Awesome Decrease In Wages Payable Cash Flow

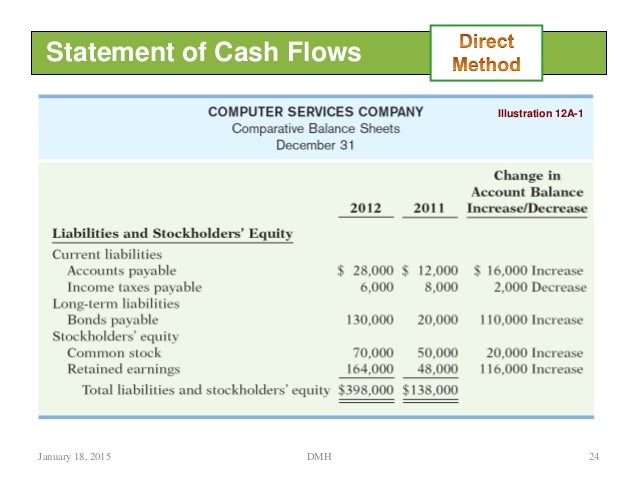

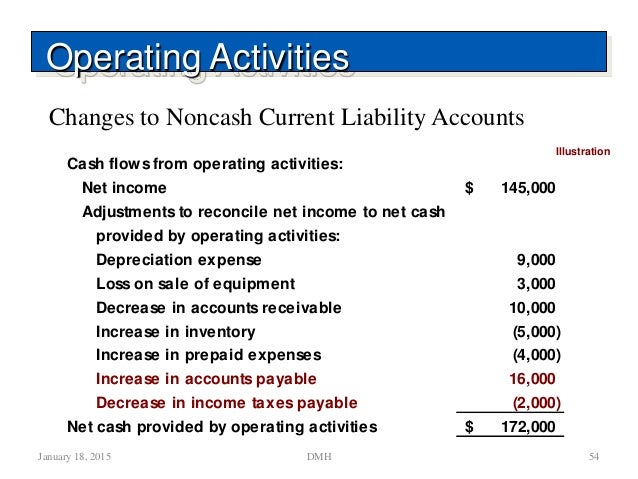

And then if there is increase in the account payable during the time for which cash flow statement is preparing.

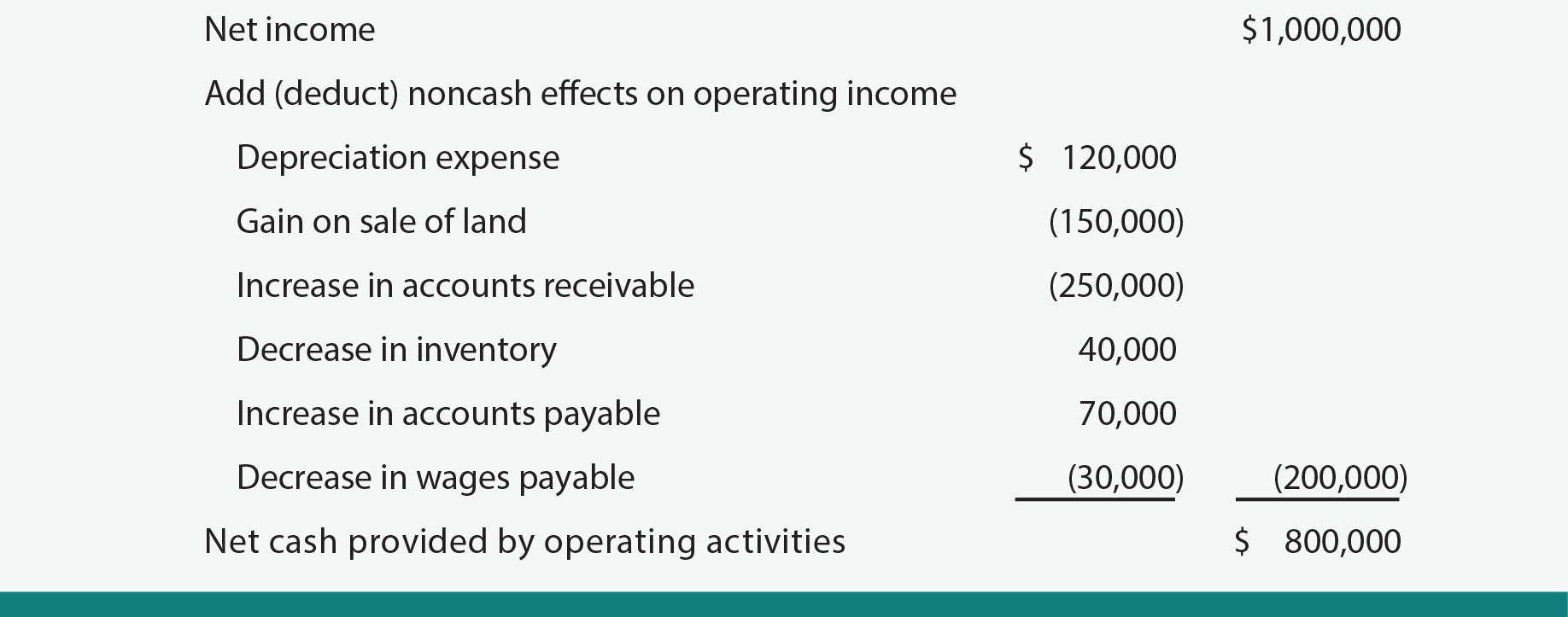

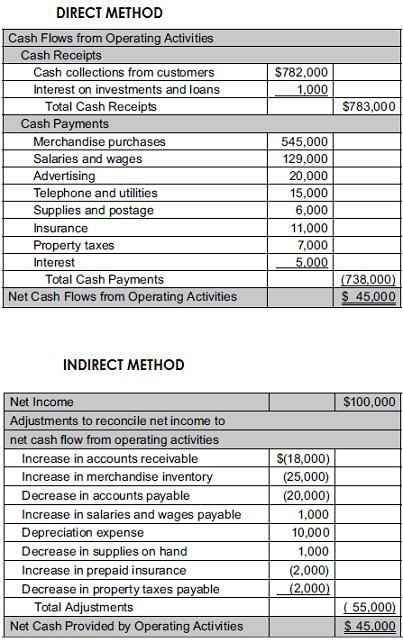

Decrease in wages payable cash flow. Decrease in Prepaid Insurance. Decrease in salaries and wages payable. Heres a general rule of thumb when calculating the cash flow from Operations using the Cash Flow Statement Indirect Method.

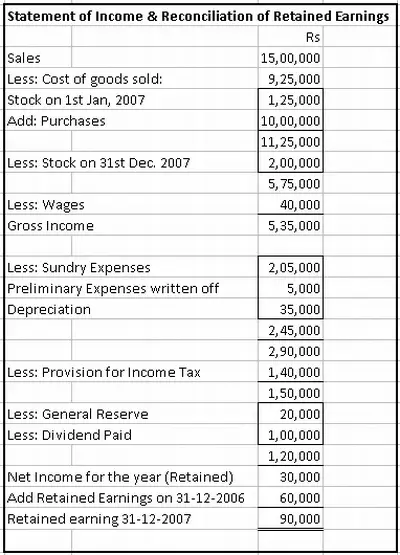

Net Cash Flow from Operating Activities. We start the cash flow from the positive or negative net income. In order to prepare the cash flow statement we adjust the profit before tax with working capital adjustments and operating expenses and accrual is an operating expense payable.

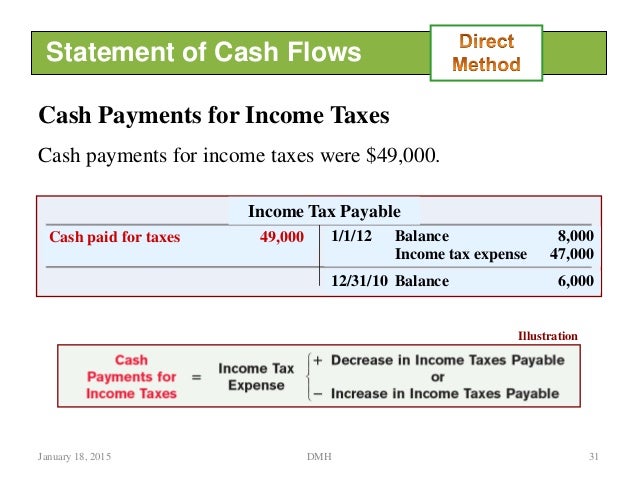

An increase in accounts payable decreases net income but increases the cash balance when adjusting net income in the cash flow statement. Companies need to calculate the increase of decrease in accounts payable prior to including it on the statement of cash flows. Gain on Sale of Equipment.

It means the company has paid 100000 to its supplier which is a reduction to cash flow but in effect do. If you were able to extend your average payable period from 20 days to 30 days adding those 10 extra days defers 3000 in cash outflows. Use the following information regarding the Newcastle Corporation to prepare a statement of cash flows using the indirect method.

The drop in payables would mean a drop in operating cash flow in the statement. Once thats done deduct any increase in accounts payable in the period or add back any decrease in accounts payable. Cash flow math.

In order to adjust net income to cash flow the increase in accounts receivable for the period must be subtracted from net income. Then add any increase in inventory in the period or if theres a decrease in inventory deduct this. Also know How does a decrease in accounts payable affect cash flow.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)