Outrageous Provision For Warranty Expense

I Warranty expense and II provision for warranties are what type of accounts.

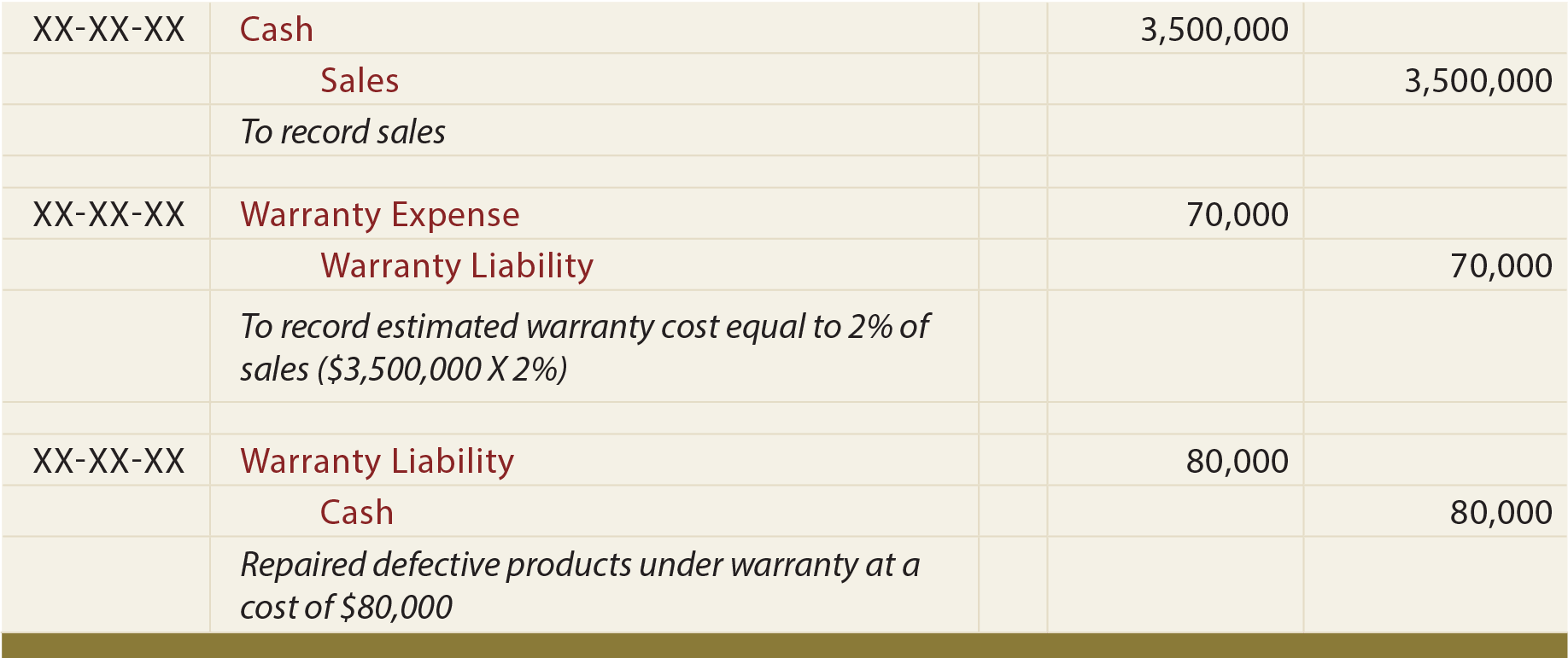

Provision for warranty expense. It means that you should book a provision for warranty repairs in the amount of estimated cost of repairs over the next 2 years. I Negative liability II liability c. The journal entry is.

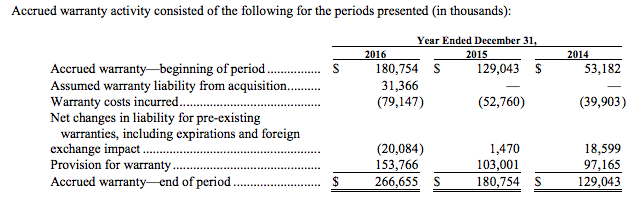

Warranty expense is the cost associated with a defective product repair replacement or refund. Total warranty provisions of EUR 693m have been made in 2020 2019. EUR 291m corresponding to 47 percent 2019.

A provision for the warranties is credited which goes under the liabilities in the balance sheet. 19 rows Expenses are not a contingent liability ie. What types of accounts are I GST collections and II GST outlays.

While the credit creates the liability account reflecting the estimated debt the company thinks it has at present. Ad Find For warranty. I Liability II expense 11.

I Liability II asset b. If a warranty claim period extends for longer than one year it may be necessary to split the accrued warranty expense into a short-term liability for those claims expected within one year and a long-term liability for those claims expected in more than one. I Expense II liability d.

Calcutta High Court held In the case of The CIT vs. Management assesses the likely outcome of pending and future. 24 percent of Vestas revenue.