Cool Gaap Accounting For Tooling Costs

Expenses for tooling classified as goods will be reflected by debiting goods warehouse release to account 504 Costs of goods sold crediting to account 132 Goods and debiting sales of tooling to account 311 Trade receivables crediting to account 604 Sales of goods.

Gaap accounting for tooling costs. Management attempted to approximate how many of each product would be ordered and divide the tooling cost by that amount. It is the most widely used accounting framework within the United States. Ad Find gaap accounting software on topsearchco.

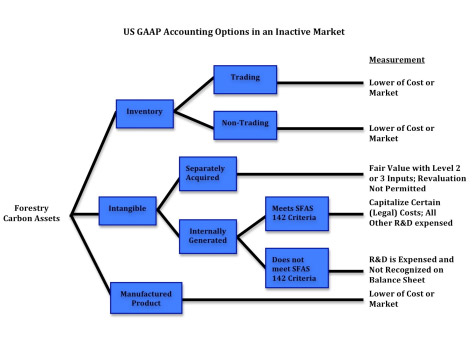

As such a portion of this amount should be recorded in the Suppliers construction in progress fixed assets as tooling costs are incurred. For instance in accounting for setup costs an entity applying US. In some cases the tooling is built by the supplier for sale to the OEM ie the tooling is or will be owned by the OEM and consideration for the tooling is received through an increase in the sales price of.

Us PPE and other assets guide 11. Ad Accountancy Fees - This Is What Youre Searching For. I feel If tooling is a process involved in the making of the product and its appropriate the cost incurred may be charged as a part of the cost of sale.

Occupancy electricity maintenance depreciation and other indirect costs are in that absorption rate. GAAP is an acronym for generally accepted accounting principles. Reasonable fee for all your accounting and bookkeeping needs.

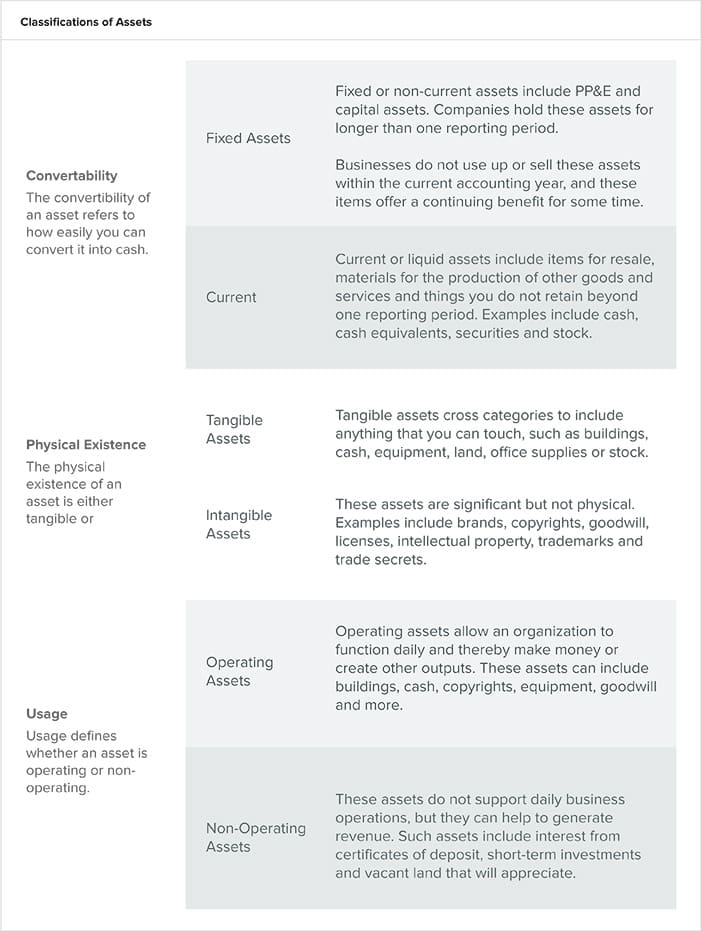

Accounting guidelines known as generally accepted accounting principles or GAAP permit businesses to capitalize certain costs related to intangible assets such as patents copyrights trademarks and goodwill. GAAP may previously have needed to analogize to the guidance on the deferral of direct loan origination costs in paragraph 310-20-25-2. 11 Capitalization of costs chapter overview.

Ad Find Gaap Accounting Software. Automotive suppliers often incur costs related to tooling prior to production. If the tooling is used in the business like Plant Machinery then its appropriate to capitalise and charge depreciation ofcourse.