Supreme Fx Gain Loss Income Statement

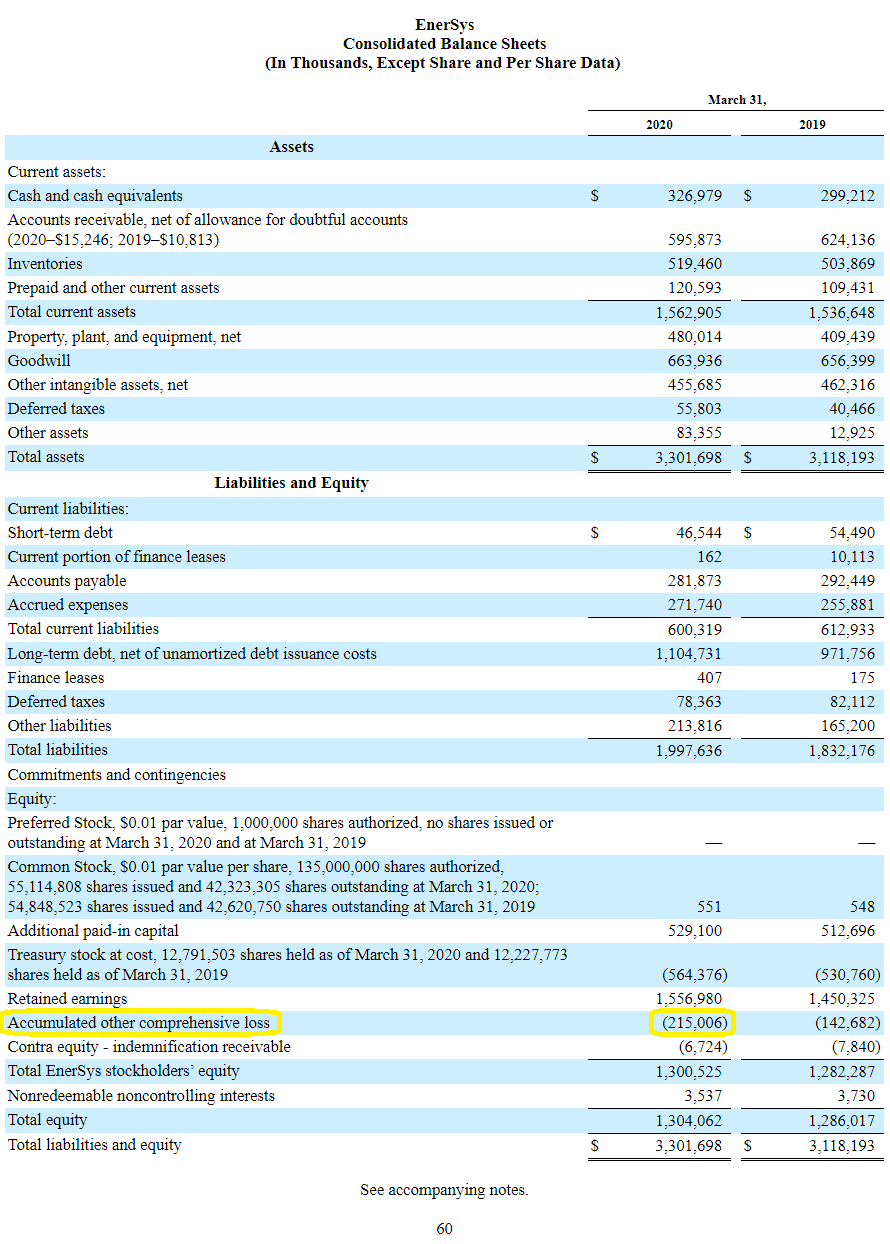

Balance sheets are often re-translated at each period month end.

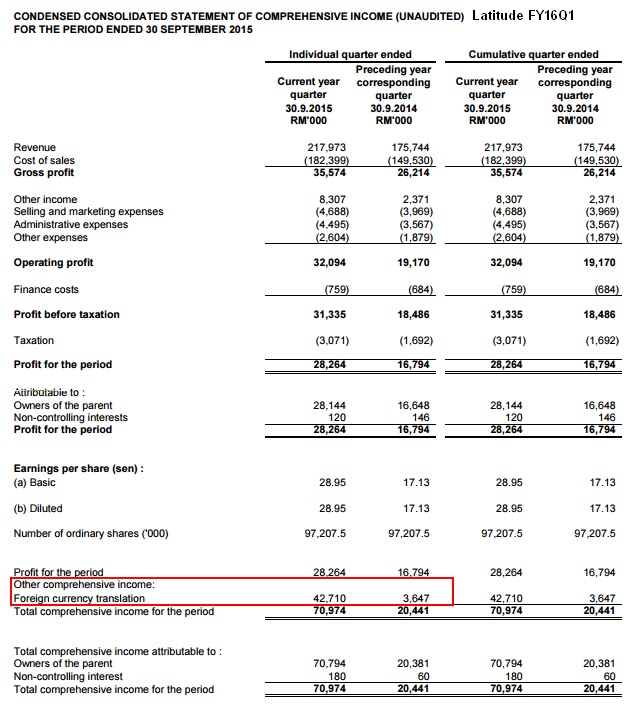

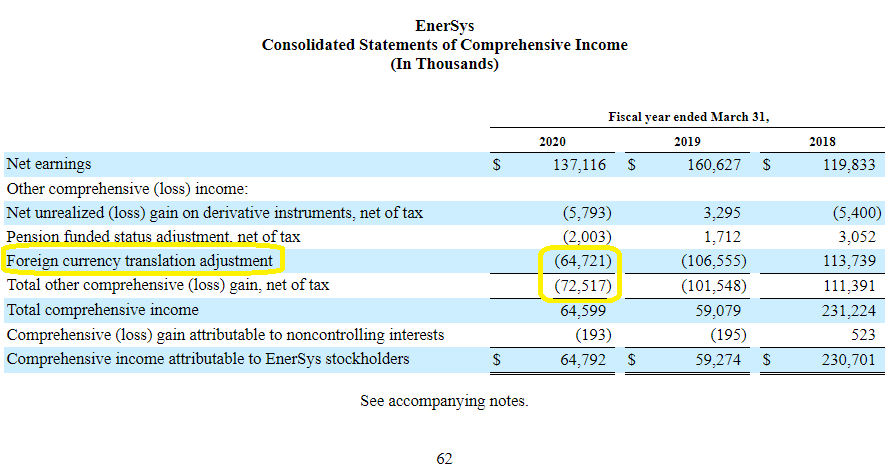

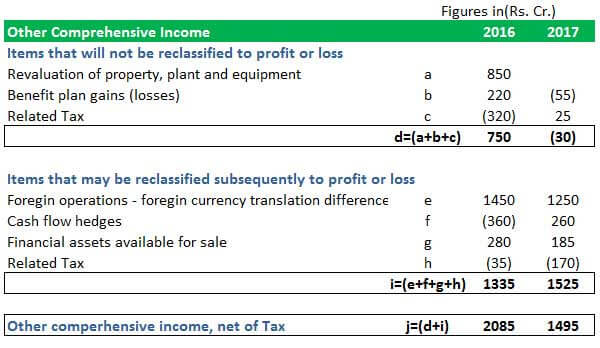

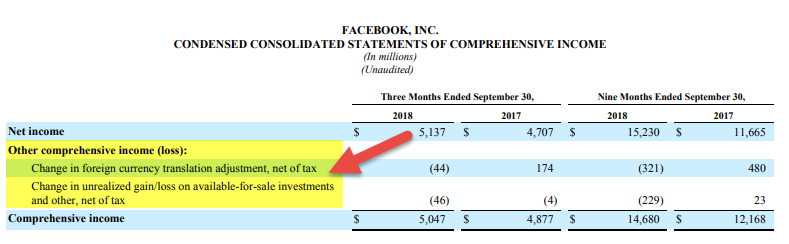

Fx gain loss income statement. Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time. IAS 2115A If a gain or loss on a non-monetary item is recognised in other comprehensive income for example a property revaluation under IAS 16 any foreign exchange component of that gain or loss is also recognised in other comprehensive income. To eliminate FX gains or losses caused either by timing of hedges or by over- or under-hedging a company using the prior-month balance sheet FX rate as its income statement FX rate would need to place a hedge on the last day of the month for an amount equal to both.

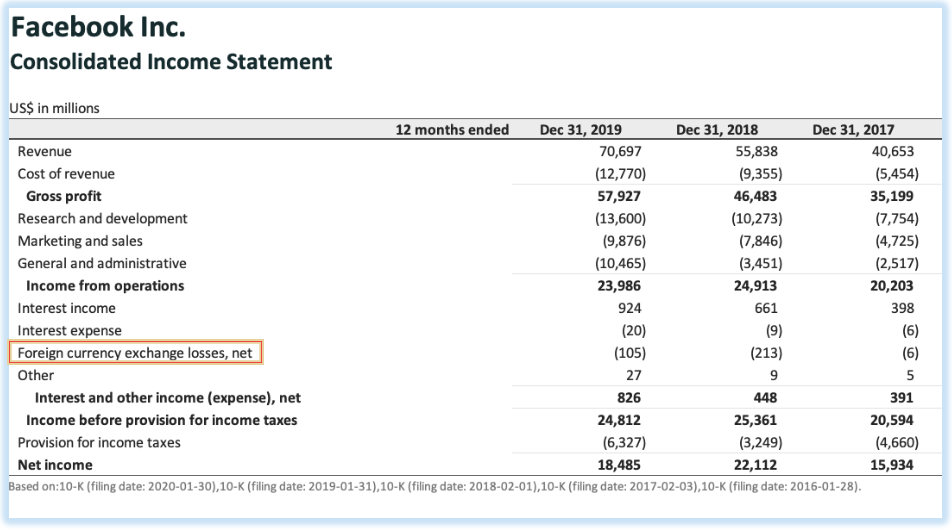

These balances are calculated based on the different transactions in foreign currencies for the business which was finalized earlier. Currency gains and losses that result from the conversion are recorded under the heading foreign currency transaction gainslosses on the income statement. All exchange gains and losses are considered permanent whether they arise during revaluation or upon settlement and they are not reversed in the next period.

Foreign currency gains and losses also known as exchange rate gains and losses is an accounting concept used to define the impact on international businesses financial statements of the fluctuation of the exchange rate of the non-functional currencies in which the company holds monetary assets and liabilities. When financial reports have to be generated the foreign currency balances are converted to the. IAS 2130 Translation from the functional currency to the presentation currency.

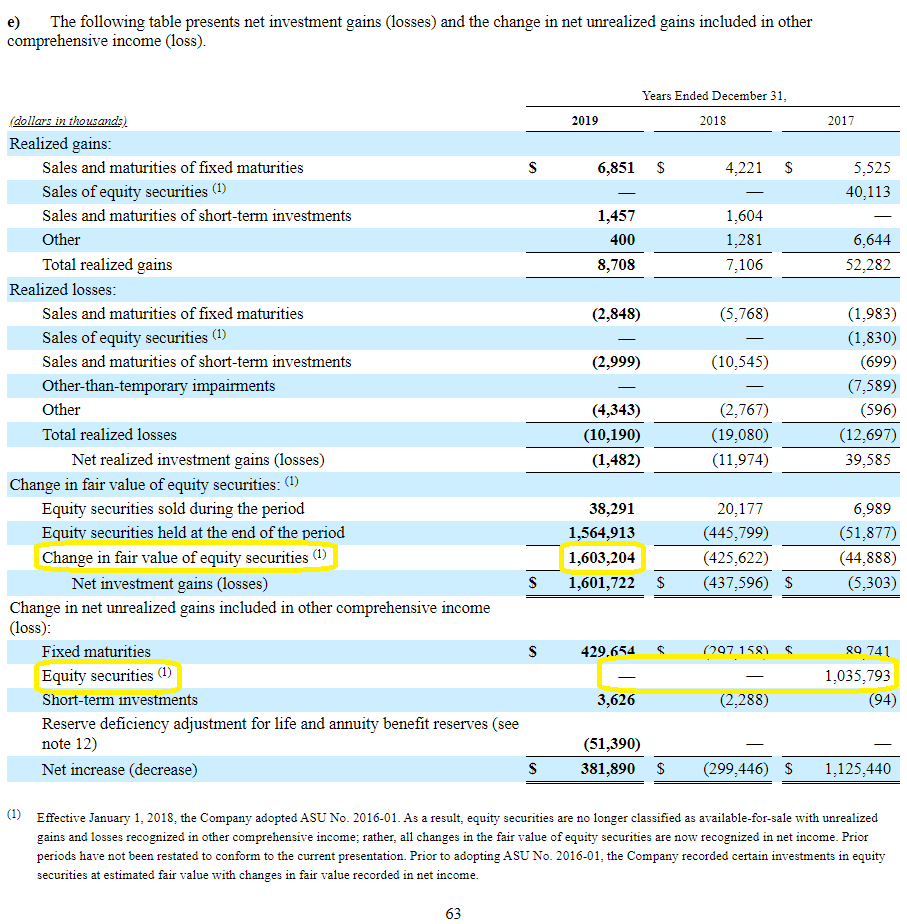

These are monetary items and need to be remeasured at month-end with the gainloss going through the Income Statement as Other Income. This is covered under ASC 830 check out this nice guide from EY explaining the codification see section 33. Record realized income or losses on the income statement.

My understanding is that any Unrealized Fx gain or loss is on account of translation of Monetary AssetsLiabilities that are that are not in the functional currency impacts the Income statement hence it needs to be added back in the Cash Flow statement. They are posted to exchange gain and exchange loss accounts and are included in income they appear on the income statement and they are subject to tax for the current period. Here is the simplest example of a gain made on exchange rates.

Unrecognised FX gainslosses do not impact cashflow and are calculated when an item is re-translated such as a Balance sheet item. On January 1st you transfer 120 CAD to your US bank account as 100 USD. The gain loss on exchange account for income is a special account with balances in different foreign currencies.