Spectacular Example Of Off Balance Sheet Items

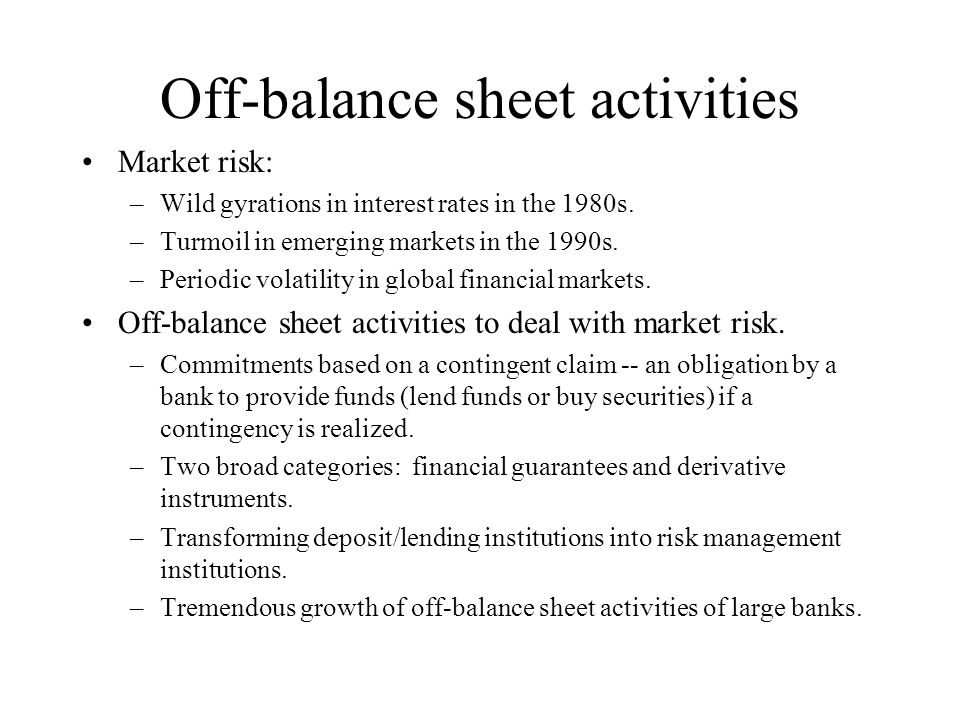

Off balance sheet sources of liquidity risks for banks include items which might cause demands for additional funding in the future.

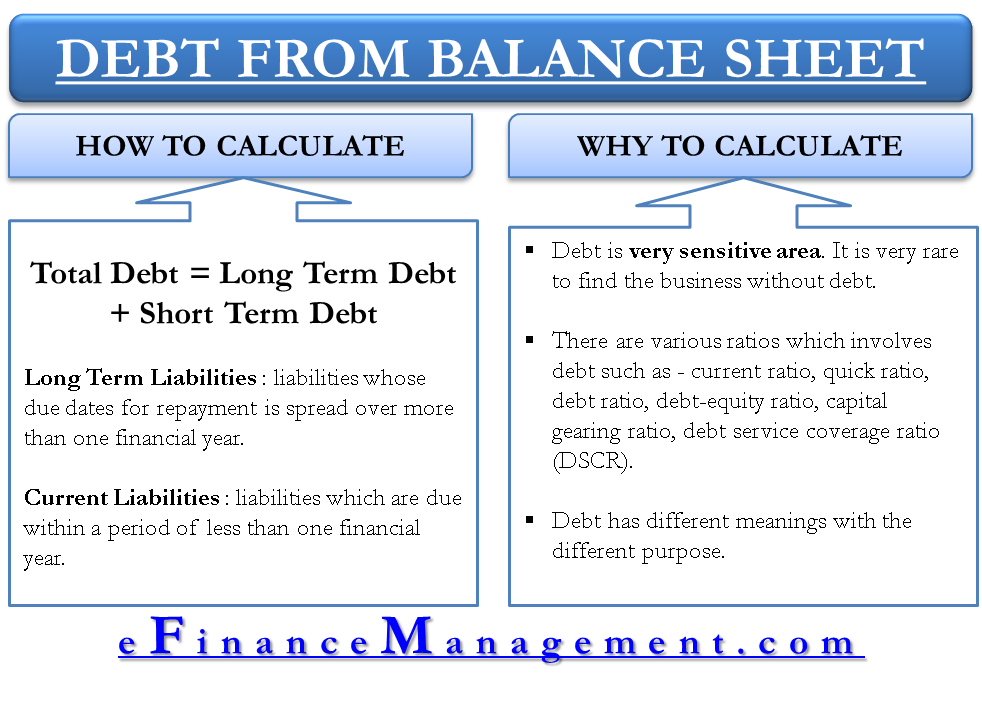

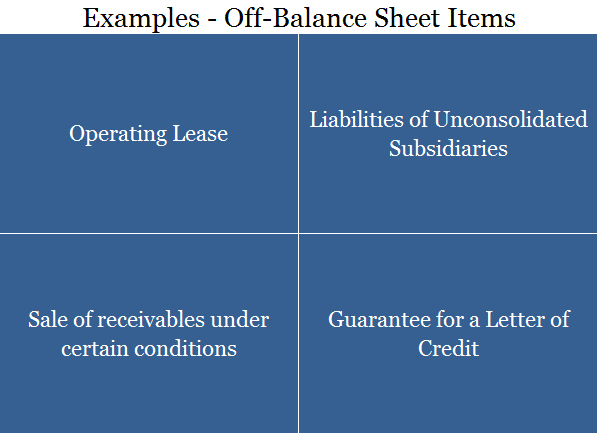

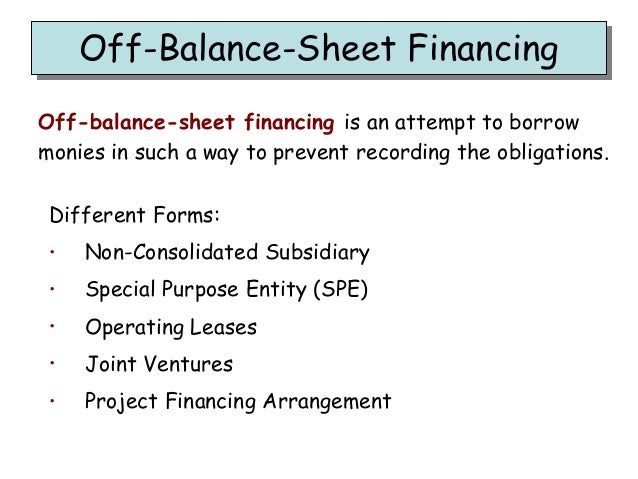

Example of off balance sheet items. Besides operating leases other examples of off-balance-sheet financing include selling receivables under certain conditions providing guarantees or letters of credit or participating in joint ventures or research and development activities. Assets Liabilities Equity Using this template you can add and remove line items under ea. These items are usually associated with the sharing of risk or they are financing transactions.

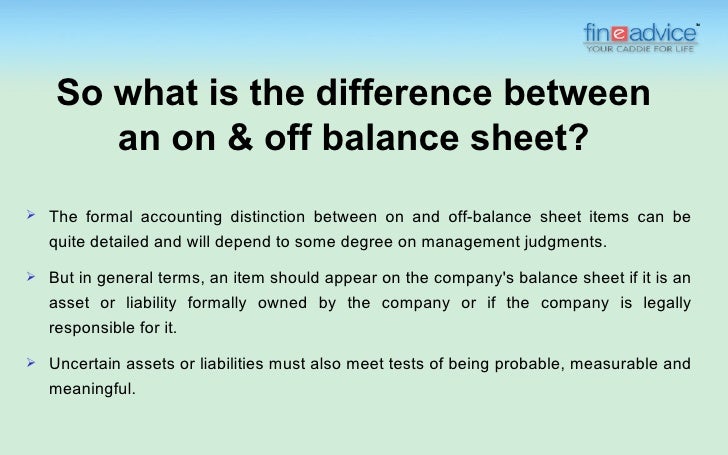

Off-Balance sheet items are generally shown in the notes to accounts along with the financial statements. An operating lease used in off-balance sheet financing OBSF is a good example of a common off-balance sheet item. They are either a liability or an asset which are not shown on a companys balance sheet as the business is not a legal owner of the respective item.

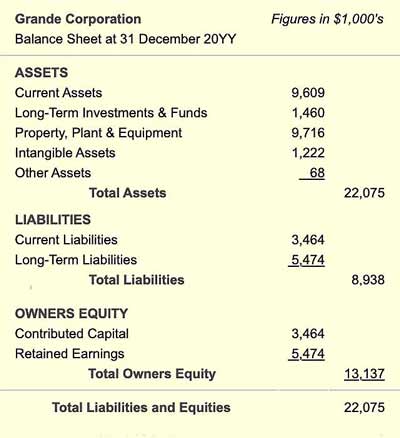

Among the above examples operating leases are the most common examples of off-balance-sheet financing. This helps improve their accounting ratios or. We will present examples of three balance sheet formats containing the same hypothetical amounts.

The notes to the financial statements are omitted as they will be identical regardless of the format used. Some companies may have significant amounts of off-balance sheet assets and liabilities. 1 Leasing It is the oldest form of off-balance-sheet financing.

Other examples of off-balance sheet items include guarantees or letters of credit joint ventures or research and development activities. Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage. It was extensive use of off-balance sheet items such as credit default swap derivatives and on and off-balance sheet items like mortgage-backed securities which caused several well-known firms to implode and others to tumble greatly.

In the account form shown above its presentation mirrors the accounting equation. Another example of off-balance sheet items would be when investment management firms dont show the clients investments and assets on the balance sheet. Examples of off-balance-sheet financing include joint ventures research and development partnerships and operating leases rather than purchases of capital equipment.

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)