Looking Good Tim Hortons Financial Statements 2018

Financial Information at September 30 2019.

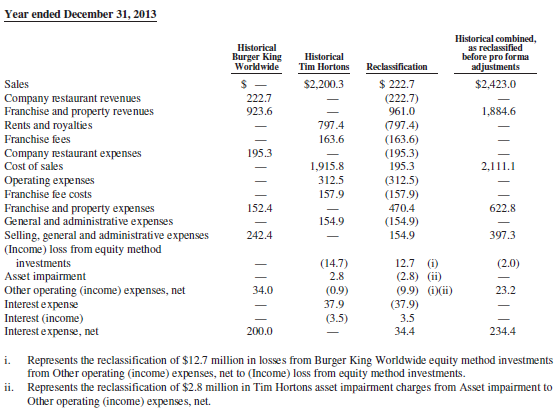

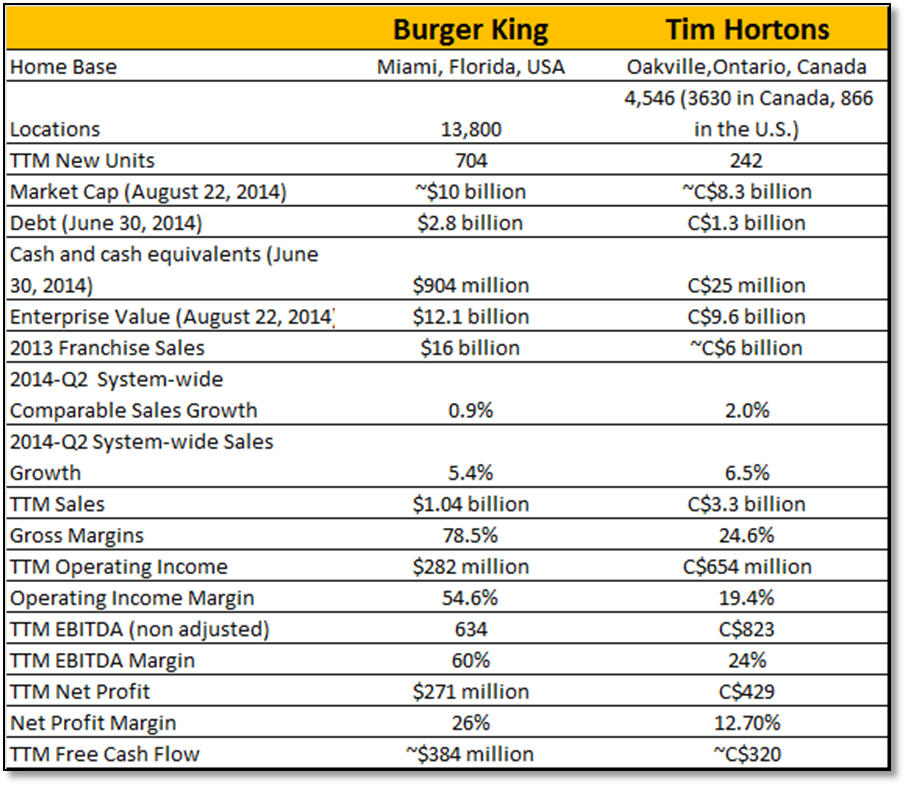

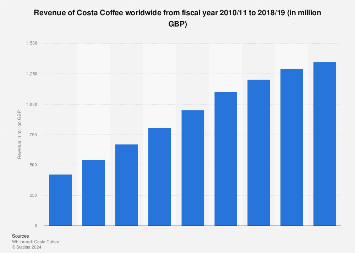

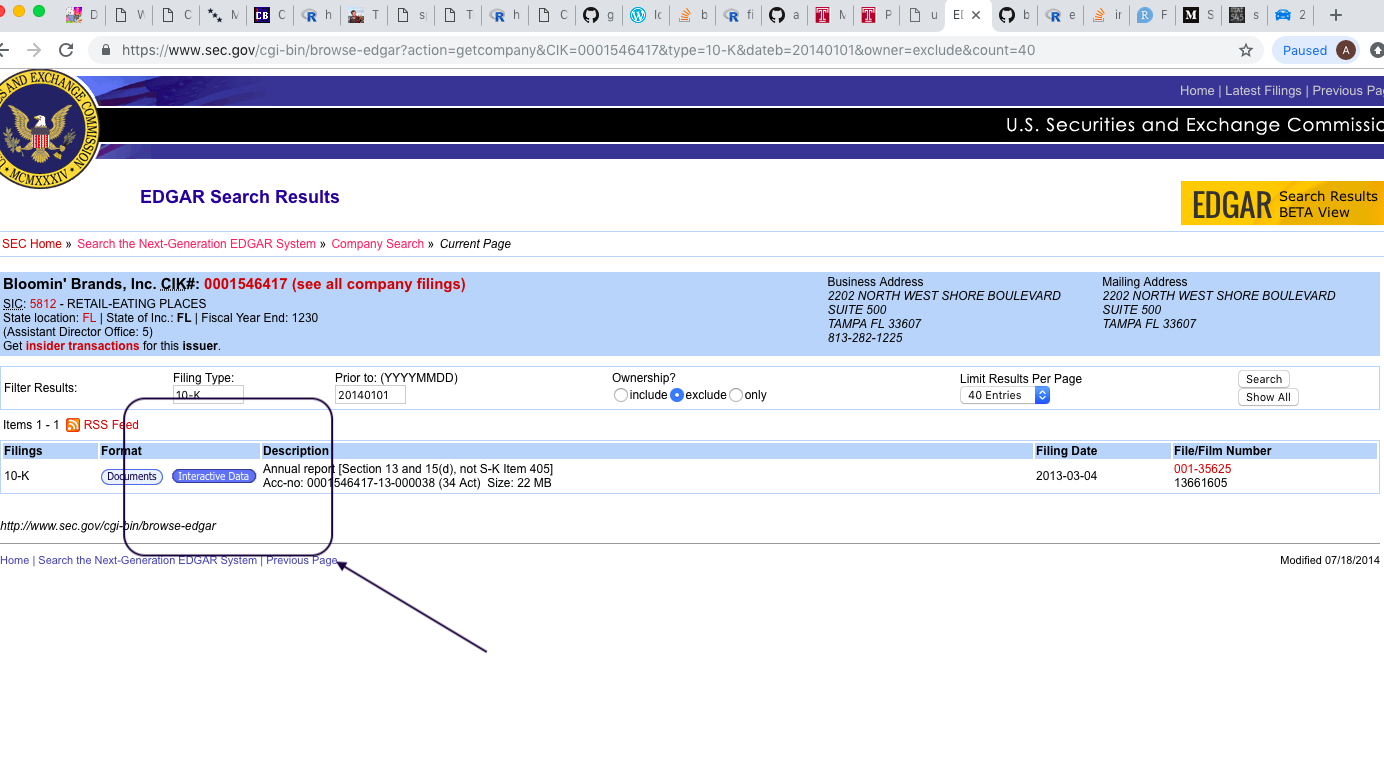

Tim hortons financial statements 2018. Section II Estimated initial investment for a Tim Hortons franchise based on Item 7 of the companys 2018 FDD. Restaurant Brands International Limited Partnership 2019 SEC Form 10-K Annual Report. Tim Hortons Revenue has grown by 97 from 3 billion in 2016 to 33 billion in 2018.

Tim Hortons holds an impressive share of Canadian coffee segment at 62 in addition to 76 for baked goods segment of Canadian market. Restaurant Brands International Limited Partnership 2020 SEC Form 10-K Annual Report. Revenue for the quarter totalled 139 billion up from 123 billion a year ago.

This statistic shows the annual revenue of Tim Hortons from 2015 to 2018. On an adjusted basis the company earned 68 cents per share for the quarter. Presentation FY 2019 Results.

Intangible assets net including goodwill 4. Tim Hortons rolls back Roll Up the Rim prize pool as it makes sweeping changes to contest in digital shift. Section III Initial franchise fee royalty fee marketing fee and other fees for a Tim Hortons franchise based on Items 5 and 6 of the companys 2018 FDD.

Presentation Q3 2019 Results. Analysts on average had expected a profit of 67 cents per share for the quarter according to Thomson Reuters Eikon. Tim Horton Childrens Foundation Inc.

Section IV Number of franchised and company-owned Tim Hortons outlets at. Notes to Combined Financial Statements October 31 2018 and October 31 2017 in thousands of Canadian dollars 1 1 Status of Tim Horton. Paper-cup version to last for only two weeks of month-long program value of.