Fun Cash Flow Statement Pwc

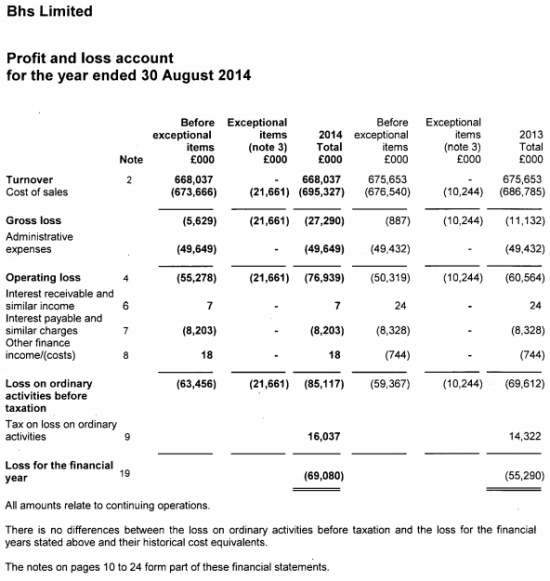

An income statement represents a period of time as does the cash flow statement.

Cash flow statement pwc. Hi can you walk me through what happens to the 3 financial statements. The most common reason is the wide range of data sources used by the company. Companies must discount the estimated cash flows with all their assumptions probabilities and uncertainties using what Statement no.

13 2016 the IASB issued IFRS 16 Leases and on Feb. The plaintiffs former employees of PwC claimed their accrued benefits upon withdrawing from the firms cash balance plan before age 65 were not. A liquid solvent relatively.

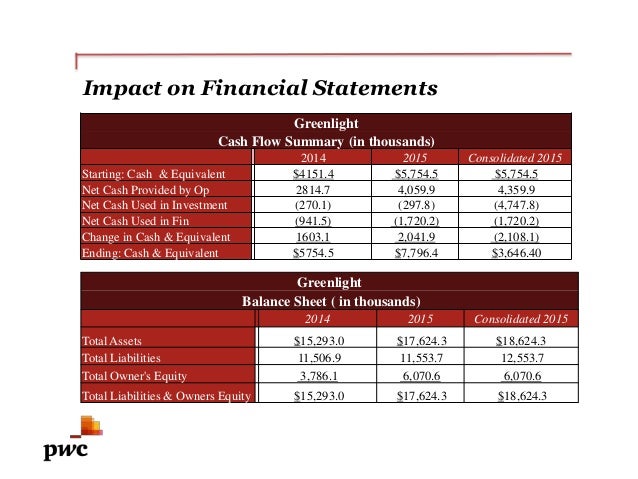

Balance sheet at the end of the period Statement of profit and loss for the period Statement of changes in equity for the period Statement of cash flows for the period. Cash flows related to the foreign subsidiary will be translated using the exchange rate on the date of cash flow. For example if I have stock based compensation of 10 PL stock based compensation is an expense net income drops with 10 1-t say t40 net income drops with 6 Cash flow statement.

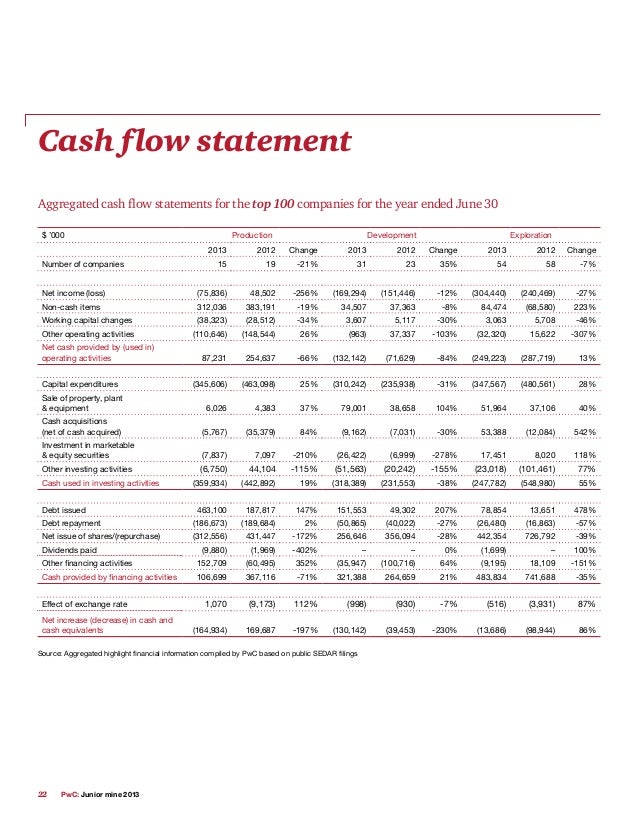

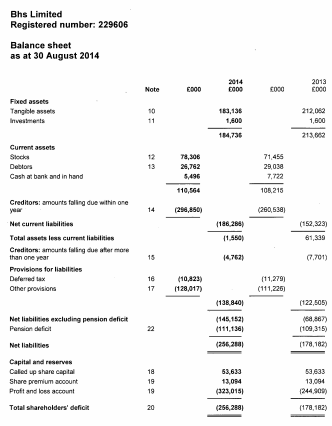

Statement of cash flows. Key Takeaways A balance sheet reports a companys assets liabilities and shareholder equity at a specific point in time. The latter is illustrated in this publication.

143 calls a credit-adjusted risk-free rate a rate such as that for zero-coupon US. This contrasts with the balance sheet which represents a single moment in time. However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters.

25 2016 FASB issued Accounting Standards Update ASU 2016-02 LeasesTopic 842The two standards differ on some points but each accomplishes the joint objective of recognizing that leases give rise to assets and liabilities that should. The purpose of the income statement is to show managers and investors whether the company made money profit or lost money loss during the period being reported. Whether Im looking at acquisition opportunities at HoriZen Capital or building best practices models I often see cash flow statements that dont reconcile with the balance sheet.