Favorite Prepare An Absorption Costing Income Statement

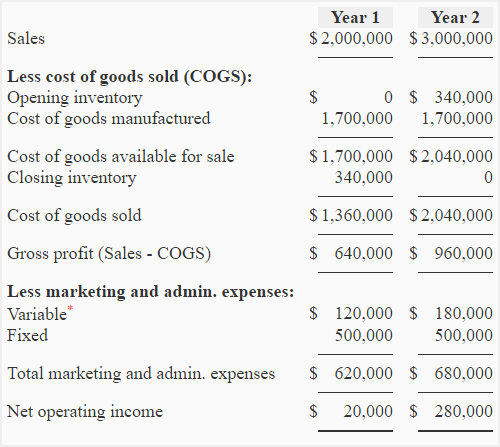

Compute the unit product cost for year 1 year 2 and year3.

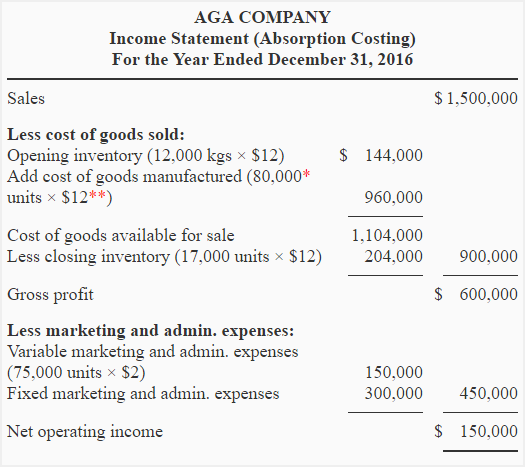

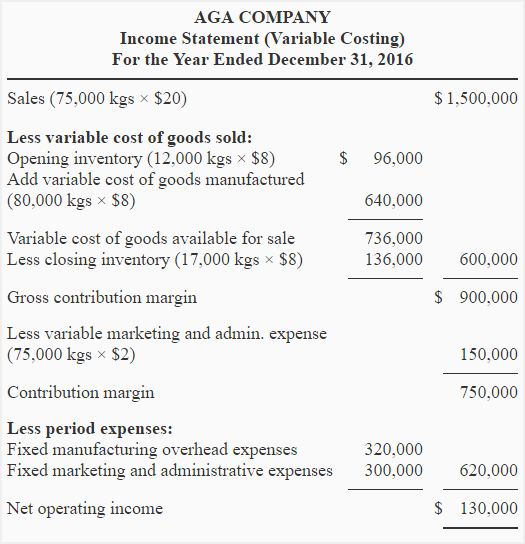

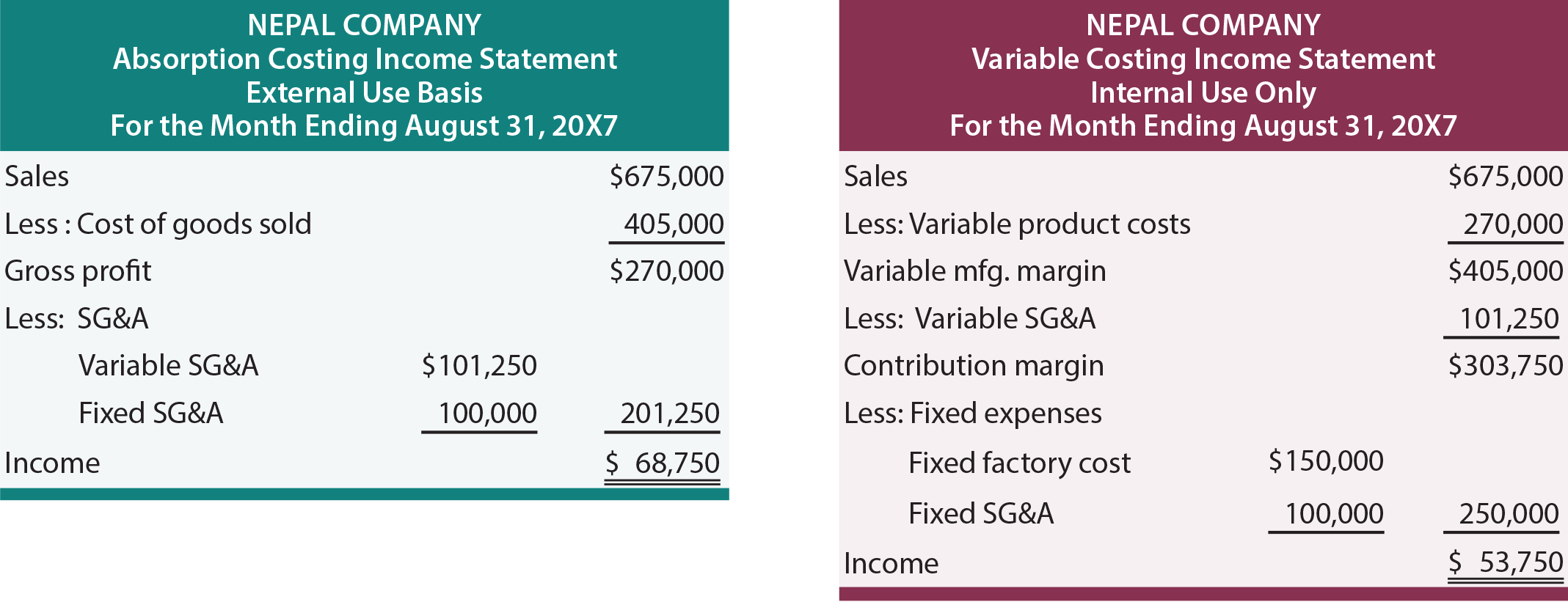

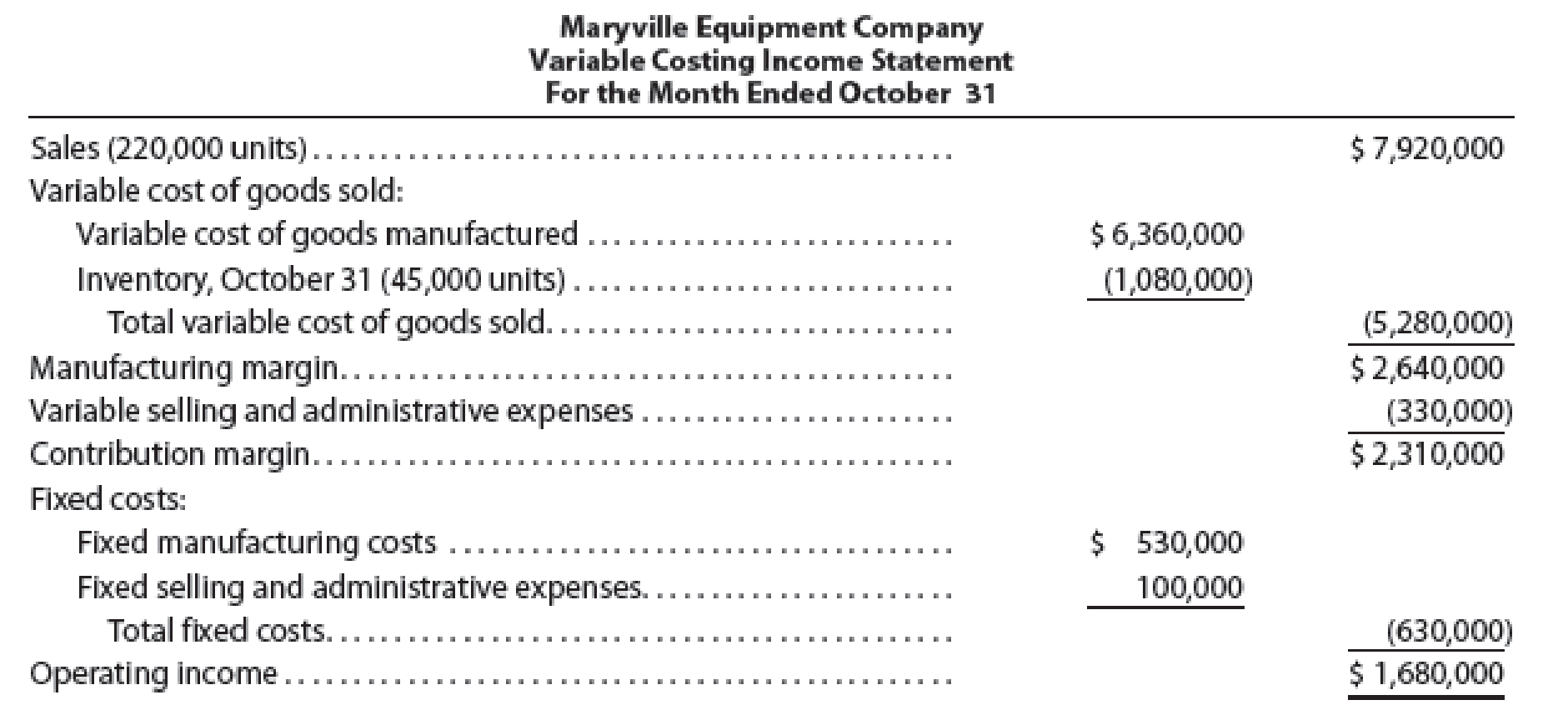

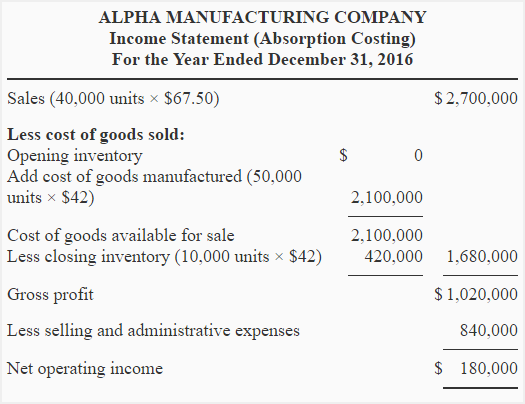

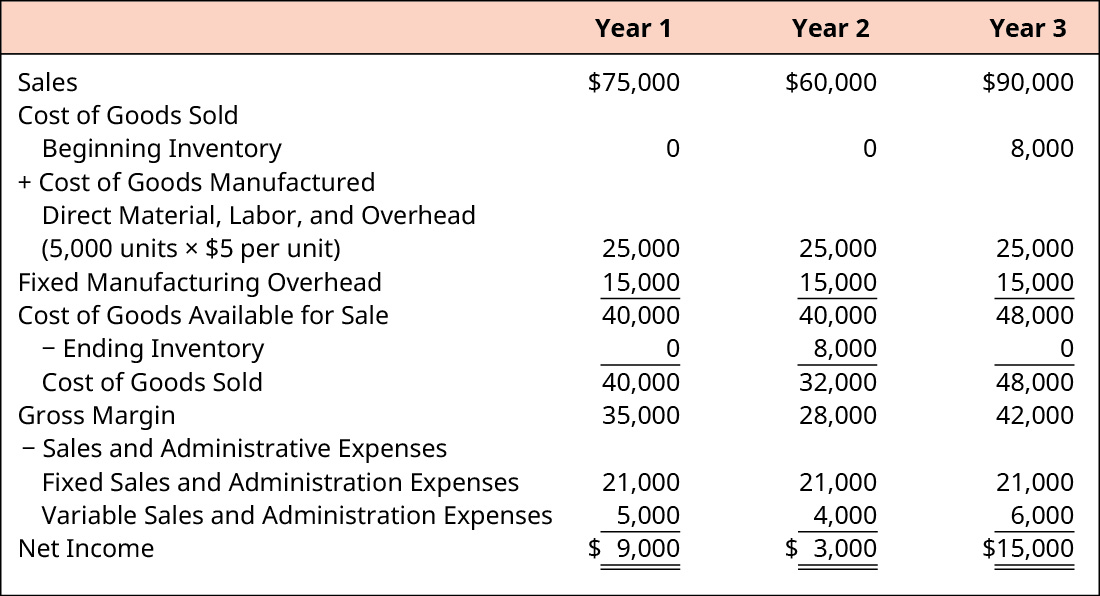

Prepare an absorption costing income statement. A Prepare an absorption costing income statement with one column showing the from BAB 240 at Seneca College. Prepare an income statement for year I. Prepare income statement under two costing system.

Prepare an income statement for year 1 year 2 and year 3. There is also a variable selling cost of 1 per unit and fixed selling cost of 2000 per month. With the absorption costing income statement you accounted for the costs of your beginning inventory twice.

Next comes the cost of goods sold. Because an absorption costing income statement provides a more complete picture of the actual costs to manufacture a product it is often the preferred method for tracking profitability. Problem 8-31 Algo Completing a Master Budget LO8-2 LO8-4 LO8-7 LO8-8 LO8-9 LO8-10 Hillyard Company an office supplies specialty store prepares its master budget on a quarterly basis.

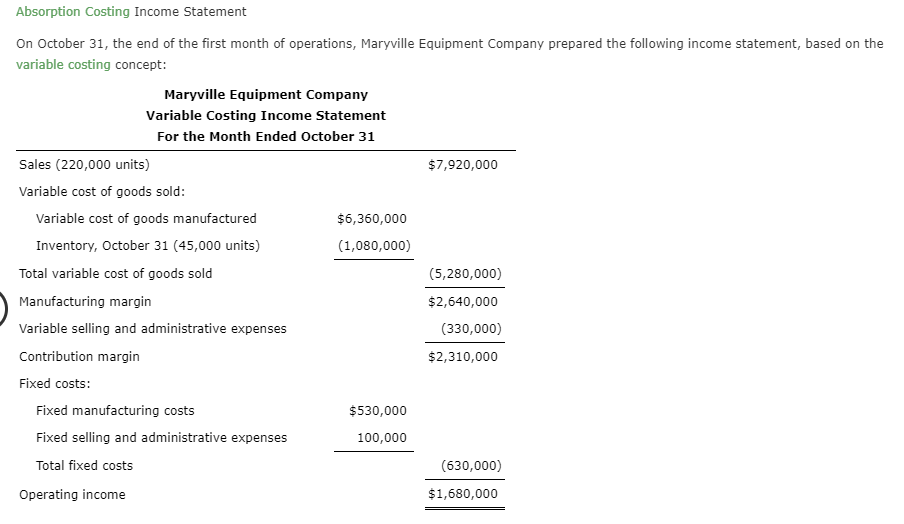

Prepare an income statement based on the absorption costing concept. Prepare an income statement using absorption costing. Absorption costing statement assumes that fixed costs attach to products so all the production costs whether fixed or variable should become part of product cost.

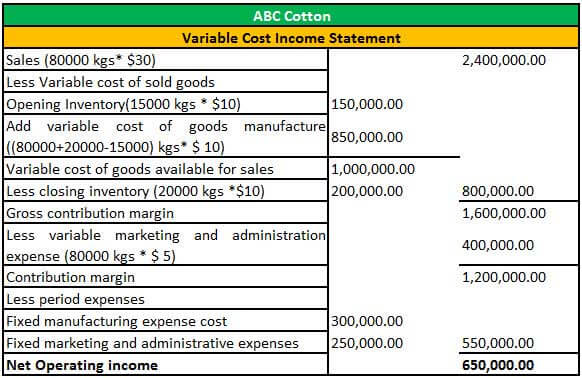

Marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing. Prepare an income statement using variable costing. Prepare an absorption costing income statement for the quarter ending March 31.

Preparing an Absorption Costing Income Statement As Accounting Tools notes the first line item of an absorption income statement is gross. Preparing an Absorption Costing Income Statement The first line item of an absorption income statement is gross sales for the period. Assume the company uses absorption costing and a FIFO inventory flow assumption FIFO means first-in first-out.