Fabulous Changes In Balance Sheet Accounts Are Necessary For

Assume the fiscal year-end is December 31 2019.

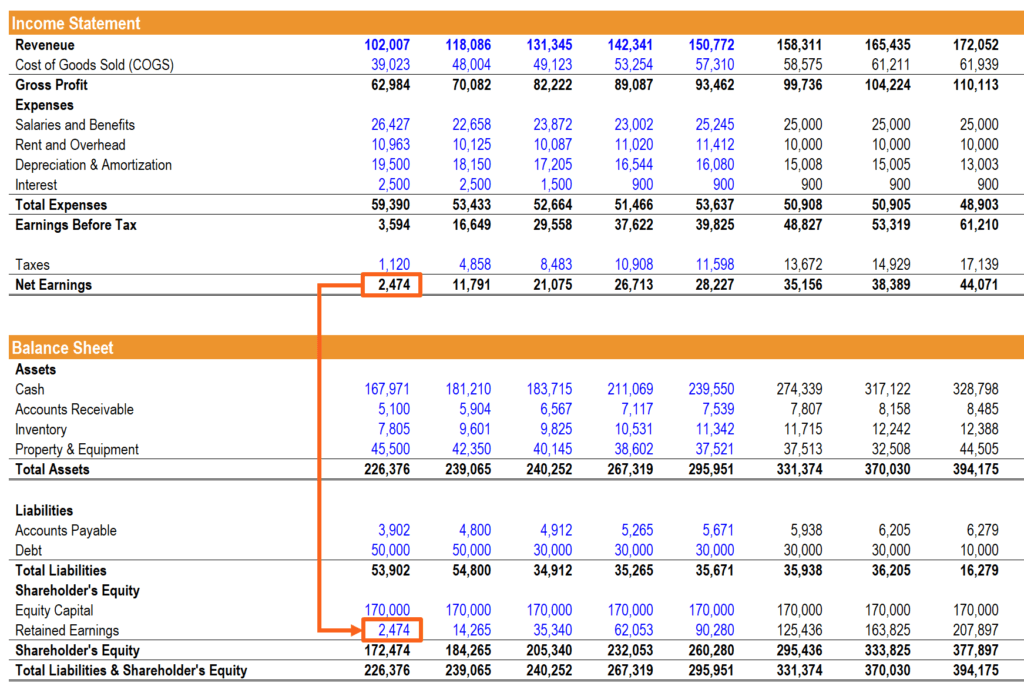

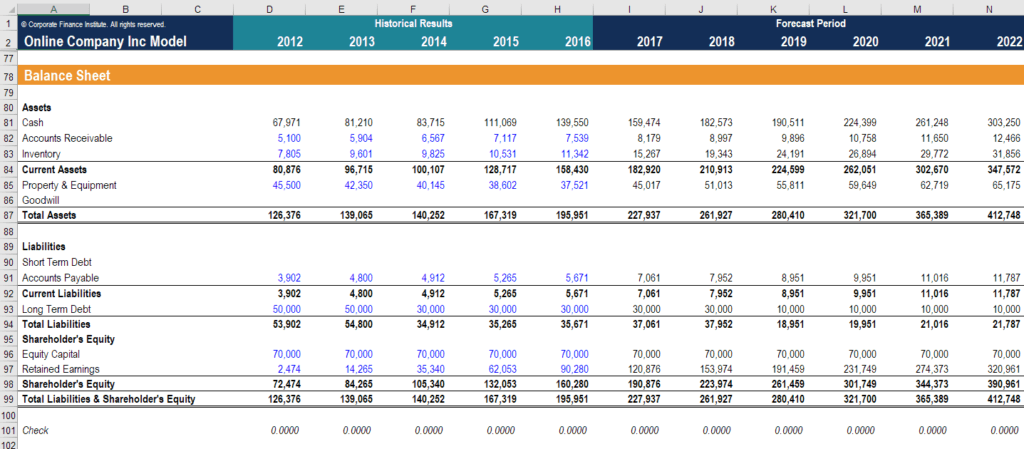

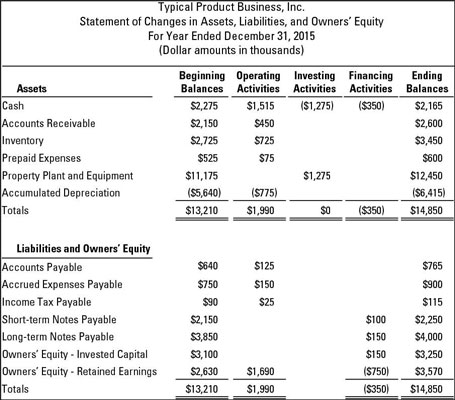

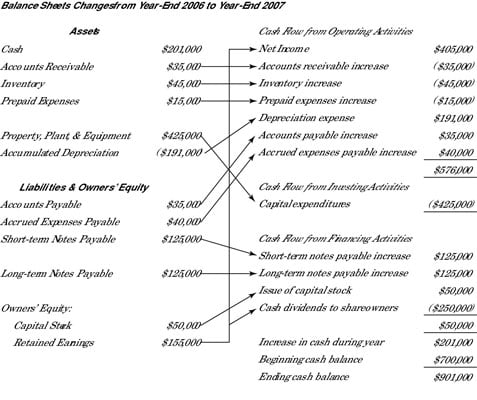

Changes in balance sheet accounts are necessary for. These amounts are mentioned in Column I and Column II of the comparative balance sheet. The companys income statement under weighted-average inventory accounting method for financial year ended 31 December 2012 and 31 December 2011 is given below. Firstly specify absolute figures of assets and liabilities relating to the accounting periods considered for analysis.

Also called a statement of financial position a balance sheet shows what your company owns and what it owes through the date listed as Accounting Coach stated. More importantly if you familiarise yourself with using financial ratios the balance sheet can provide warning signs so you can solve any problems before they destroy your business. Find out the absolute change in the items mentioned in the balance sheet.

Changes found in these areas should flag the need for further examination of the Balance sheet in order to accurately assess the actual financial condition of the business. Here are some of the changes. You are required to work out the necessary adjustments needed to balance sheet accounts as at the date of change in policy.

For example with the addition of leases to the balance sheet organizations should review existing contractual agreements such as lending covenants to seamlessly adjust to the new standard. Post the entries to general ledger T-accounts and calculate balances. Inventory will decrease when goods are sold.

If the current year books are closed-no entry is necessary if the error has already counterbalanced. When preparing the statement of cash flows analysts must focus on changes in account balances on the balance sheet. Since all business transactions affect at least two accounts there will likely be an enormous number of changes to the balance sheet.

The balance sheet is a vital financial statement you should be reviewing regularly as it changes with every transaction. Therefore you can check your prior period balance sheet to make sure it hasnt changed since you last closed your books. Several departments in your company will be affected by the changes in lease accounting including the finance department but not exclusively.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)