Divine Total Cash Inflow Formula

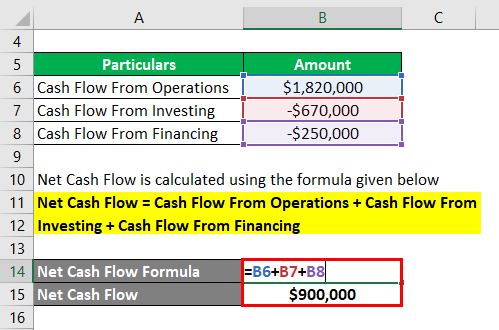

NCF total cash inflow - total cash outflow.

Total cash inflow formula. We can then use the cash flow from assets equation to find the change in NWC. You can see that the total flow of cash into the business receipts for January is expected to be 500 and that the total outflow from the business expenditure is 1500. The total expected cash inflows are subject to a maximum value equal to 75 of the total expected cash outflows.

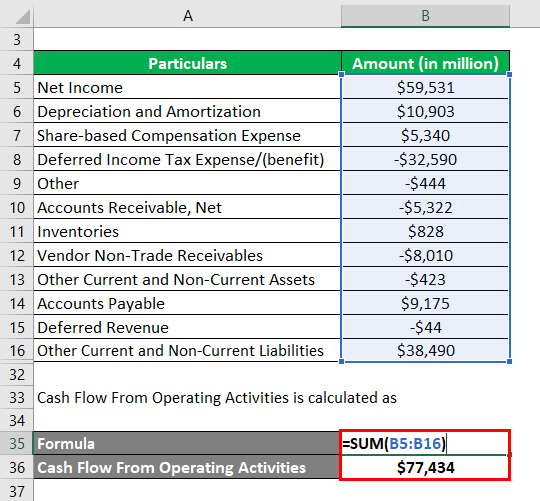

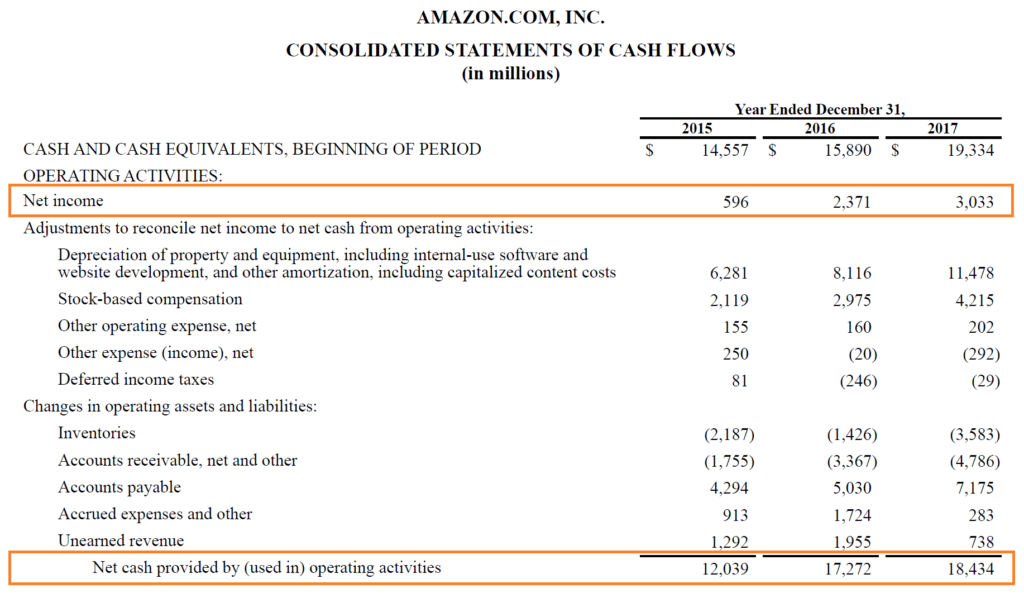

Cash Flow from Operations Net Income Non-Cash Items Changes in Working Capital. Looking for more details on Operating Cash Flow formula. The total cash inflows are 5000 plus 0 plus 10000 or 15000.

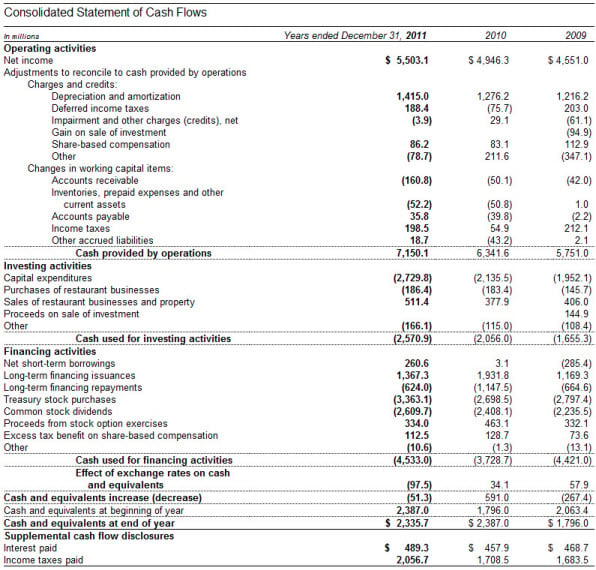

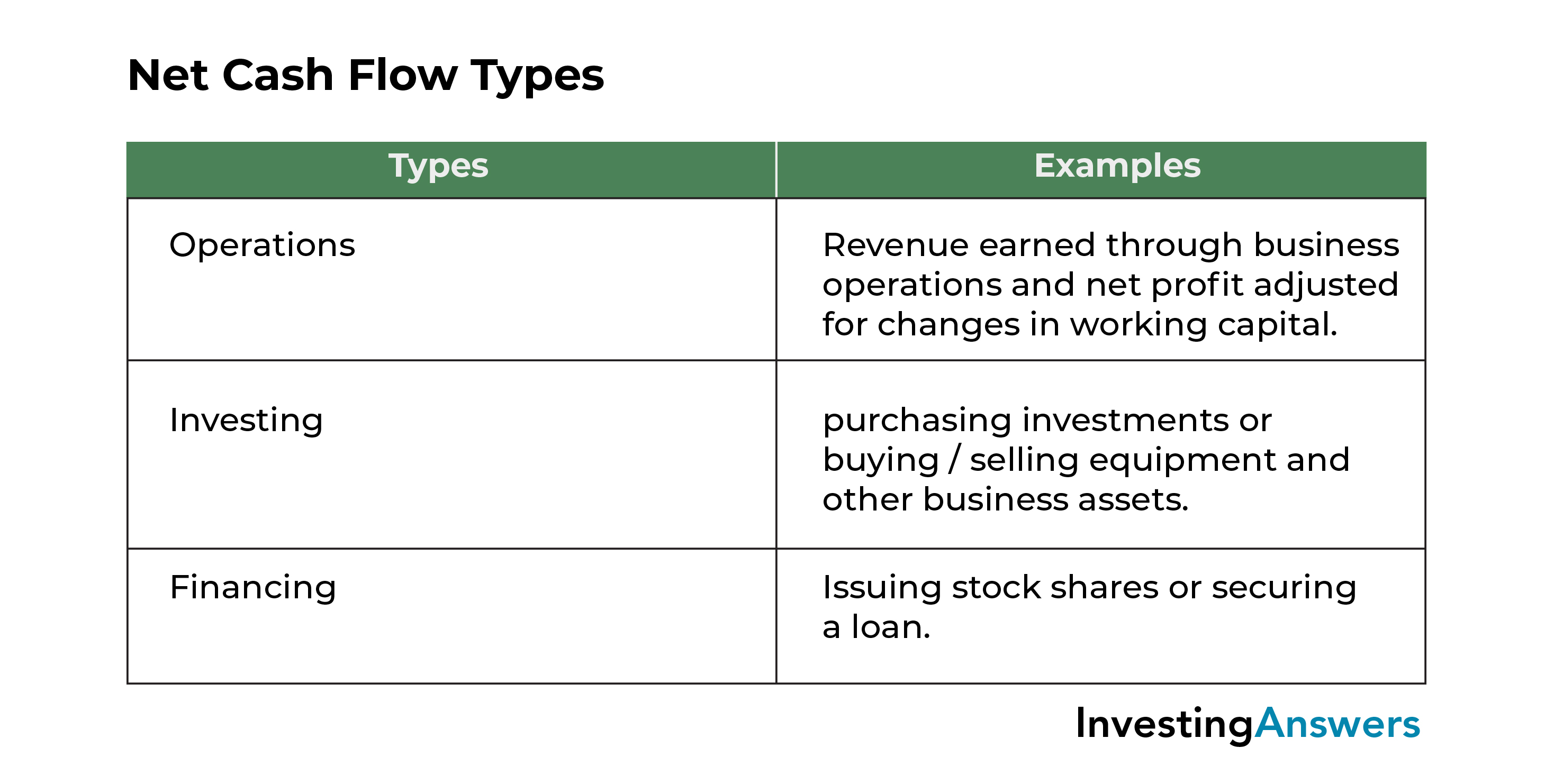

The listing shown below acts as a quick reference to. If a company has an operating income of 30000 5000 in taxes zero depreciation and 19000 working capital its operating cash flow is. When profitable companies expand too fast they can run out of cash and liquidity and go bust.

The earning before interests taxes surplus your operating profit deducted by using expenditures from the Total Income. 30000 5000 19000 44000. For a growing business a substantial use of cash will often be investment for further growth for example additional investment in net working capital for expansion.

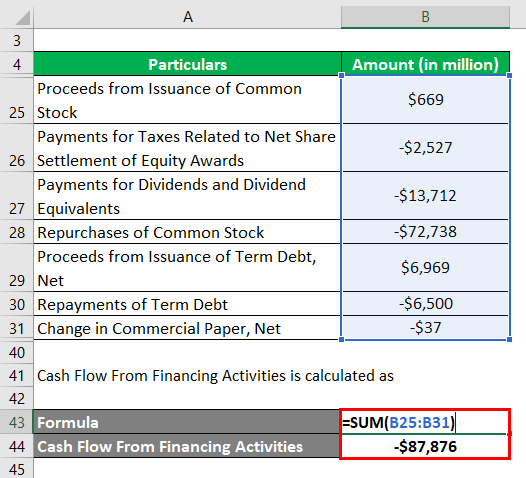

Calculating Total Cash Flows. Total expected cash inflows Outstanding balances of contractual receivables Expected Inflow rates. 85000 0 9000 -10000 66000 That means in a typical year Randi generates 66000 in positive cash flow from her typical operating activities.

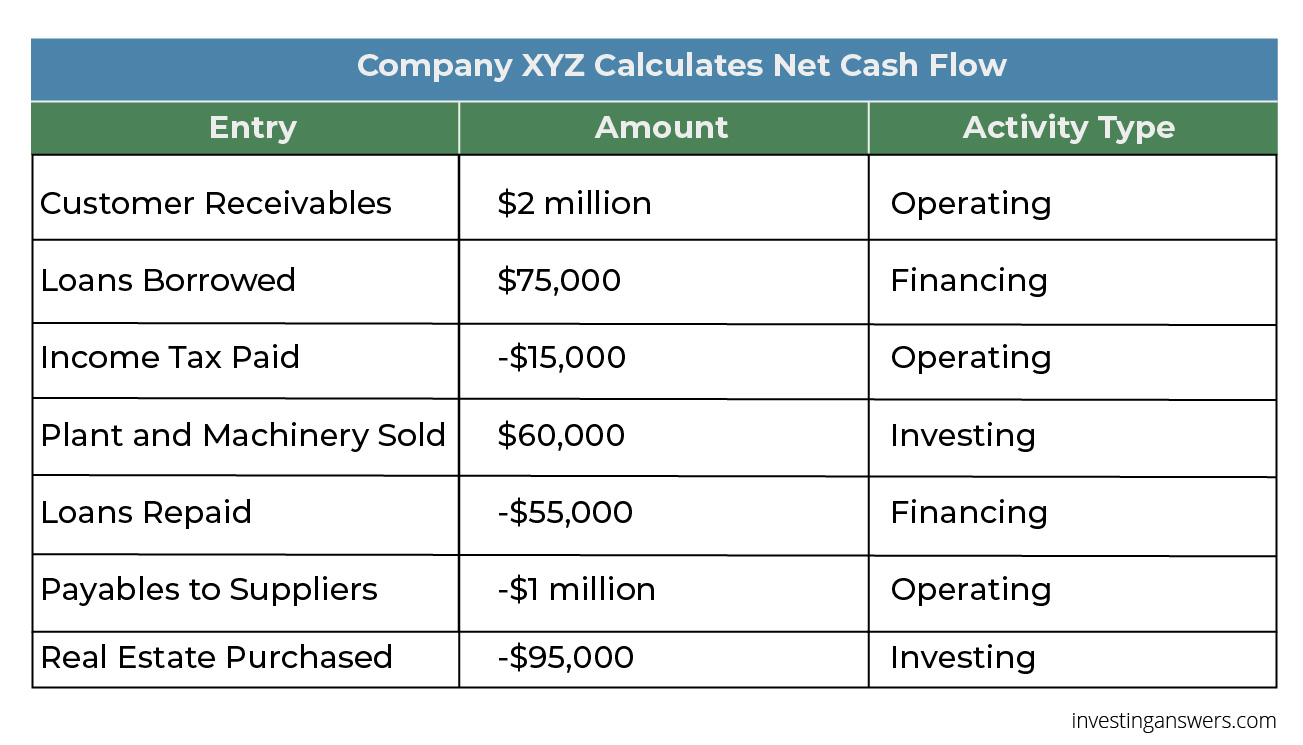

Sales 138000 Costs 71500. Operating financial and investment. While the exact formula will be different for every company depending on the items they have on their income statement and balance sheet there is a generic cash flow from operations formula that can be used.