Formidable Formula For Calculating Cash Flow

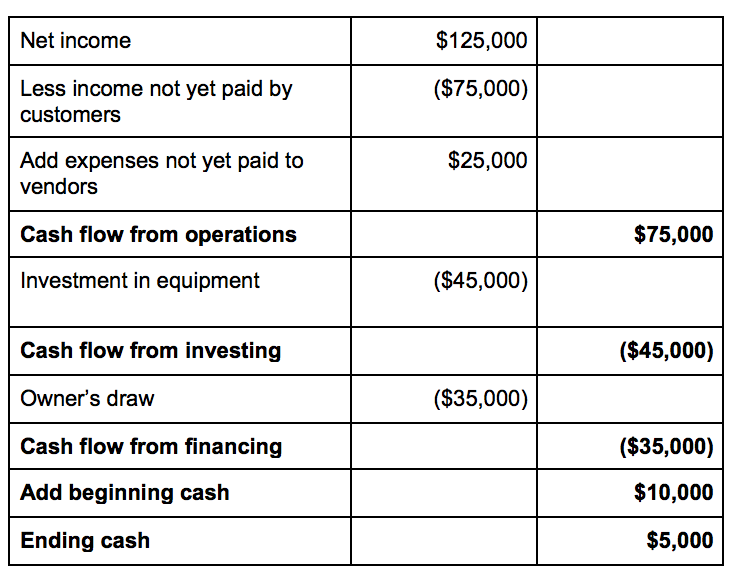

This formula is simple to compute and its often ideal for smaller businesses partnerships and sole proprietors.

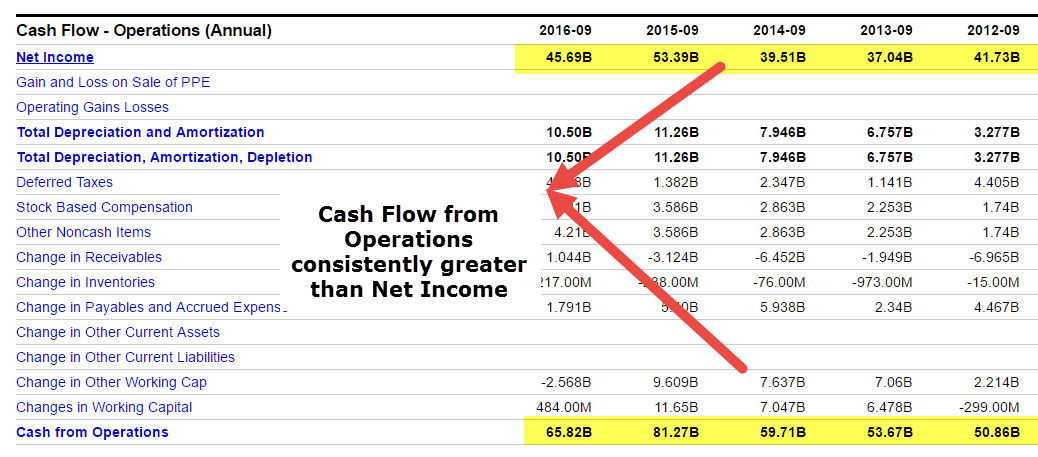

Formula for calculating cash flow. By taking capital expenditures into account we are using the Free Cash Flow FCF formula. The free cash flow shows the amount of cash left over after all the operating expenses and capital expenditures are paid. Free Cash Flow Formula FCF is the most general and vital cash flow formula.

Free Cash Flow Operating Cash Flow Capital Expenditures. 1 Direct Method OCF Formula This method is very simple and accurate. It is the money the business can invest in growth paying dividends and more.

Uses of Funds From Operations. Cash flow formula. Total revenue operating expenses OCF To use the direct method use total revenue and total operating expenses posted to the income statement.

Here is the DCF formula. In 2017 free cash flow is calculated as 18343 million minus 11955 million which equals 6479 million. If you wonder how to calculate net cash flow the formula is.

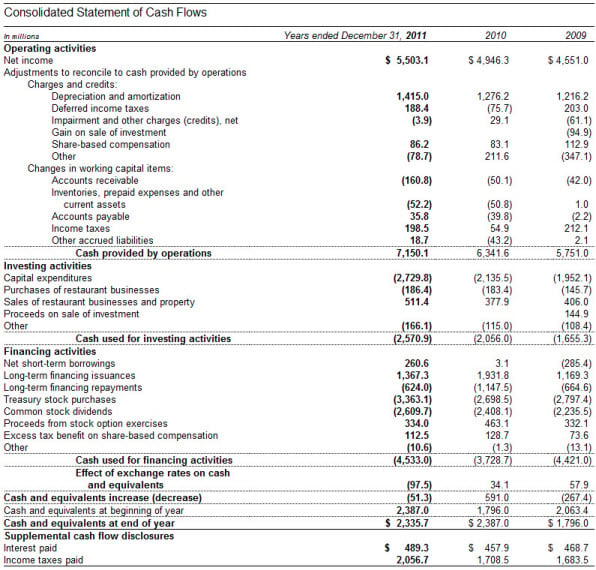

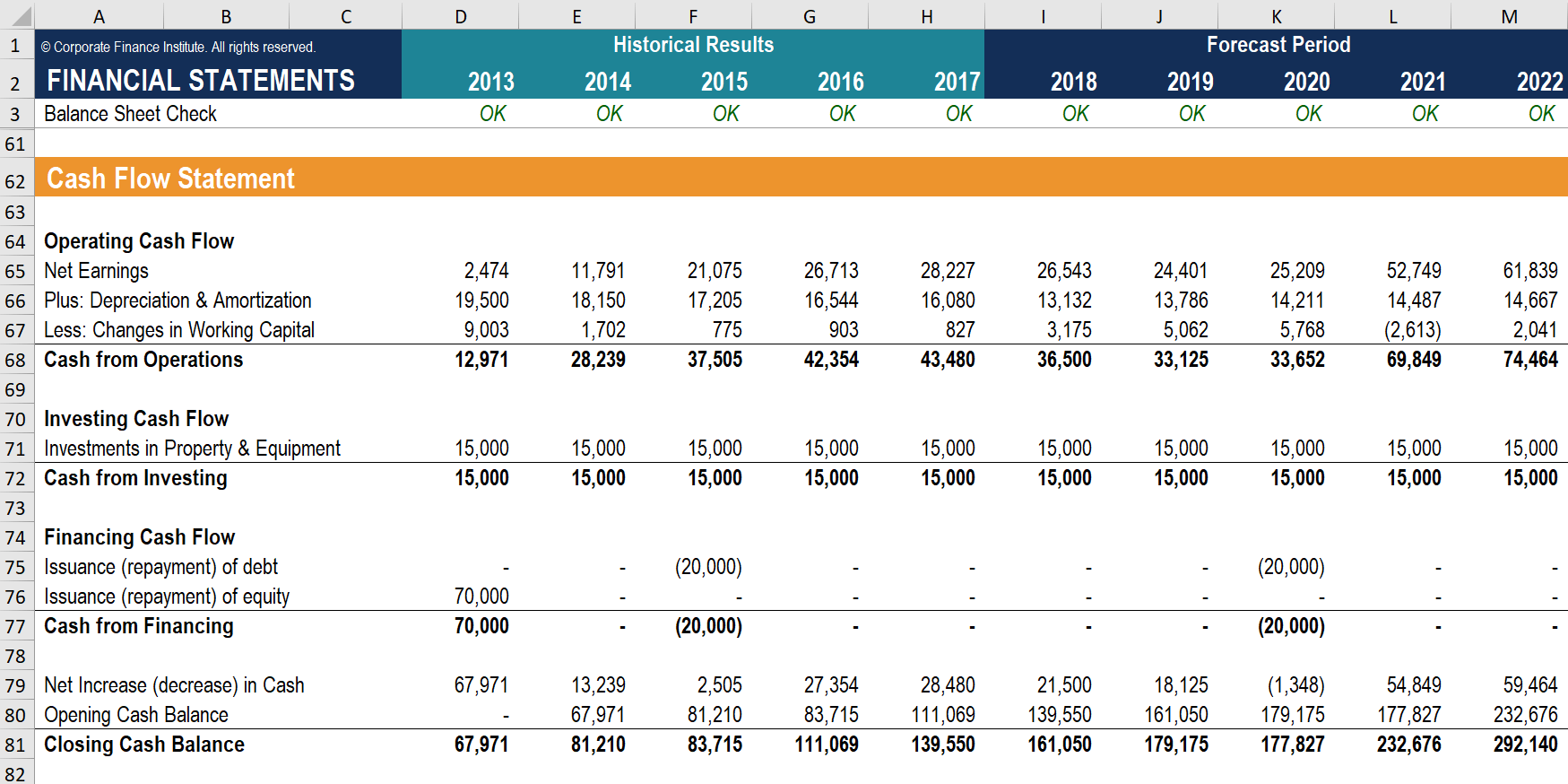

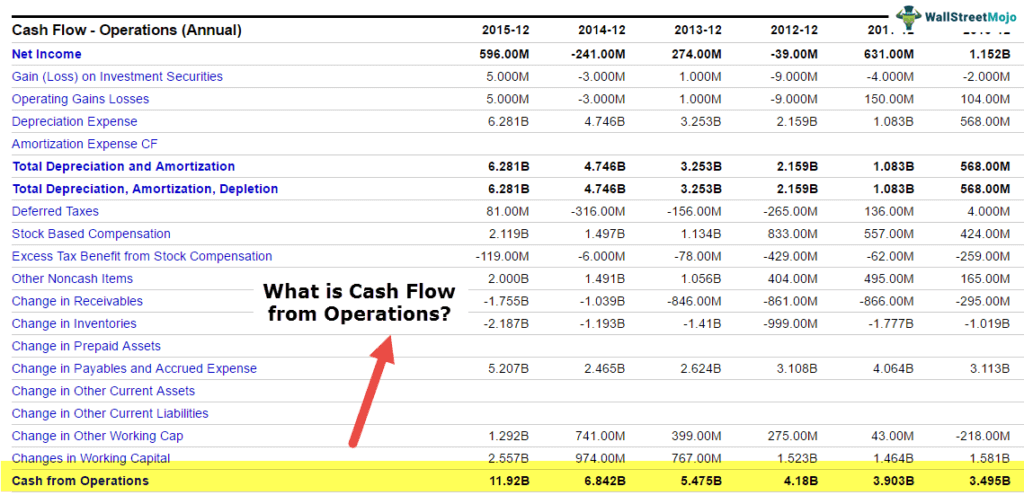

Cash Flow from Operations Formula While the exact formula will be different for every company depending on the items they have on their income statement and balance sheet there is a generic cash flow from operations formula that can be used. Formula for net cash flow Financial professionals can calculate net cash flow by adding together operating cash flow financing cash flow and investing cash flow in the following formula. There are two formulas to calculate Operating Cash Flow one is a direct method and the other is an indirect method.

When you include the three areas of cash flow we discussed aboveOperating Activities CFO Investing Activities CFI and Financing Activities CFFthe formula can be expanded to look like this. Fund flow vs cash flow from operations. The FCF formula is Free Cash Flow Operating Cash Flow Capital Expenditures.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)