Beautiful Work Deferred Tax On Provision For Doubtful Debts

The provision for doubtful debts is an accounts receivable contra account so it should always have a credit balance and is listed in the balance sheet directly below the accounts receivable line item.

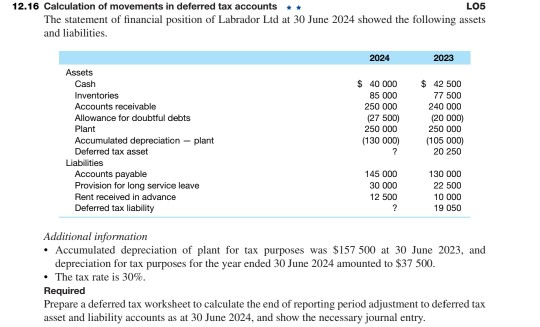

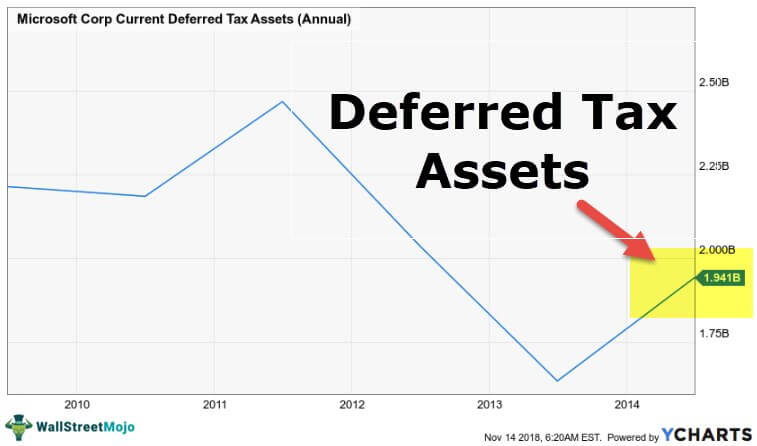

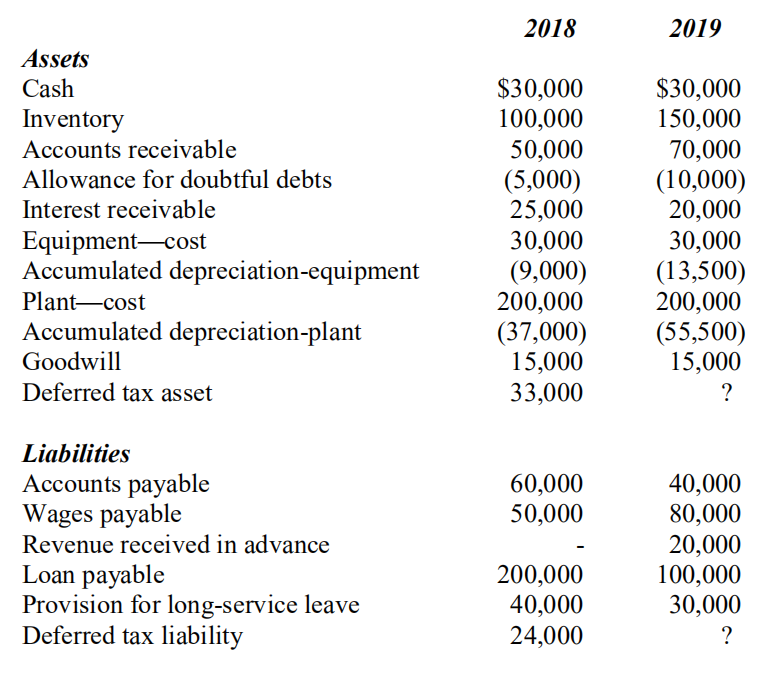

Deferred tax on provision for doubtful debts. So more tax will be paid NOW but less tax later when the debt is written off the deduction will be allowed. Section 43B a Do not enter amounts here if the TDS is paid on or before the due date for filing return of income. Increase in allowance for doubtful debts Increase in provision for long service leave.

In accounting records provision for doubtful debts is recognized as expense way before the actual write off while tax laws allows claim of bad debt expense only when non-recoverability of debt is confirmed and debts are written off. Statutory and other dues. Arka Bose None 30 July 2013.

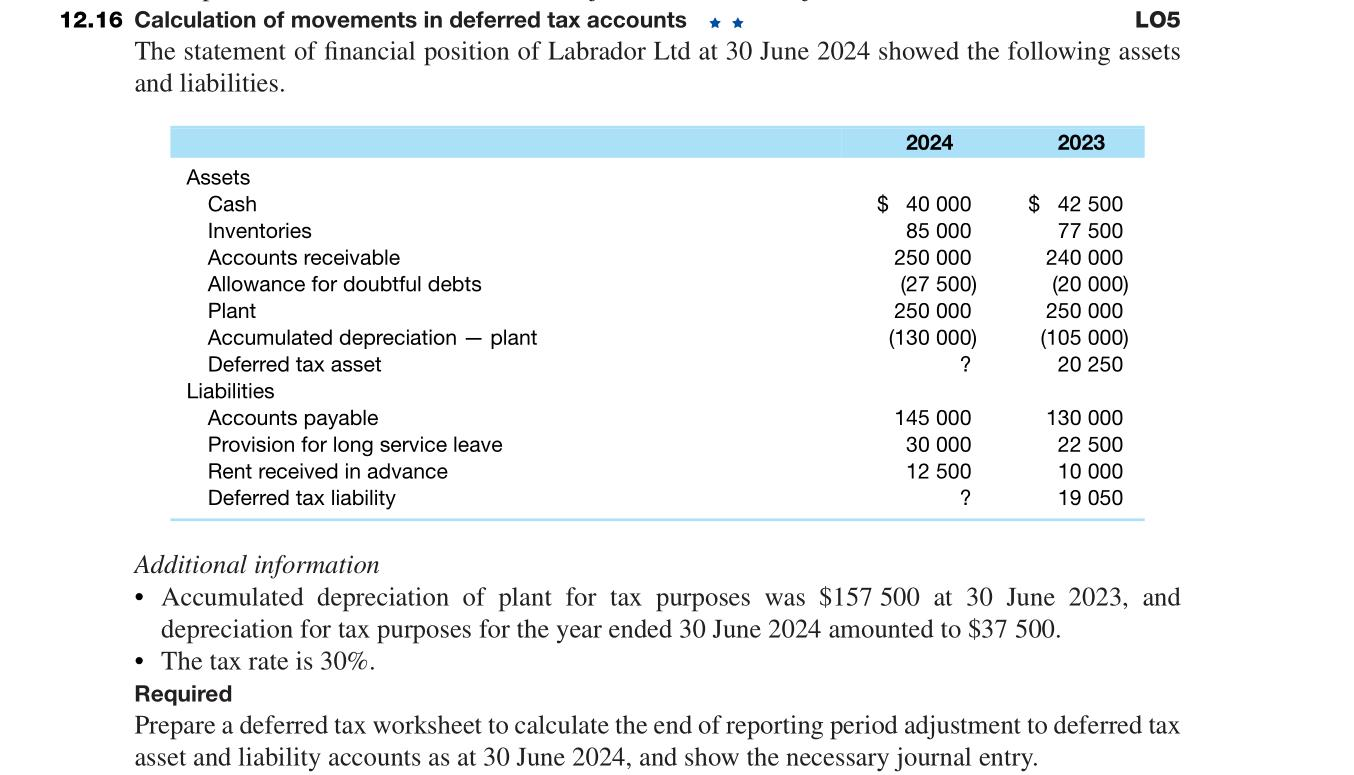

Deferred tax charge is not a provision for tax but is a provision for tax effect for difference between taxable income and accounting income and further that deferred tax charge cannot be termed as income-tax paid or payable which has to be paid out of the profit earned. Under the accounting standard FRS 39 which sets out the principles for recognising and measuring financial instruments general and specific provisions for bad and doubtful debts will no longer be made. Deferred tax is the tax effect that occurs due to the temporary differences either taxable temporary difference or deductible temporary difference.

Provision for doubtful accounts. For deferred tax purposes such a disallowance could be regarded as either permanent or timing depending on the circumstances. If you create provision for doubtful debts it is not allowed as per IT act but when you write off these provision as bad debts then it will allowd under IT act.

The company usually either has deferred tax liability or deferred tax asset as the deferred tax would be net off between deferred tax liability and deferred asset. 1 600 3 500. Tax base 1000000 10000005 800000.

Provision is a timing difference. In case of a provision for doubtful debts tax base of an asset future deductible amount recivables provisionbut if there is no provision tax base of an asset receivablesin this case it is equal to carrying amount because economic benefits are not taxable. 19 rows Provision for bad and doubtful debts general note impairment loss on trade debts.