Fantastic Federal Reserve Income Statement

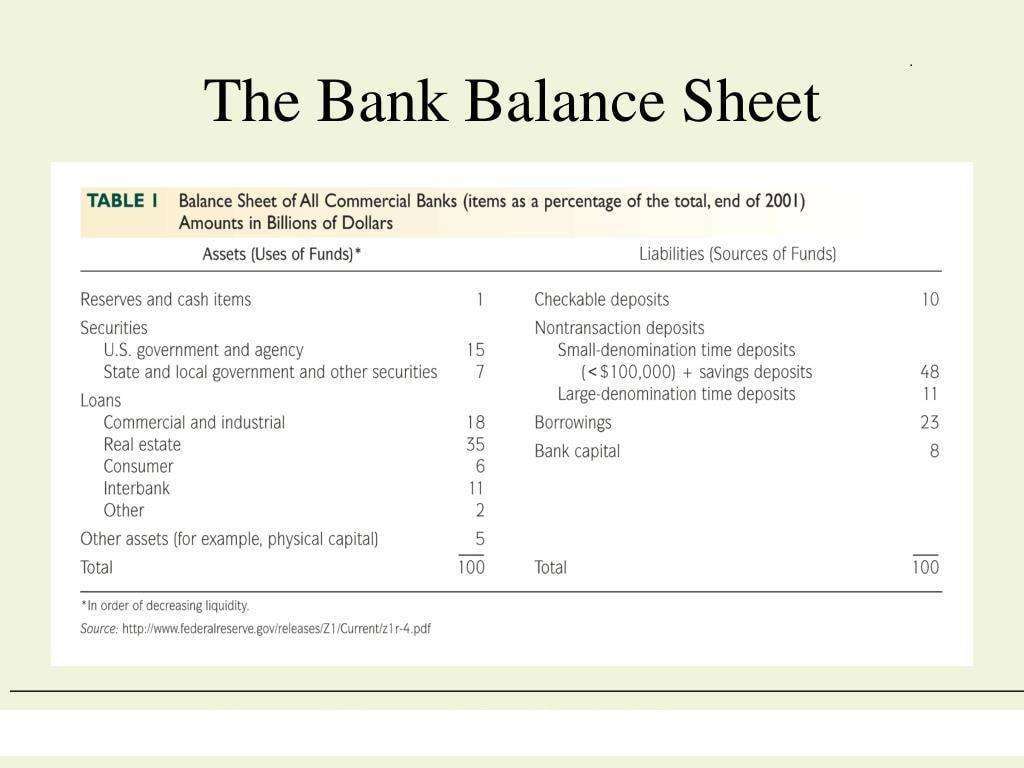

Lowering the reserve requirement increases loanable funds causes banks to lower interest rates and stimulates the economy.

Federal reserve income statement. Statement from the Low Income Investment Fund on the Federal Reserves Approach to CRA Modernization. Bureau of Economic Analysis the Federal Reserve Bank of Dallas and the Federal Reserve Bank of San Francisco. Heres is the text of the statement the Fed.

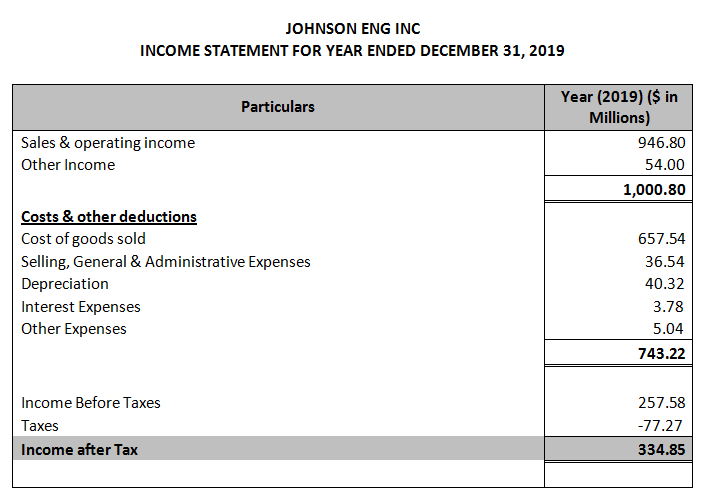

Bank notes and checks. Pursuing maximum employment stable prices and moderate long-term interest rates. The Daily Treasury Statement summarizes the US Treasurys cash and debt operations for the Federal Government on a modified cash basis.

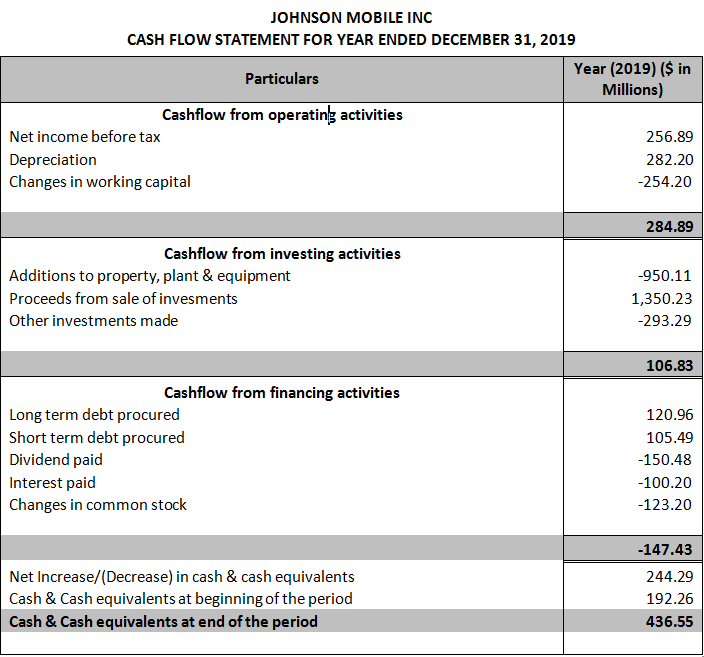

The DTS presents a summary of. Current Daily Treasury Statement. 5 Details of the Desks approach were described in an operating statement released by the Federal Reserve Bank of New York.

Maintaining stability of the financial system and containing systemic risk. When the Federal Reserve raises the reserve requirement banks must hold larger reserves and thus have less money to lend. Weve updated our Underlying Inflation Dashboard with data from the US.

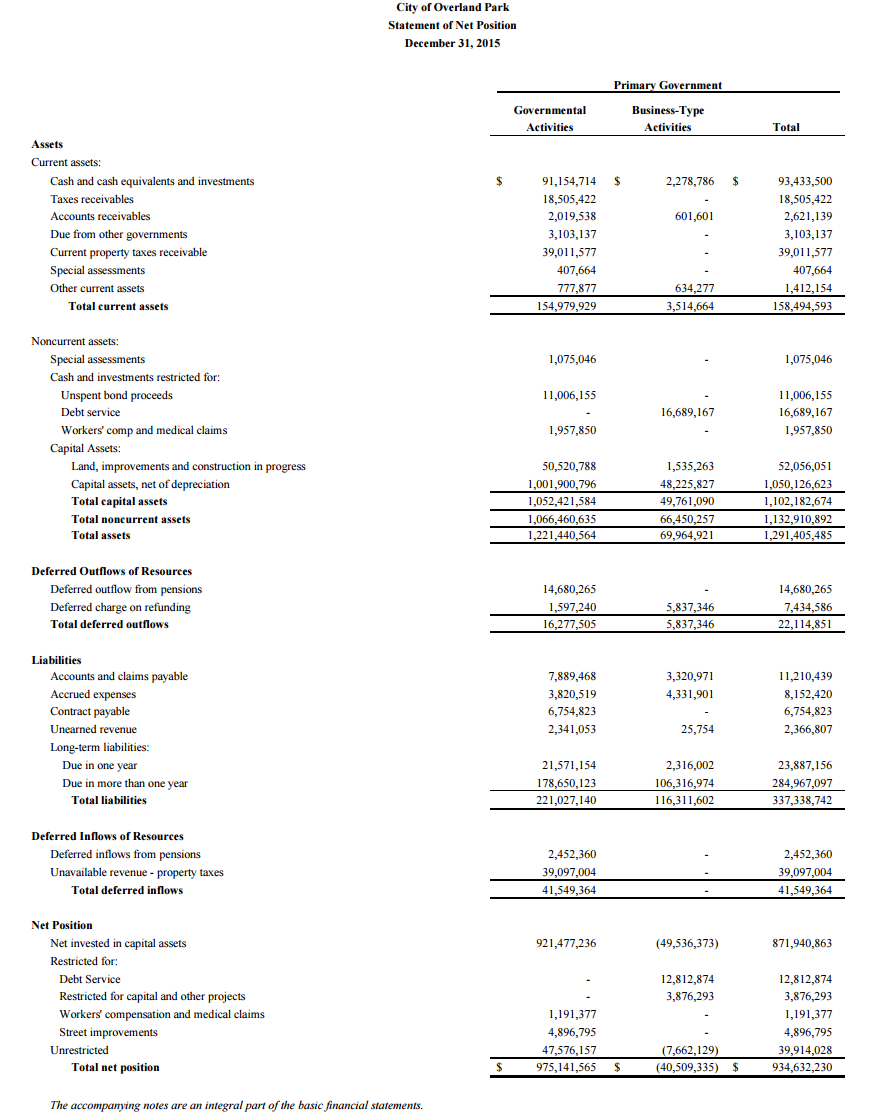

However the Federal Reserve seldom changes reserve requirements. The Federal Reserve Bank financial statements also include the accounts and results of operations of one limited liability company LLC that has been consolidated with the Federal Reserve. On September 21 2020 the Federal Reserve Board unanimously voted to issue an advance notice of proposed rulemaking ANPR to collect public comments on proposed changes to the Community Reinvestment Act CRA.

Federal Reserve Bank of St. Introduction to bank notes. The Board of Governors and the Federal Reserve Banks annually prepare and release audited financial statements reflecting balances as of December 31 and income and expenses for the year then ended.