Ace Accounts Payable Increase Cash Flow Saas Balance Sheet Example

Cash flow reporting derives the cash flow based on changes to balance sheet accounts such as Accounts Receivable Inventory Accounts Payable Depreciation and Other Investments.

Accounts payable increase cash flow saas balance sheet example. 91-8800215448In this lecture I have solved a problem with new. In the Balance Sheet your Accounts Receivable and Accounts Payable will appear as shown below. From the cards on the top of the page click Cash Flow to see the Cash Flow overview dashboard.

The income statement listed 14108 in manufacturing costs and 8212 in other operating expenses. 3 statement models are the foundation on which more advanced financial models are built such as discounted cash flow DCF models. The following five items may cause a difference between the balance sheets cash account and the statement of cash flows and adjustments must be made.

The cash account on the balance sheet should reflect the total cash available to the firm as calculated on the statement of cash flows. This means that though Net Income is reported as decreased in the process in reality - the cash has not been given out. Since we received proceeds from the loan we record it as a 7500 increase to cash on hand.

These short-term credits are recorded as current assets on the balance sheet and they have an inverse impact on cash flow as accounts payable. The chart above shows the median cash on the balance sheet by year of founding for publicly traded SaaS companies. For example the business has made a sale of 100000 in 50 credit and 50 cash receivable within months from sale.

These short-term credits are called current assets on the balance sheet and have an inverse impact on cash flows as accounts payable. Notes Payable is recorded as a 7500 liability on the balance sheet. Convert the Rearranged Balance Sheet Into a Cash Flow Statement.

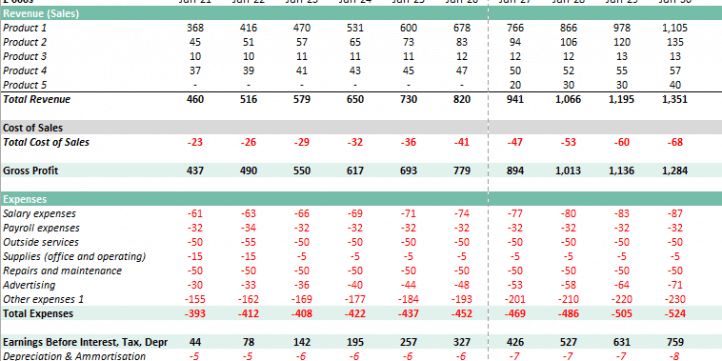

An Increase in Accounts Payable is Favorable for a Companys Cash Balance It may help to view the positive amounts on the SCF as being favorable or good for a companys cash balance. A 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. By its second year in business the median SaaS company in this data has about 7M on its balance sheet at year two from either the combination of a.