Divine P&l Company List Of Assets And Liabilities Template

The asset means resources like cash account receivable inventory prepaid insurance investment land building equipment etcThe liabilities are the expenses like the account payable salary payable etc.

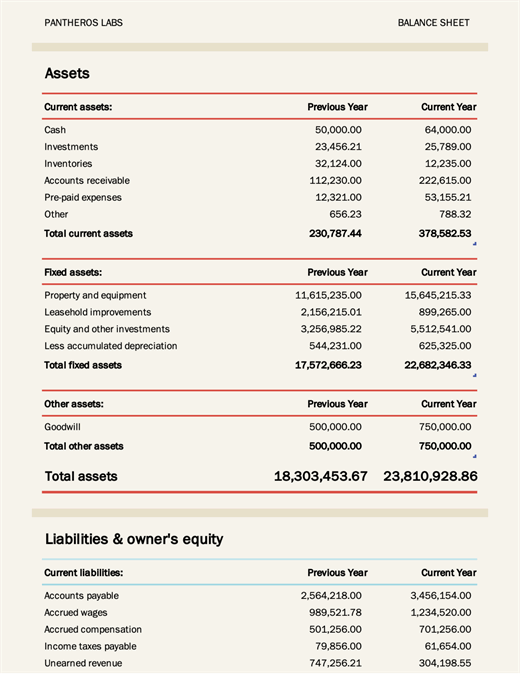

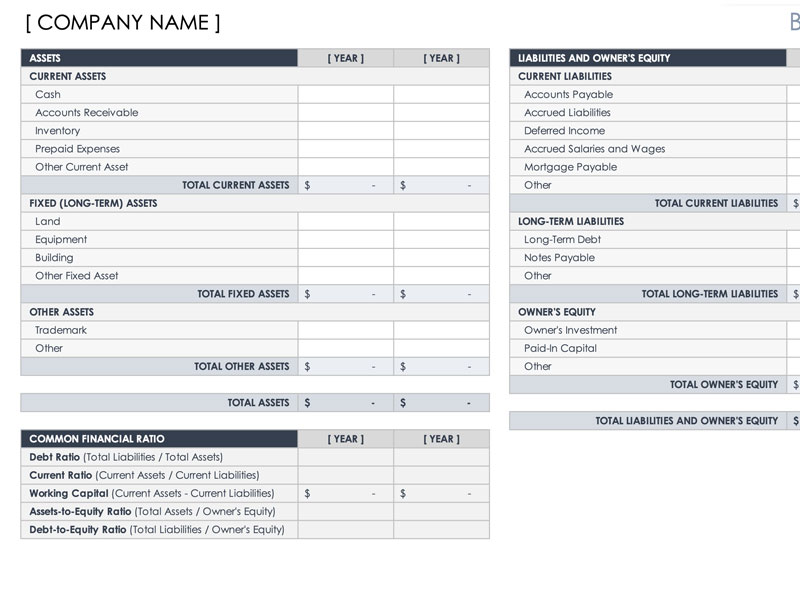

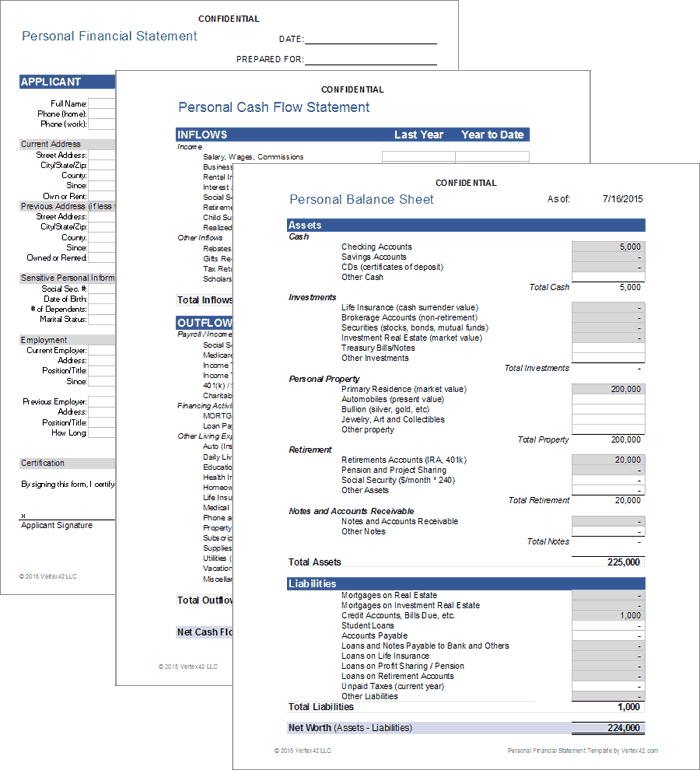

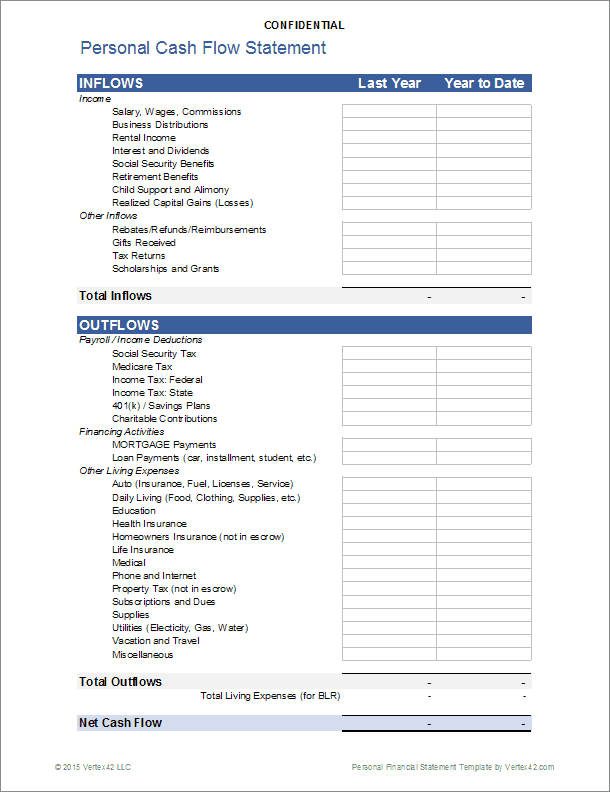

P&l company list of assets and liabilities template. Long-term business loans pension fund liabilities. 22 Balance Sheet Examples. When you enter your asset and liabilities this balance sheet template will automatically calculate current ratio quick ratio cash ratio working capital debt-to-equity ratio and debt ratio.

Liabilities are debts owed by the company. The balance sheet tells you what your business owns and what it owes to others on a specific date. The balance sheet deals with current and fixed assets short-term liabilities and long-term debt.

It makes up one-third of the typical business financial statements the others consisting of a balance sheet and cash flow statement. Calculate total liabilities by adding all short-term and long-term liabilities. A Balance Sheet is a statement of liabilities assets and capital of an organization at any given point of time.

They are the opposite of assets. C lear formatting Ctrl. You are not expected to know all the informa tion that is called for on this form but it will help y ou think of the property and liabilities that are owned by you and your spouse.

The assets and liabilities are the two sides of the coin. We have created a Balance Sheet Template that summarizes the companys assets liabilities and equity. Assets and liabilities spreadsheet templateDisplay-Your-Various-Business-Assets-and-Liabilitiesjpg.

It breaks each account into smaller sub-categories to provide more value for the user of this report. This will give your lender or investors an idea of the health of the company. Business Calculate financial ratios with this Excel balance sheet template.