Amazing Qualified And Unqualified Audit

An unqualified opinion is given after thorough.

Qualified and unqualified audit. A non-profit organization a government entity or a company listed on a securities exchange would use an unqualified audit report to show business partners that internal controls are adequate and functional. Ad Internal Audit Services - Quick And Easily Found At Asksly. An unqualified audit report expresses that the financial statements are fair and true without incorrect data and information.

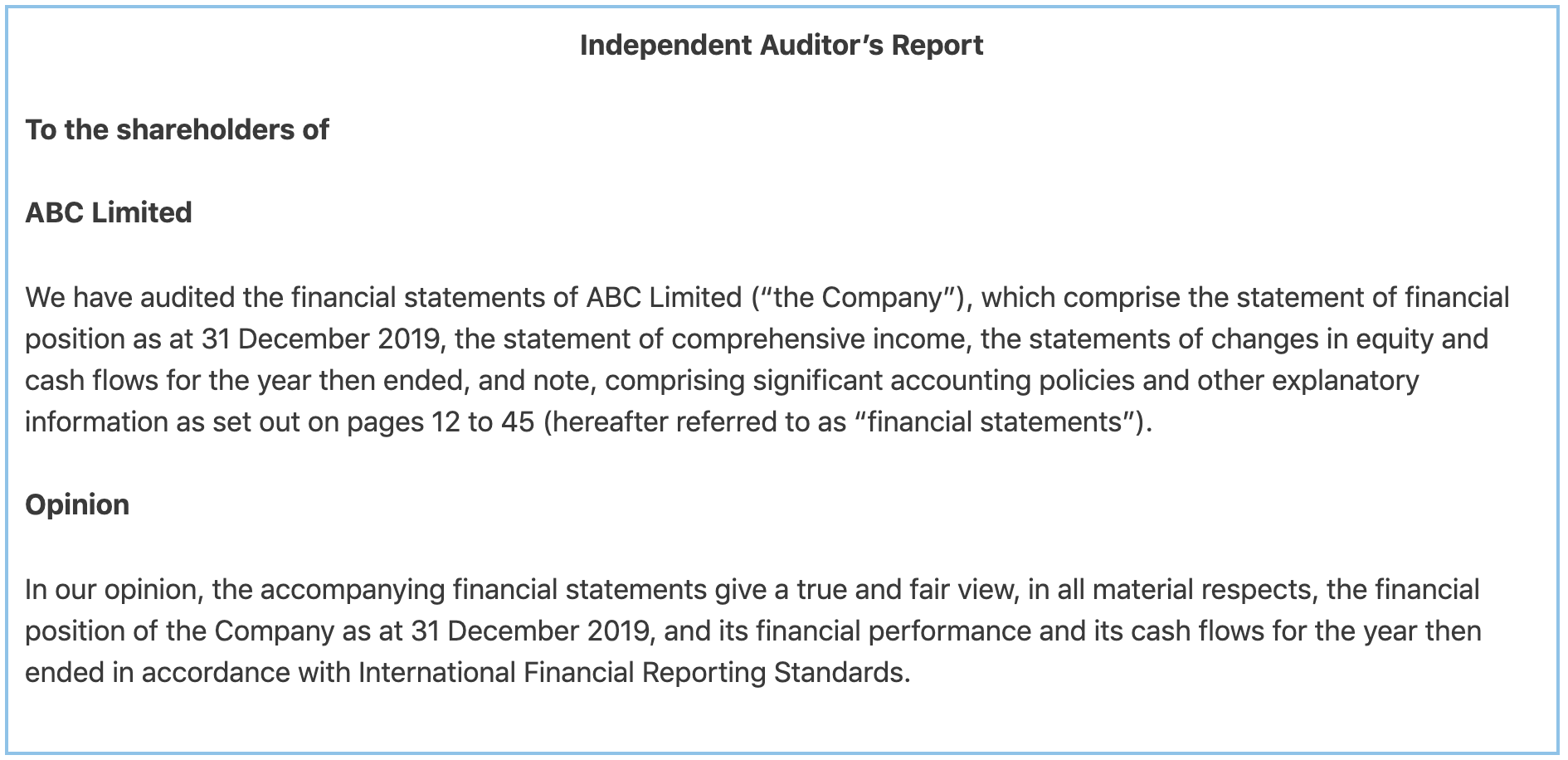

In an unqualified report an auditor will state something along the lines of In our opinion the financial statements give a true and fair view of the financial position of ABC Inc. To find audit r. An unqualified audit report is an audit report that gives a clean chit to the financial statements representing a true and fair view of the financial position of the entity.

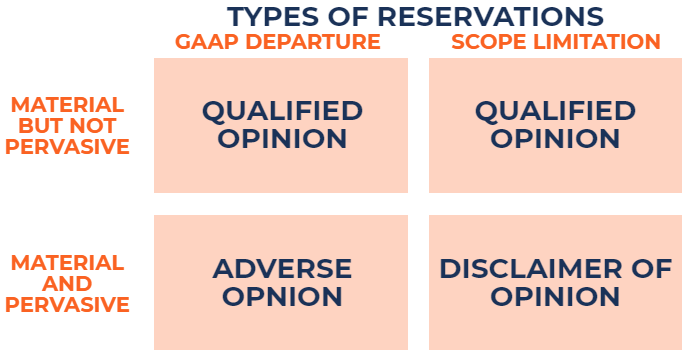

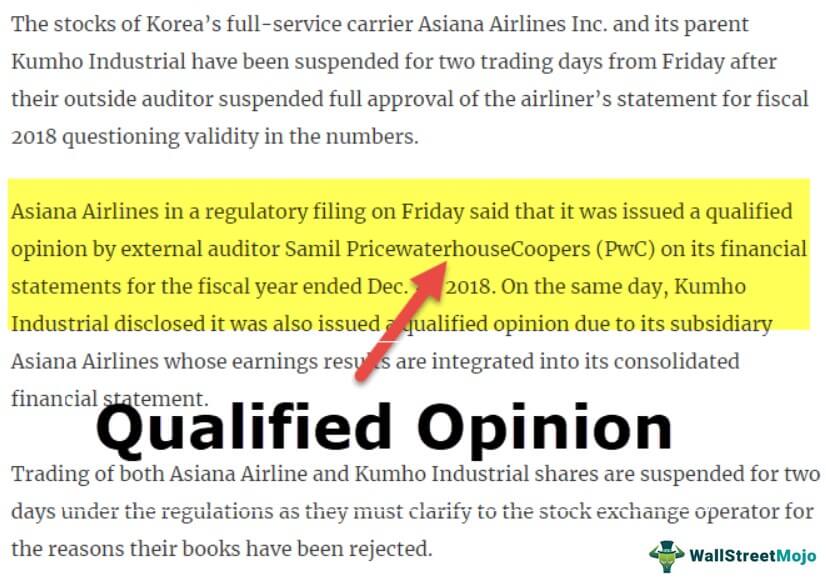

In short the auditor gives a qualified opinion here. Ad Find Audit safety. This opinion is different from a qualified opinion.

Adherence to accounting rules and standards. The auditors report is. The distinct difference between a qualified and unqualified report that separates them from each other is simply the wording in the letter.

Therefore if the audit report is unqualified the audit is unqualified and vice versa. While qualified audit report by auditor means that there are some problems associated with the books of accounts and company has deviated from generally accepted accounting principles. An unqualified audit reflects business financial statements that are transparent and compliant with generally accepted accounting principles GAAP.

The main auditor report is essential aspect of the organizations audited financial report. The unqualified audit opinion is the opinion that issue by auditors in their audit report on the financial statements when those financial statements are prepared and presents in all material respect and compliance with applicable accounting standards. The main difference between an unqualified and qualified report lies in whether the report shows possible issues with the companys financial controls.