Peerless Pro Forma Net Income Formula

Here is the formula for proforma earnings per share.

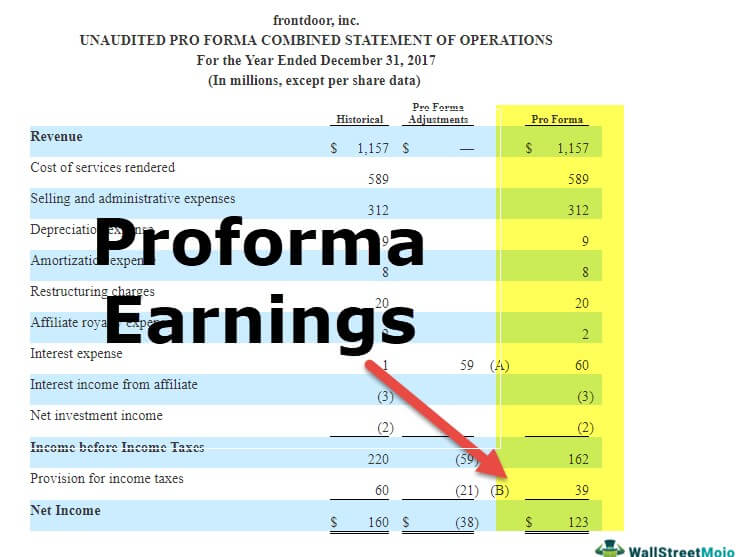

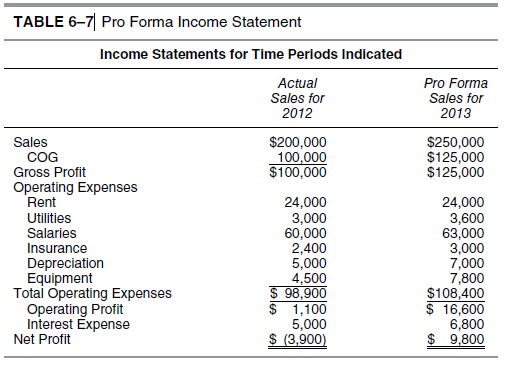

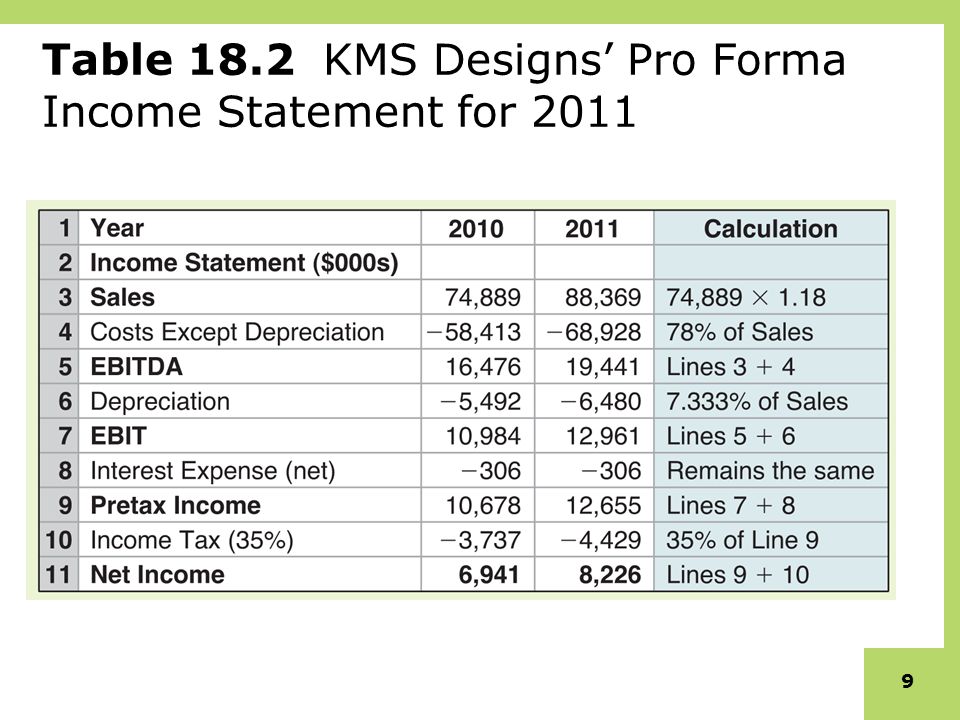

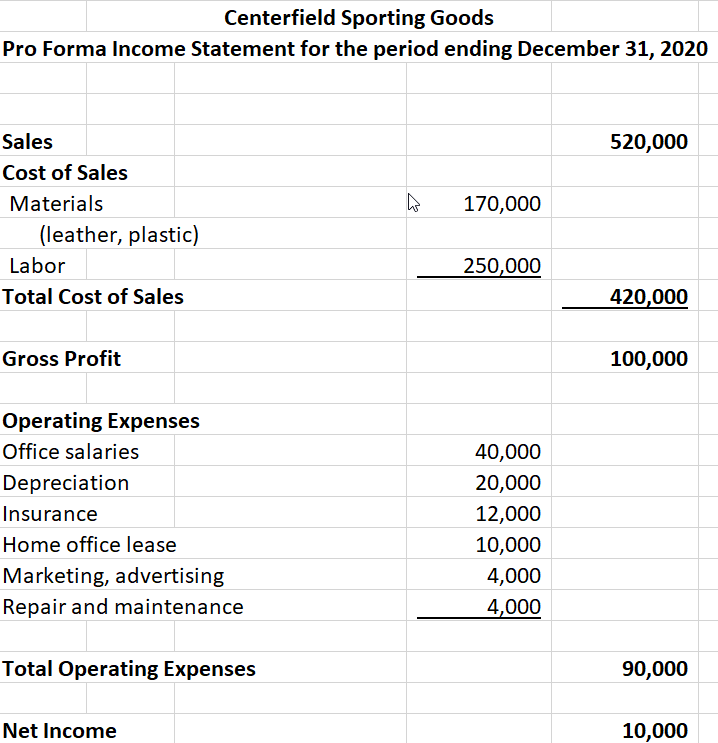

Pro forma net income formula. This chart of accounts will make up the pro forma statement for a 3 to 5 year period. To create the first part of your pro forma youll use the revenue projections from Step 1 and the total costs found in Step 2. Revenue Cost of Goods Sold Expenses Net Income.

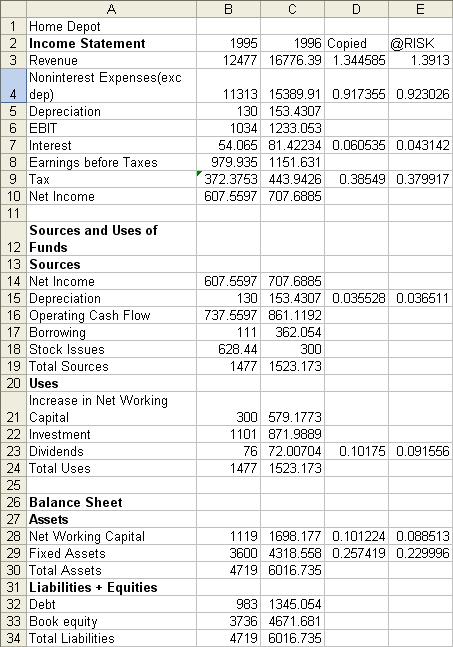

This business brought in revenues of. This portion of the pro forma statement will project your future net. So you multiply your historical salaries of 200000 and your historical expenses of 100000 by 105 percent each.

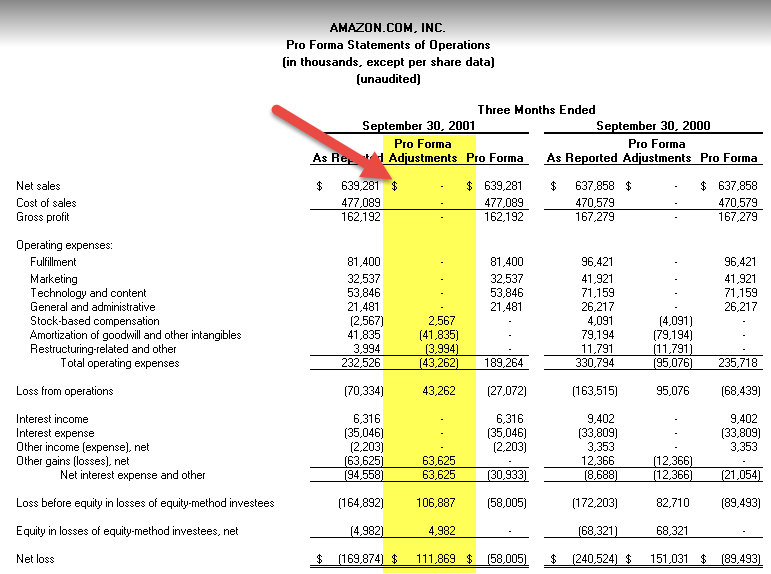

Pro-forma forecasts are usually created from pro-forma. Pro Forma CAP rate Formula. Pro Forma Total Expenses Lets assume salaries and other expenses will increase by 5 percent.

So put another way the net income formula is. The first part of the formula revenue minus cost of goods sold is also the formula for gross income. By multiplying net sales and net profit margin sales will be canceled out which leaves net income earnings.

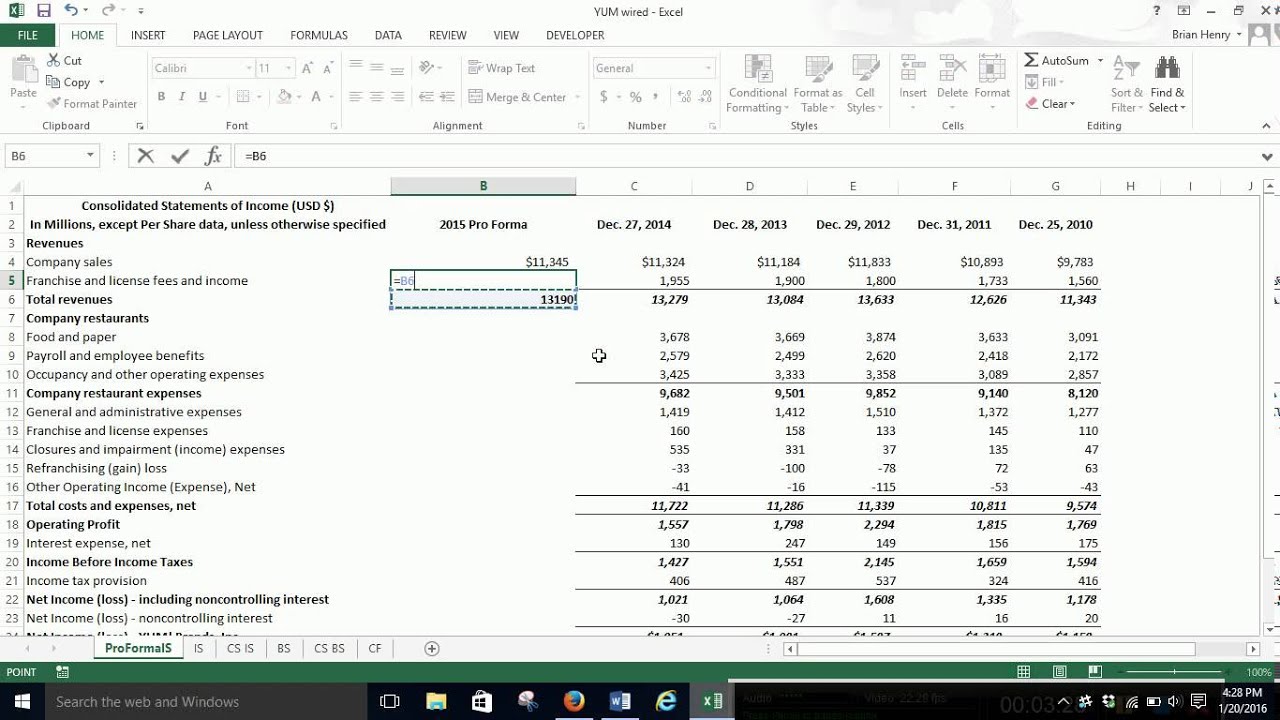

Pro Forma Net Income means as to any business unit for any Fiscal Year the portion of Companys Net Income allocable to such business unit. A pro-forma forecast is a financial forecast based on pro-forma income statements balance sheets and cash flow statements. Create the chart of accounts.

While historical financial statements are built on facts pro forma statements are a result of assumptions. It is the most important number for the Company analysts investors and shareholders of the Company as it measures the profit earned by the Company over a period of time. Net Income Total Revenues Total Expenses.