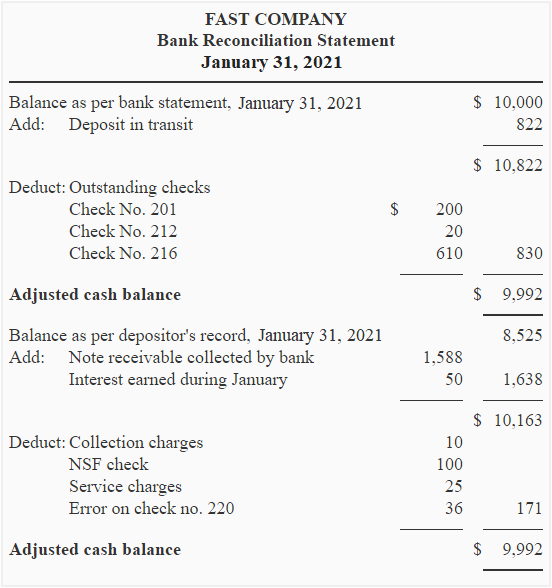

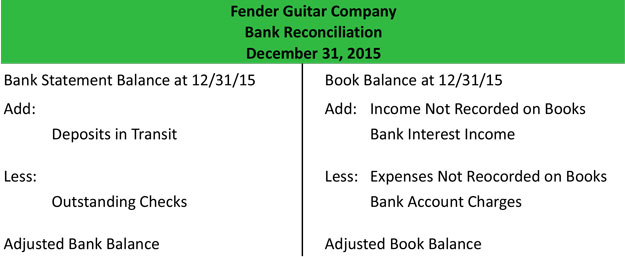

To the corresponding amount on its. A bank reconciliation statement is a statement prepared by the entity as part of the reconciliation process which sets out the entries which have caused the difference between the two balances. Such discrepancies might exist due to an error on the part of the company or the bank.

This is done by comparing the companys recorded amounts with the amounts shown on the bank statement. Bank Reconciliation Templates Bank Reconciliation is essential for any discrepancy in financial information. Obtain employment or promotion.

Below is step by step procedure for Bank Reconciliation. Again the overall structure of an income statement for a bank doesnt stray too far from a regular income statement. You can also check the amount holding of all the employees working under your company.

Check and tick all the debit entries as reflected in bank ledger with the credit entries in Bank Statement identify which are missed. The reconciled Cash balance that should be reported on the companys balance sheet as of October 31 is. A bank reconciliation helps ensure that your ending bank statement and your general ledger account are in.