Breathtaking Franchise Balance Sheet Classification

The two most important franchisor financial statements franchisees need to review are the Balance Sheet and Income Statement.

Franchise balance sheet classification. The only optional exemptions are for certain short-term leases and leases of low-value assets. At first the new standard will affect balance sheet and balance sheet. Like any business you take on the many responsibilities of.

Is the business cash strong or weak. By organizing the information into categories it can be easier to read and extract the information you need than if. The Balance Sheet What can be learned from the balance sheet.

The following are the list general categories of fixed assets. Franchises and licenses are non-financial non-physical assets that reflect legal agreements allowing the franchisee or licensee to sell or market products or services developed by the franchiser or licensing company. If so how long can it survive on its holdings.

Does it have any. Is the business burdened with too much short-term debt. The Balance Sheet.

For each of the following 2021 balance sheet items use the letters above. If the franchise contract requires the. These are classified as assets because the business owners reap monetary gains with the help of these intangible assets.

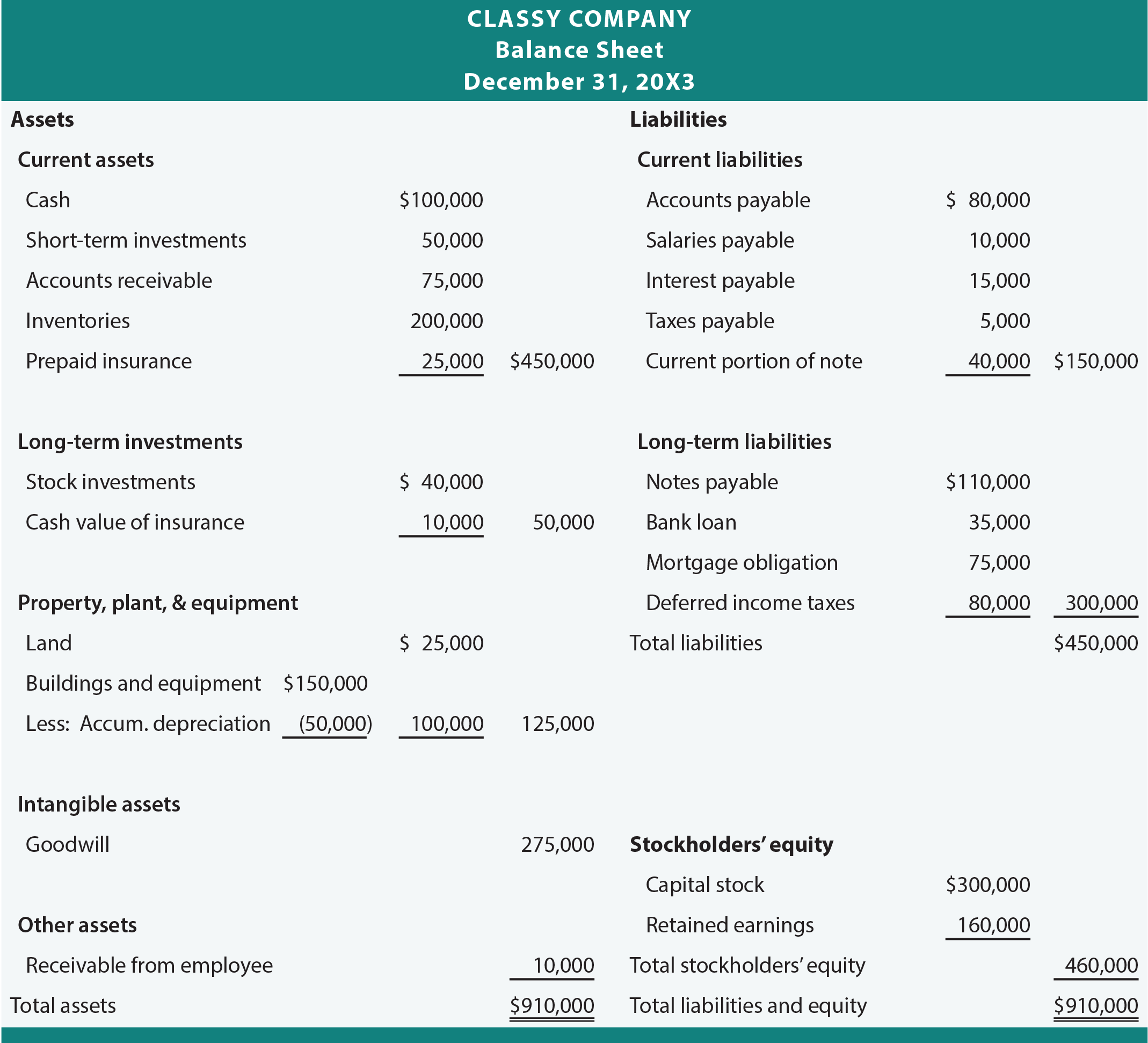

Unrecovered costs of a successful legal suit to protect the patent. A balance sheet is a snapshot summary of how much a company is worth on any given day. A classified balance sheet presents information about an entitys assets liabilities and shareholders equity that is aggregated or classified into subcategories of accounts.

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)