Top Notch Netflix Financial Ratios

Is significantly higher than the average of its sector Broadcasting Entertainment.

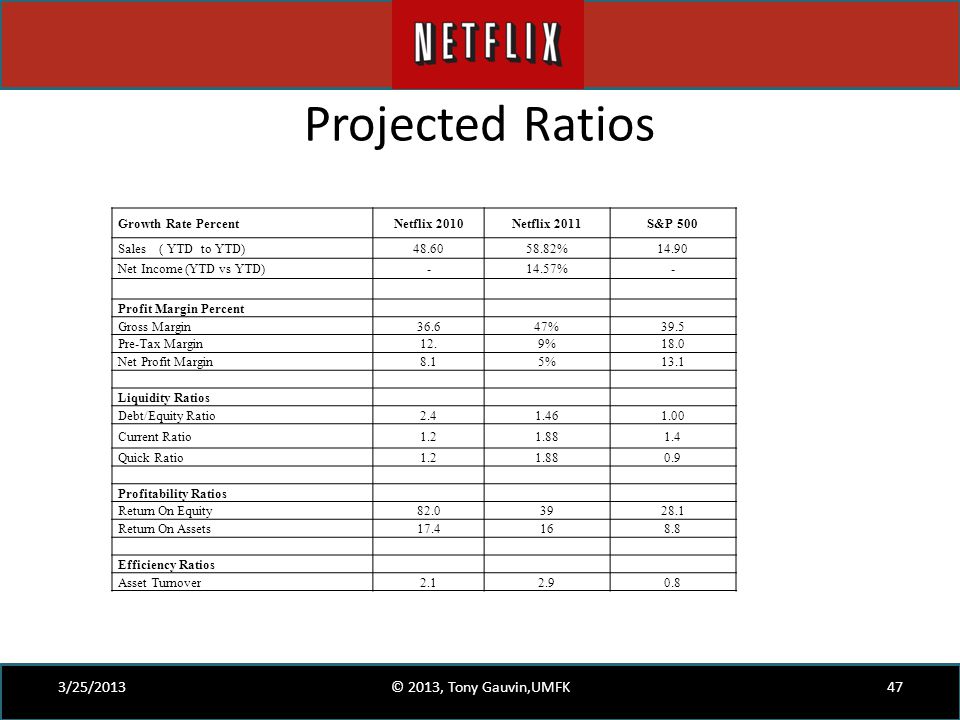

Netflix financial ratios. Is significantly lower than its historical 5-year average. Price to Book Ratio 2164. Netflix current ratio for the three months ending June 30 2021 was 123.

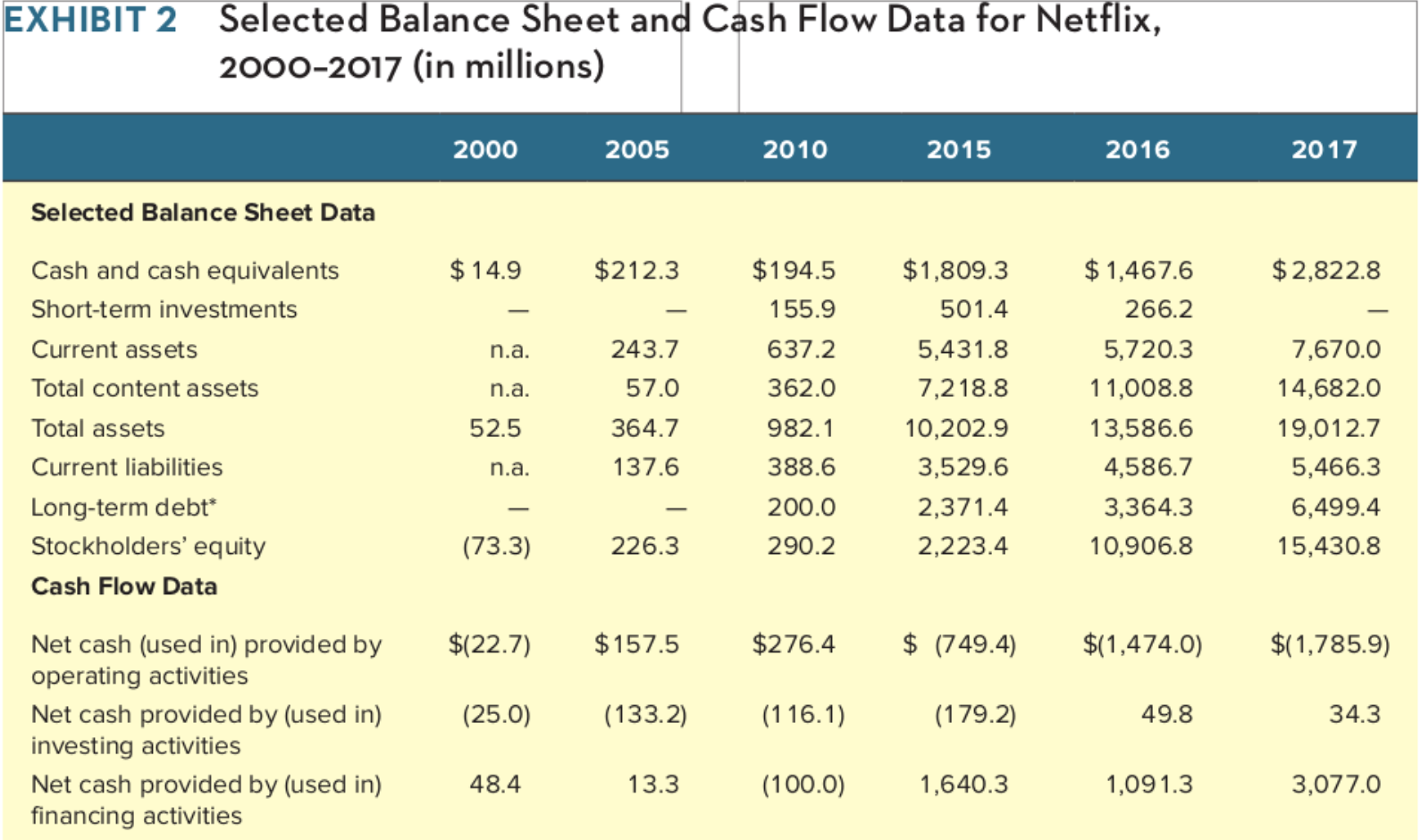

The EVEBITDA NTM ratio of Netflix Inc. Netflix Incs current ratio deteriorated from 2018 to 2019 but then improved from 2019 to 2020 not reaching 2018 level. Find out all the key statistics for Netflix Inc.

PE Ratio including extraordinary items 6513. 1 between the second and the third quartile. Enterprise Value to EBITDA 1636.

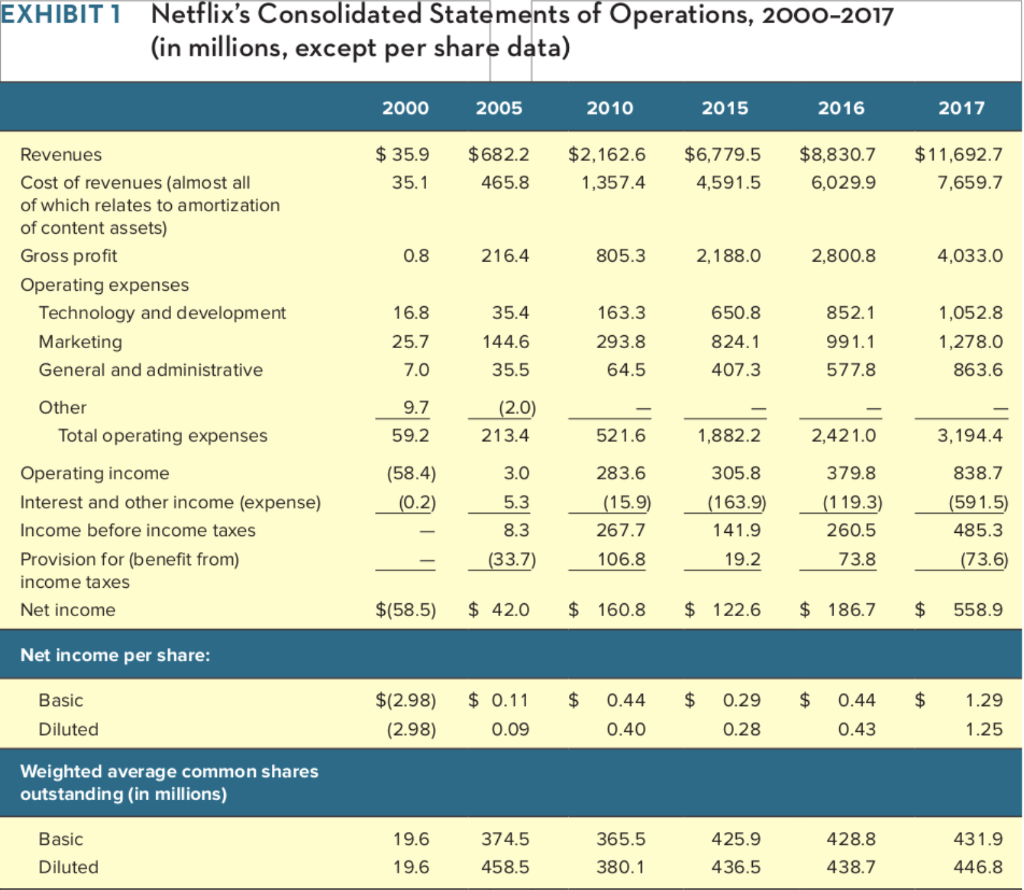

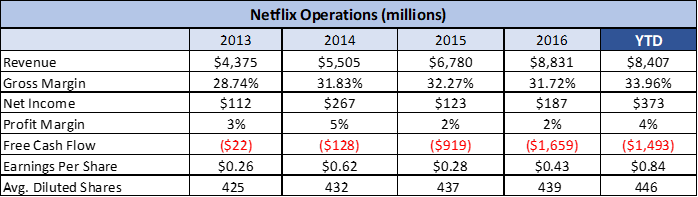

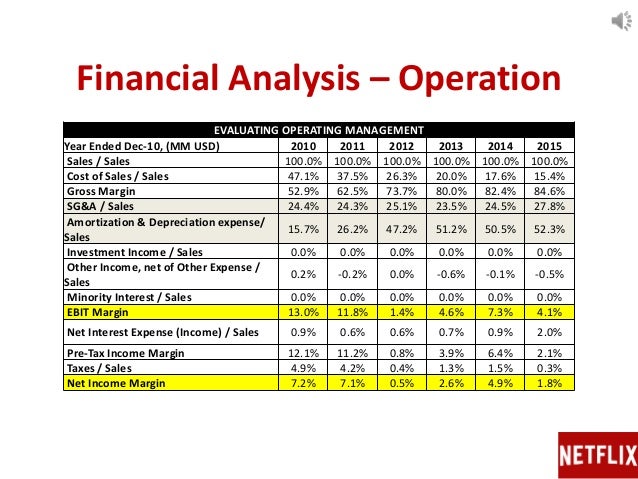

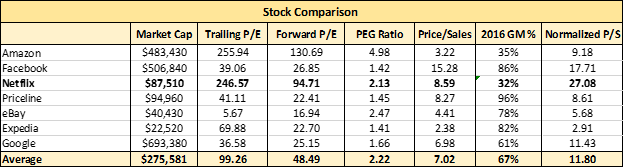

Price to Sales Ratio 983. Generally speaking Netflixs financial ratios allow both analysts and investors to convert raw data from Netflixs financial statements into concise actionable information that can be used to evaluate the performance of Netflix over time and compare it to other companies across industries. Current and historical current ratio for Netflix NFLX from 2006 to 2021.

Class A Common Stock. Current ratio can be defined as a liquidity ratio that measures a companys ability to pay short-term obligations. Netflix Financial Ratios for Analysis 2005-2021 NFLX.

An approach to decomposing Netflix Incs return on equity return on assets and net profit margin ratio as the product of other financial ratios. The EVEBITDA NTM ratio of Netflix Inc. Enterprise Value to Sales.