Casual Stock Based Compensation Income Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

The expense realized is based on.

Stock based compensation income statement. SBC to RD engineers is included within RD expenses. Once the companys shares surpass that vesting price the employee is compensated by the difference in the current share price and the stock option strike price. The options vest 30 per year over three years and have a.

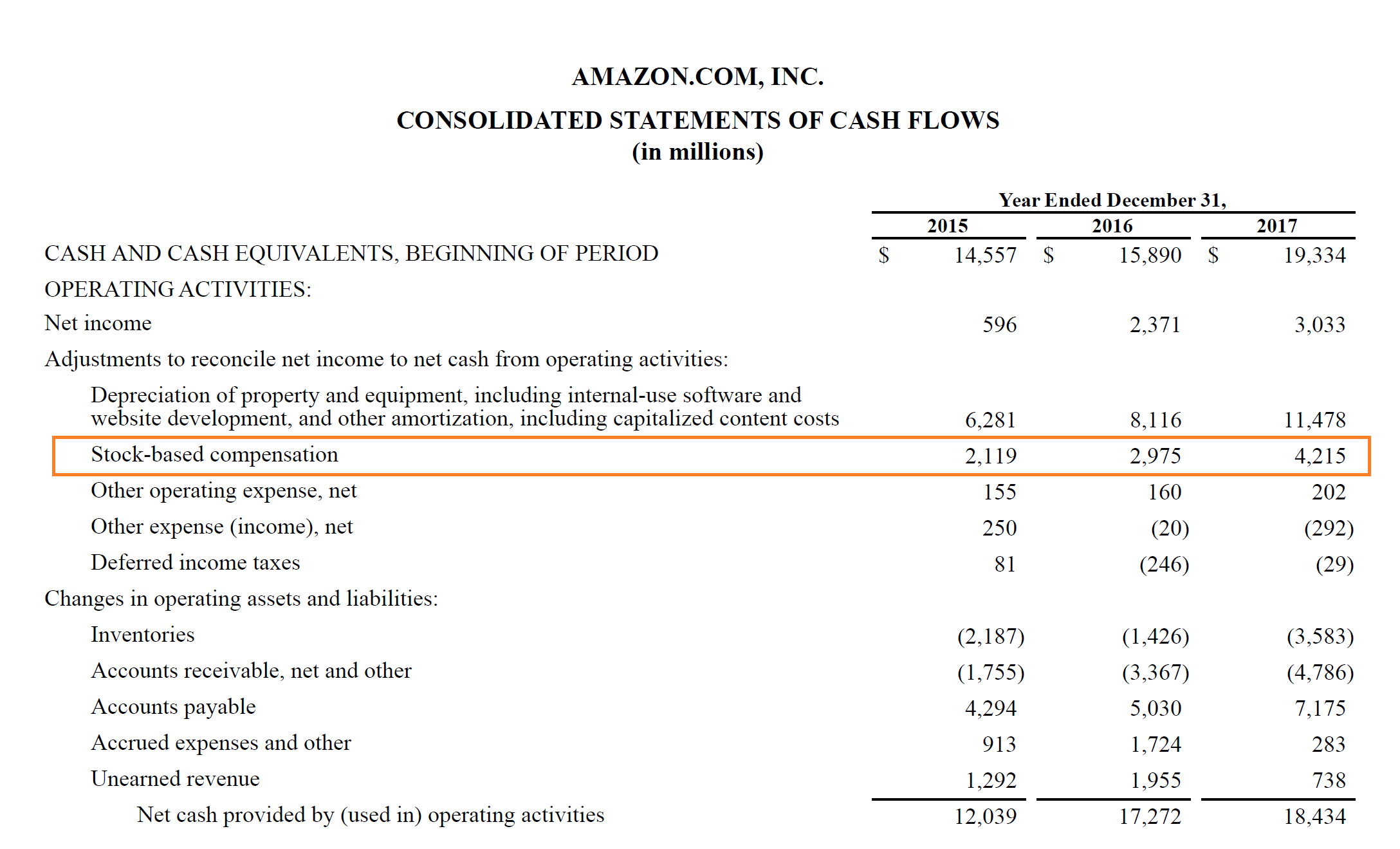

There is definitely an economic cost to stock-based compensation since it dilutes other shareholders. Under US GAAP stock based compensation SBC is recognized as a non-cash expense on the income statement. Since the company pays the CEO CFO and other employees with stock the company issues shares instead of giving them cash.

Under ASC 718 companies recognize the fair value of those awards in their financial statements. Corporations love it because it doesnt require dipping into cash flow and can be much more valuable to employees and key executives over the long run than just a fatter paycheck. Stock based compensation can be forecasted based on historical averages as seen below.

The final rules are effective for annual periods beginning after December 15 2016 for public companies and. ASC Topic 718 formerly SFAS 123R is the rule that governs expensing of all stock-based compensation. Stock-Based Compensation SBC is a way of paying employees without paying them cash.

For Burneys options the intrinsic value of 237 per option or 237000 overall 617 less the revised exercise price of 380 multiplied by the number of options must now be recorded as a compensation expense in the income statement. Specifically SBC expense is an operating expense just like wages and is allocated to the relevant operating line items. The intention of offering stock-based compensation is to align the interests of employees with company performance.

Stock Based Compensation Selling General and Administrative Expenses x Historical Average where Historical Average Prior Years Stock-based Compensation Prior Years Selling General Administrative Expenses. Us Stock-based compensation guide 11. Under US GAAP stock based compensation SBC is recognized as a non-cash expense on the income statement.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)