Peerless P&l Account Items

All expenses which are not directly related to the main business activity will be reflected in the P L component.

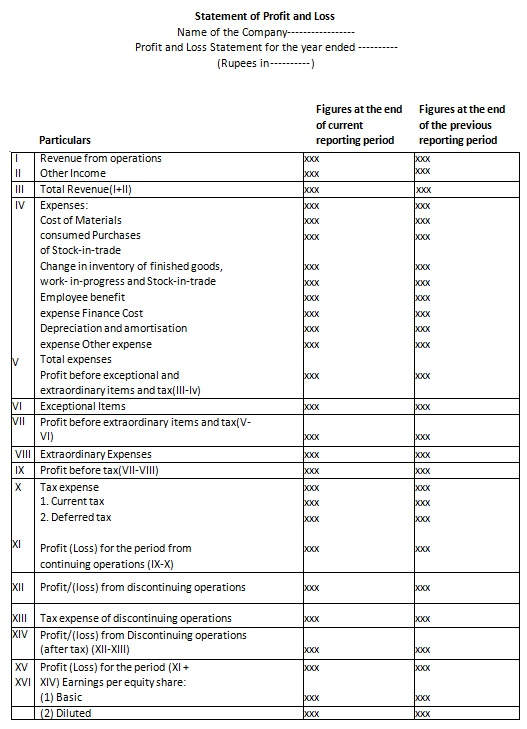

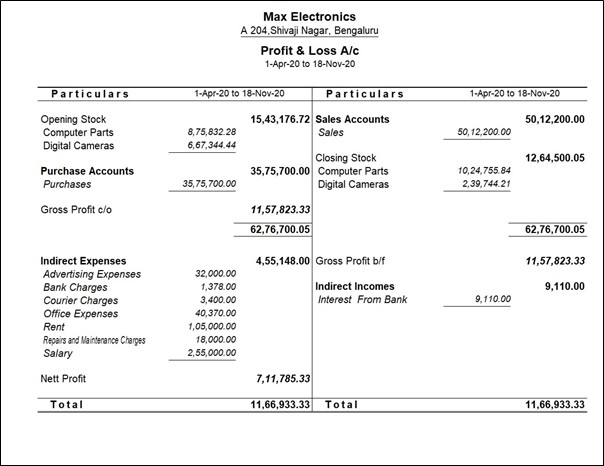

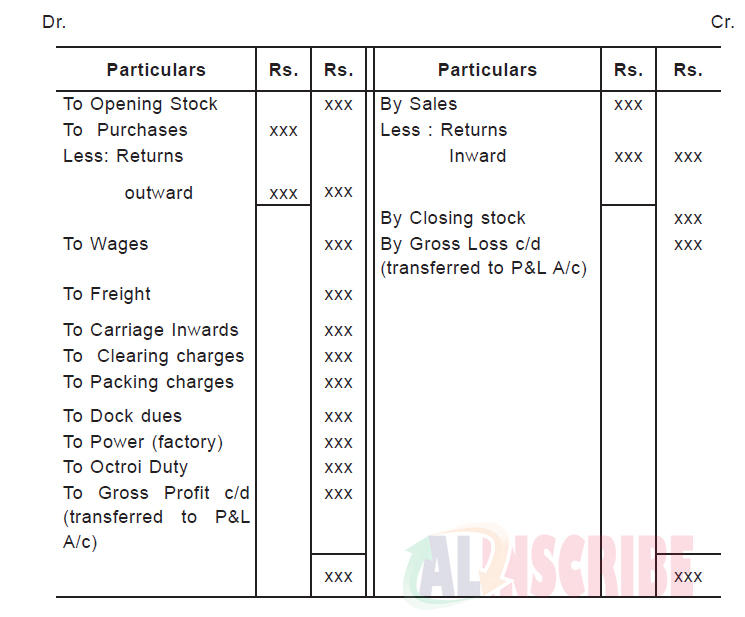

P&l account items. Profit and loss is prepared in form ledger. It shows your businesss income from sales bank interest and other income such as the online filing incentive less its expenses. Debit side of Profit and Loss Account.

The balance sheet and the profit and loss PL statement are two of the three financial statements companies issue regularly. The key headings include sales expenses and profit before tax. On the credit side.

- Items relating to Debit Side. Cost of Sales This term refers to the cost of goods sold. The following items usually appear on the debit and credit side of a Profit and Loss Account.

The main categories that can be found on the PL include. Office and administrative expenses. Interest received from bank.

View Live Inventory 360 Images Datasheets. Here is an example of a typical PL account for a small limited company. The profit and loss PL statement is a financial statement that summarizes the revenues costs and expenses incurred during a specified period usually a fiscal quarter or year.

Fast Easy Secure. The items included in profit and loss account are as follows. Profit on sale of fixed assets.