Top Notch Reasons For Decrease In Operating Profit Margin

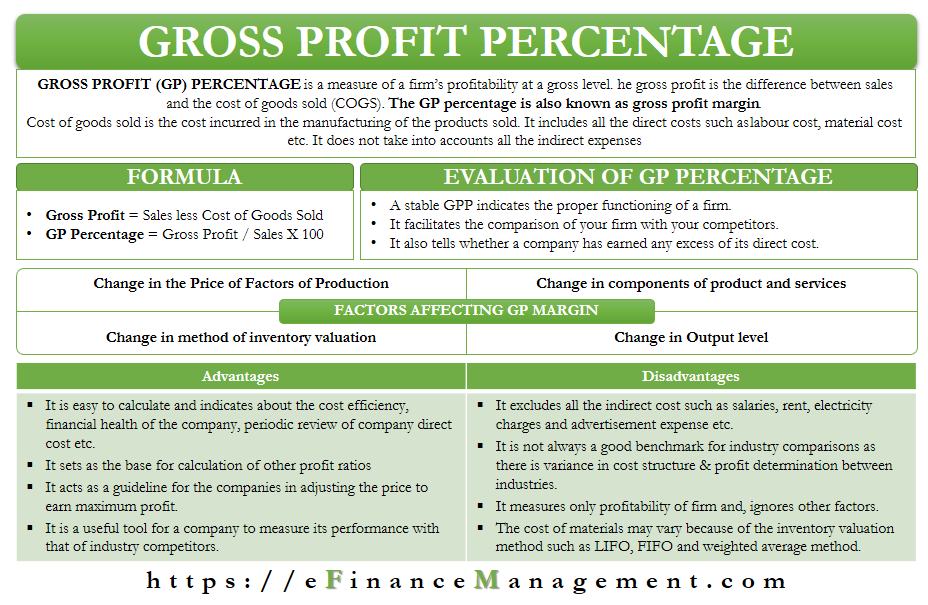

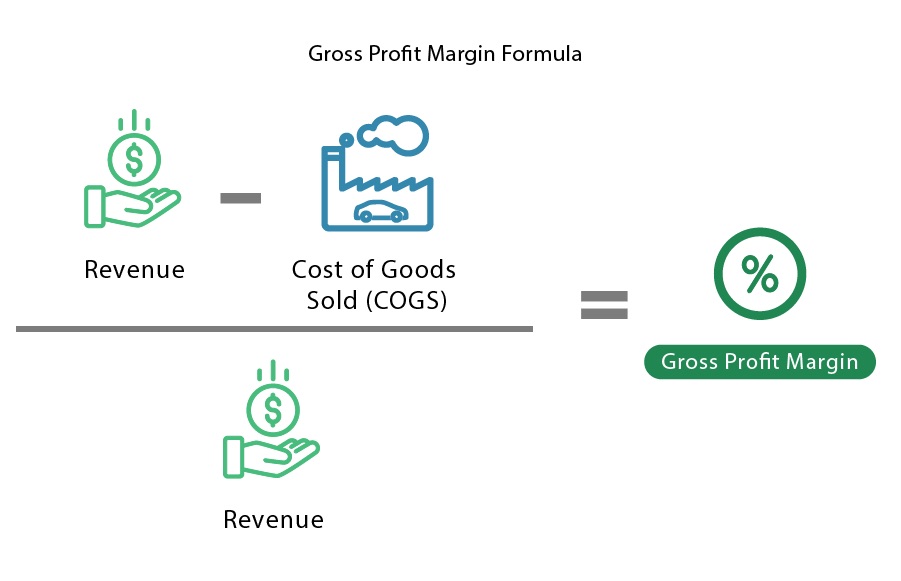

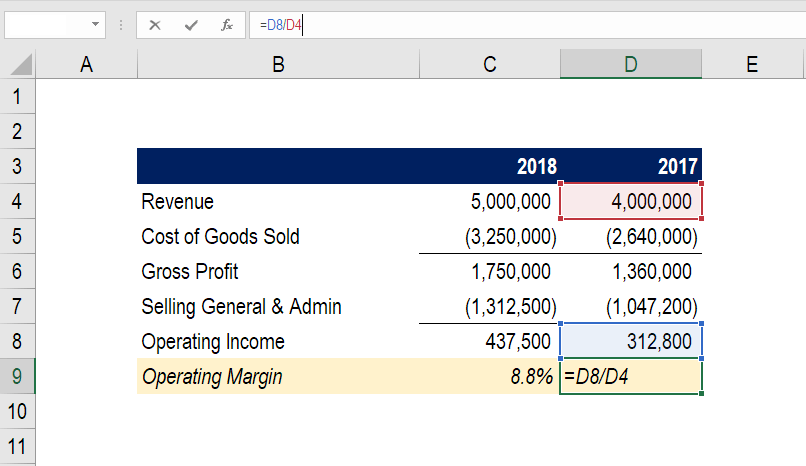

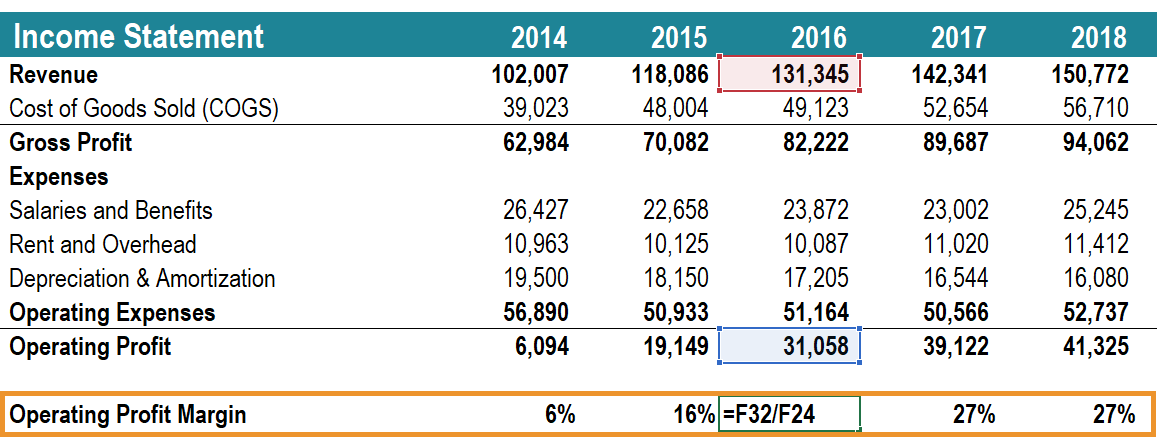

Cost of goods sold and operating expenses make up the total expenses that are deducted from sales to produce the operating profit.

Reasons for decrease in operating profit margin. An increase in gross profit margin can be due to the following reasons. A undervalued opening stock or overvalued closing stock. More competitive because they can offer lower prices than the competition.

An obvious reason for a decline in operating profit is a decline in sales. Vice versa when you see a decrease in gross profit margin when comparing to previous accounting periods some of the reasons may be due to. The operating profit margin ratio provides a means of determining how well a companys business model works in comparison to its competitors or across its industry.

The most common reason companies experience high operating margins relative to their competitors stems from a low-cost operating model. Even if target revenues are met and cost of goods sold kept within projected. A low profit margin means that your business isnt efficiently converting revenue into profit.

D Decrease in OP Margin Ratio Decrease in GP Margin Ratio Possible Causes. The simple answer is that the change in overhead costs is greater then the change in gross profit percentage. An obvious reason for a decline in operating profit is a decline in sales.

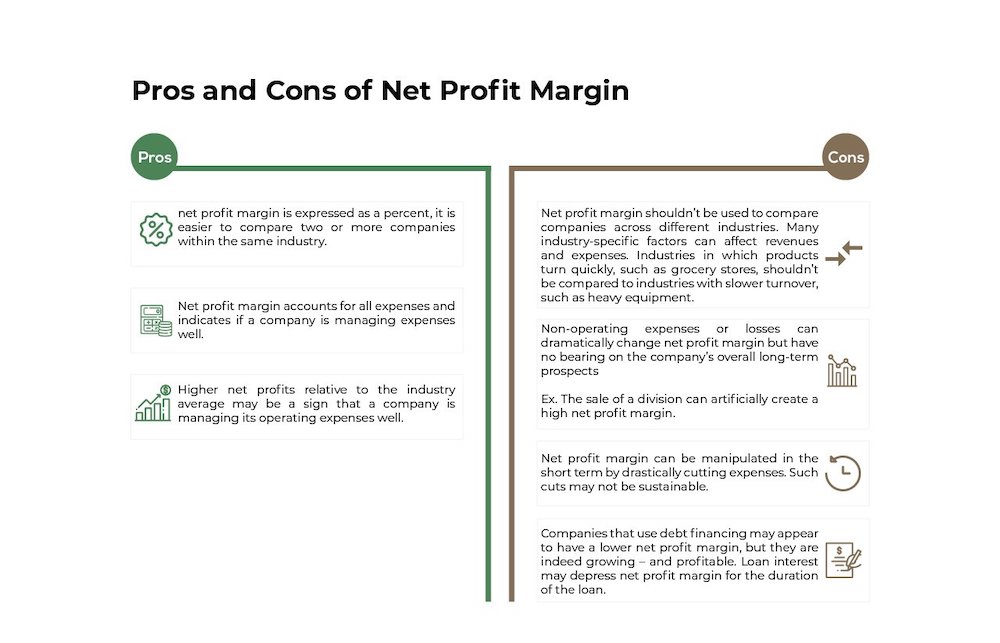

But subsequently there has been a decrease in the margin and currently the Operating Profit Margin for Apple is 25. Operating margin is a profitability ratio measuring revenue after covering operating and non-operating expenses of a business. Therefore declines in margin generally occur because of shrinking revenue relative to sales volume or higher COGS.

Low margins are determined relative. Overstaffing lower productivity poor cost control. Wrong valuation of closing stock re.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-28at7.09.49PM-f53a583c48954953a7cd0d23454be040.png)

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

/dotdash_Final_Profit_Margin_Aug_2020-01-bea7f096438b4af2ad52a5a94d3ae793.jpg)