Beautiful Pro Forma Ebitda Definition

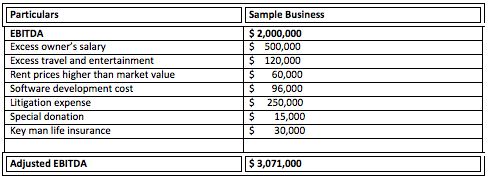

Some firms prefer to build the run-rate EBITDA on a more granular basis.

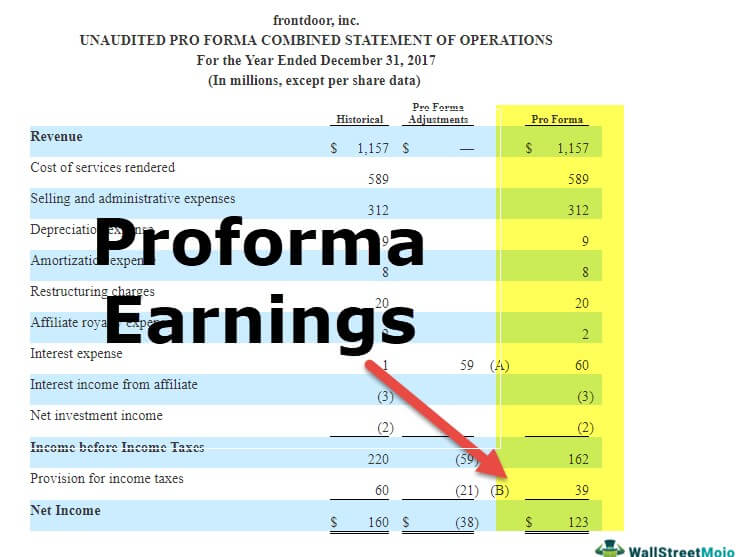

Pro forma ebitda definition. The most common pro-forma adjustment would be to reflect the trading results of an acquired entity. Pro-forma earnings most often refer to earnings that exclude certain costs that a company believes result in a distorted picture of its true profitability. Usually youll see this mentioned when someone is trying to understand how a company will look after an acquisition.

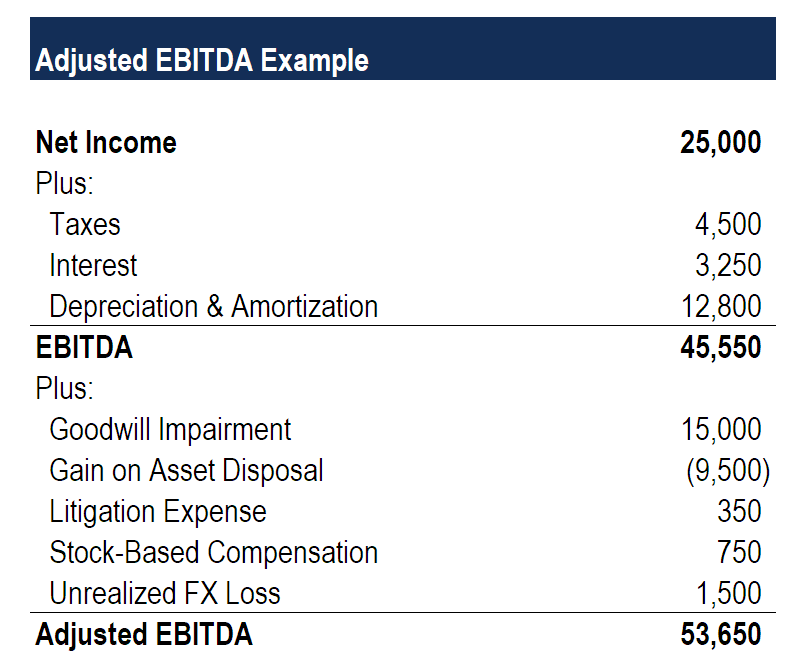

To define the term EBITDA is Earnings before Interest Taxes Depreciation and Amortization. EBITDA stands for E arnings B efore I nterest T axes D epreciation and A mortization and is a metric used to evaluate a companys operating performance. Operating Income Depreciation Amortization.

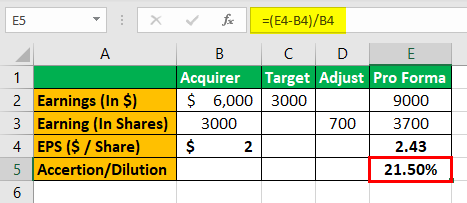

You adjust the EBITDA to present the EBITDA how it would be in the new situation. The earnings are calculated by taking sales revenue and deducting operating expenses such as the cost of goods sold. Making assumptions regarding synergies and incorporating them into the income statement to calculate EBITDA.

Gains Made By Ahold Delhaize We examined how pro forma earnings information within earnings announcements impacts the investment judgments of nonprofessional investors. Making individual assumptions for revenue margin and overheads to arrive at an adjusted EBITDA figure. What Is Adjusted EBITDA.

Adjusted EBITDA earnings before interest taxes depreciation and amortization is a measure computed for a company that takes its earnings and adds back interest. Pro forma is a Latin term that means for the sake of form or as a matter of form. For example if a company adds a new product through the last 12 months then the pro forma TTM EBITDA would estimate the contribution of this product for the entire 12 month.

Many more EBITDA definitions are used in the MA world. So when Relevium Technologies announced it was acquiring BioGanix is was time to Pro Forma the financial statements. The term Pro Forma is used to describe how a company will look after an event like an acquisition or divestiture has taken place.