Simple Identify The Sections Of A Classified Balance Sheet

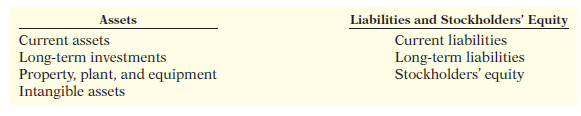

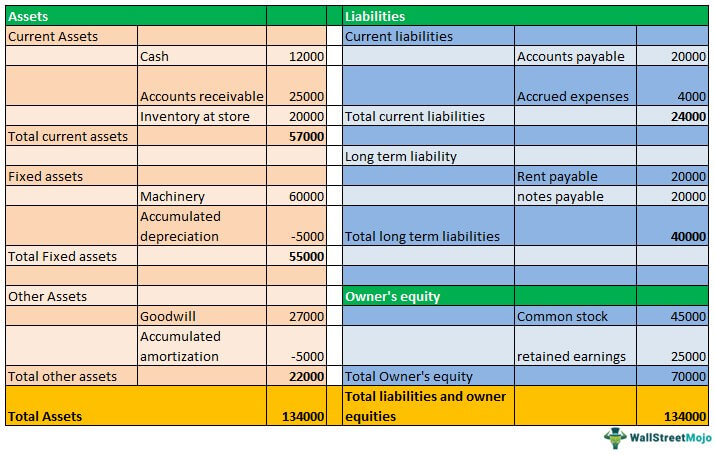

They classify liabilities as either current or long-term.

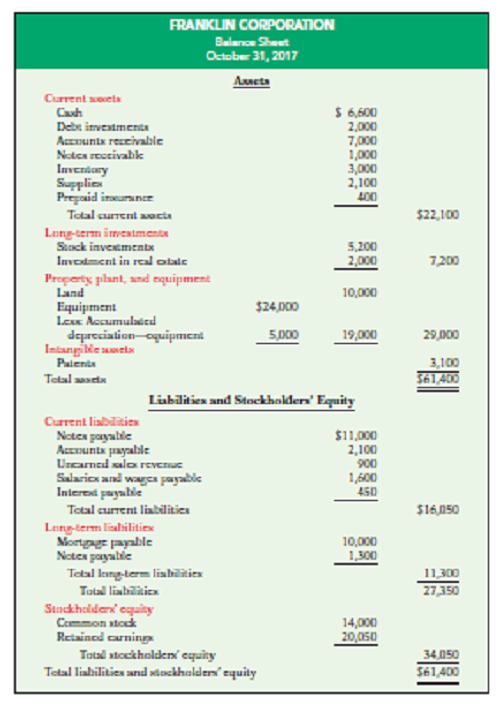

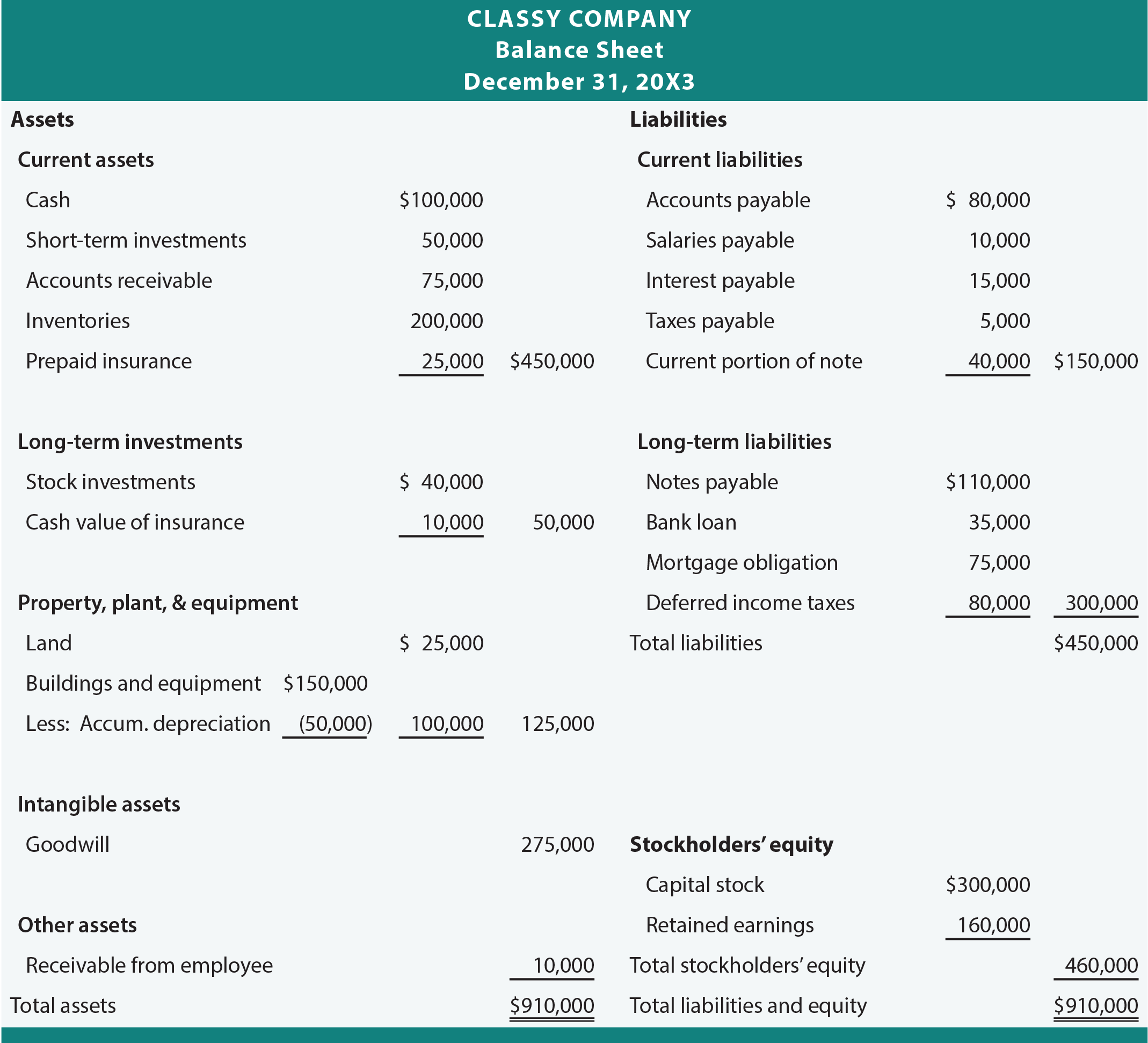

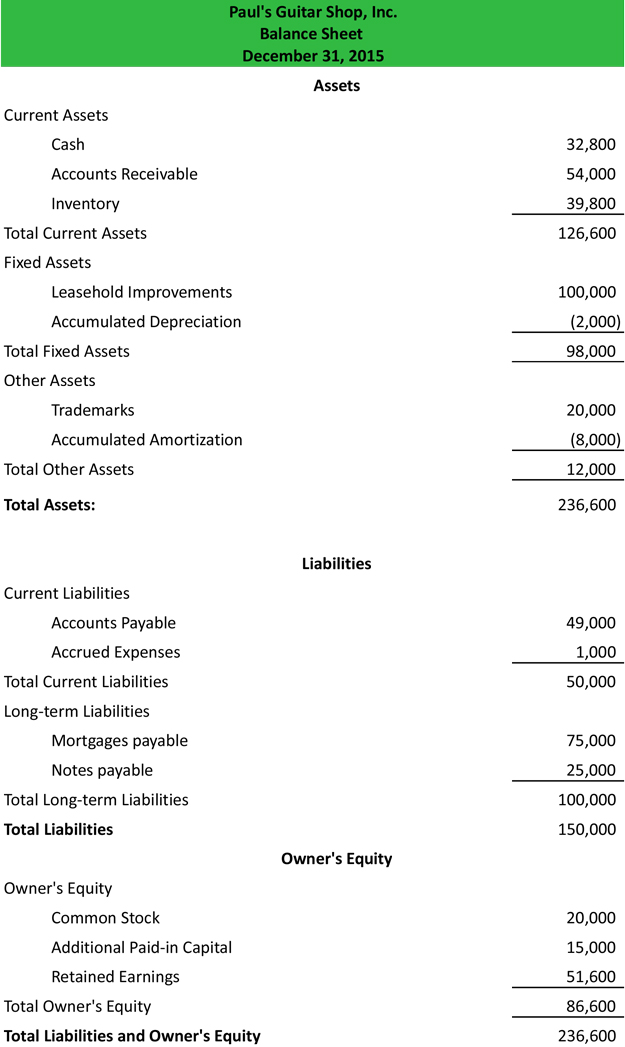

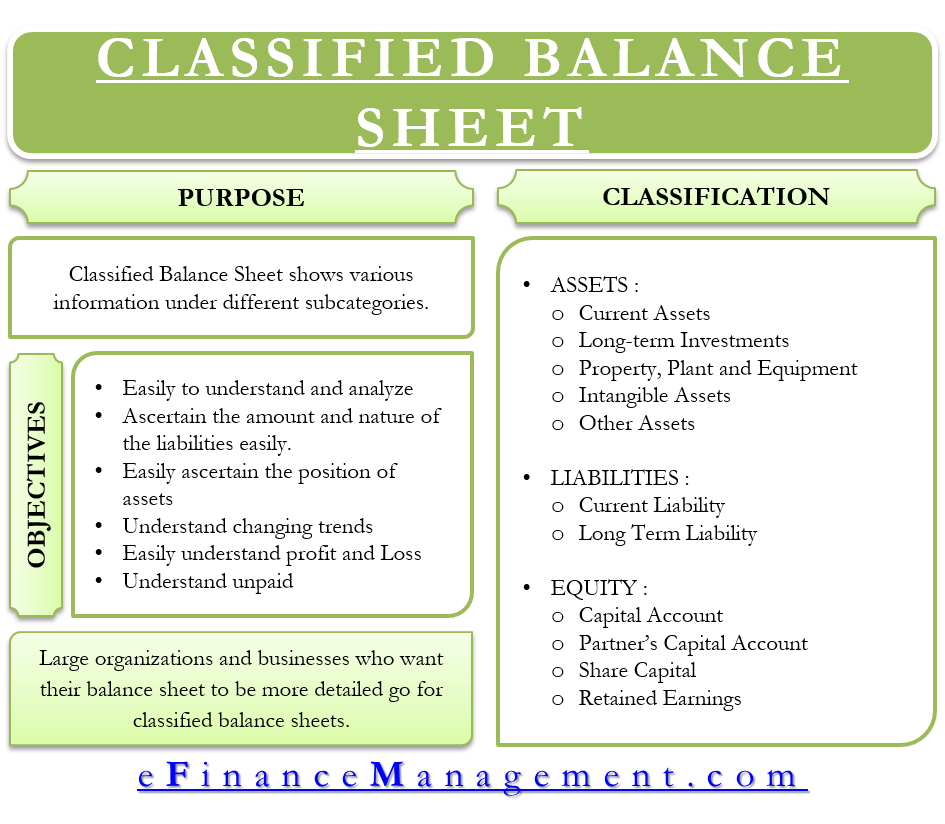

Identify the sections of a classified balance sheet. In order list the classifications for assets on a classified balance sheet. Simply put it presents the financial status of the firm to the user in a. Chapter Outline Learning Objective 1 - Identify the Sections of a Classified Balance Sheet.

Compute EPS and discuss how it is used to measure profitability. Cite examples of long-term investments. Common stock additional paid-in capital treasury stock and retained earnings are listed for corporations.

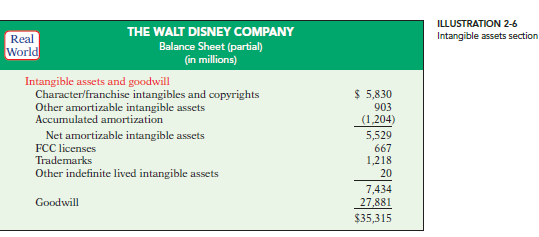

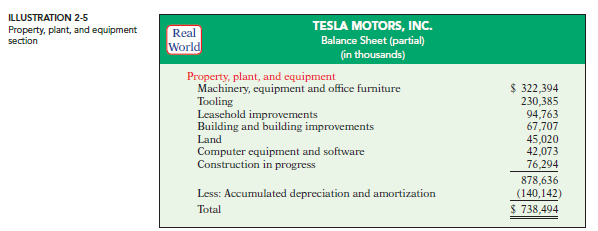

In both balance sheet formats the three major sections are assets liabilities and shareholders equity. Machinery Factory Building etc. A classified balance sheet presents information about an entitys assets liabilities and shareholders equity that is aggregated or classified into subcategories of accounts.

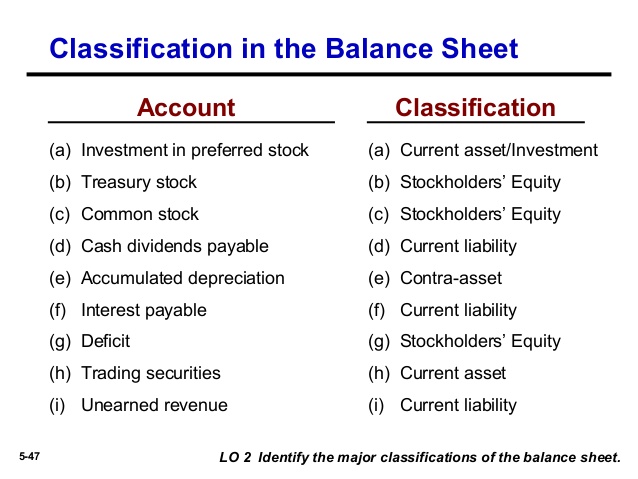

The classified balance sheet uses sub-categories or classifications to further break down asset liability and equity categories. A classifi ed balance sheet generally contains the standard classifi cations listed in Illustration 2-1. A classified balance sheet is a financial statement with classifications like current assets and liabilities long-term liabilities and other things.

Define liquidity and solvency. Partnerships list member capital accounts contributions distributions and. Identify the order in which these items would appear by dragging them in order into the appropriate sections of the statement.

A classified balance sheet groups like accounts together. This is useful because items within the groups have similar economic characteristics. Explain the differences between current and long-term assets and liabilities.