Ace Kabbage Financial Statements

We take your privacy very seriously.

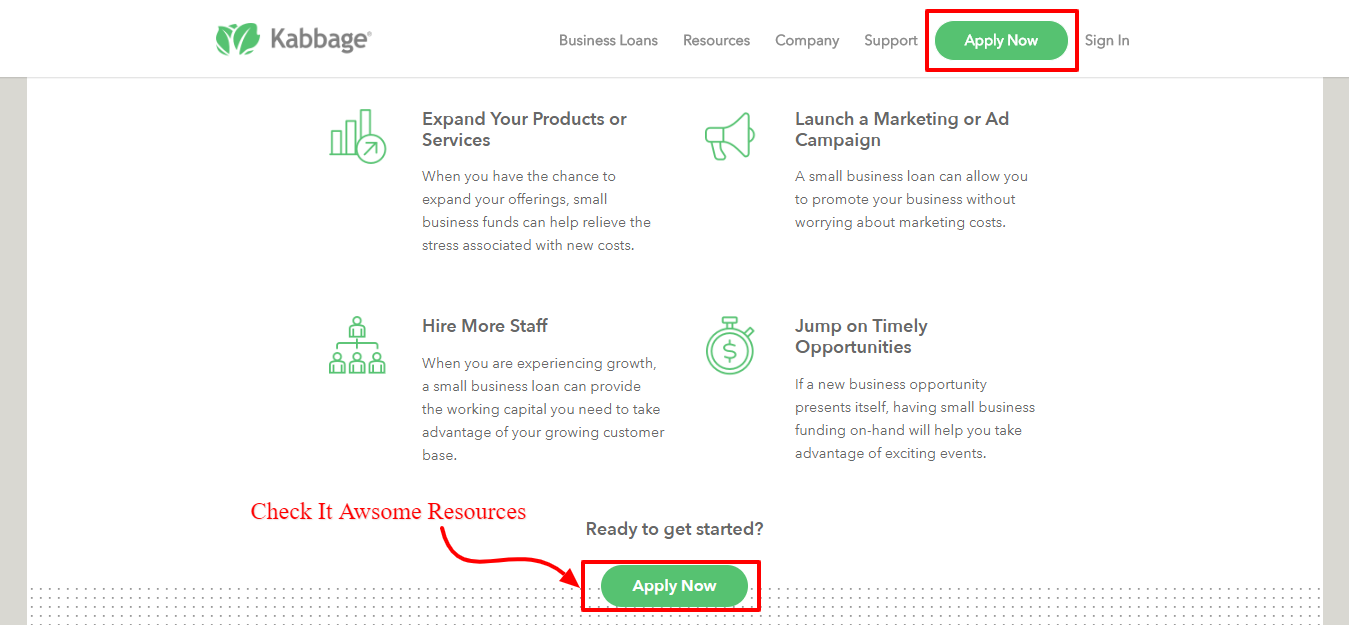

Kabbage financial statements. Why do I have to verify my personal information when I call Kabbage. There are 4 companies in the Kabbage Inc. No need to dig up years of financial statements.

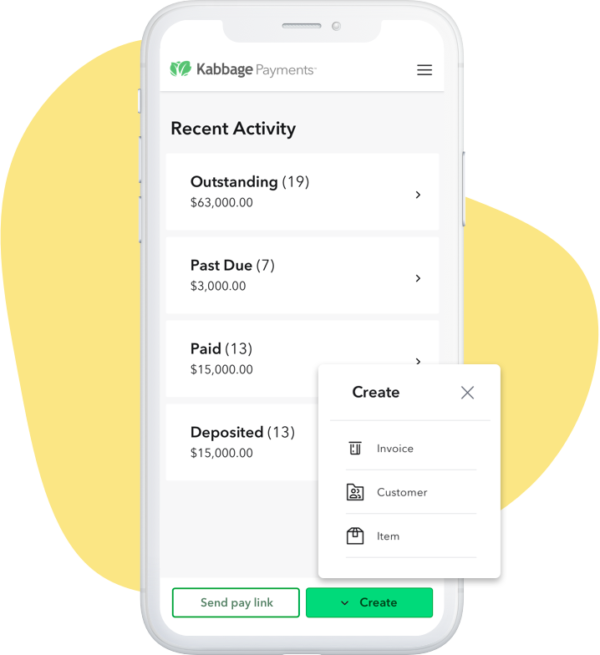

Instead of submitting financial documents such as tax returns and debt statements with Kabbage you link your qualification to a business checking account or similar online services that you employ like PayPal or QuickBooks. Ad See detailed company financials including revenue and EBITDA estimates and statements. The Atlanta-based fintech company Kabbage has a valuation of 12 billion and is on the Forbes Fintech 50 2019.

Similarly future accountants and auditors need to recognize how new technology for example block chain can be expected to disrupt the financial reporting and assurance process. OnDeck was founded in New York New York in 2006. Even though theres no minimum credit score required to apply Kabbage goes through your statements and examines your cash flow.

In addition to these qualifications Kabbage looks at several financial performance indicators like how consistent your revenue is your cash flow and your personal credit scores. Kabbage loans are issued by Celtic Bank Member FDIC. If you sell products online Kabbage can access your e-commerce data through sites like Etsy and Amazon as well as your Paypal account to analyze your online revenues and determine how much money you qualify to borrow.

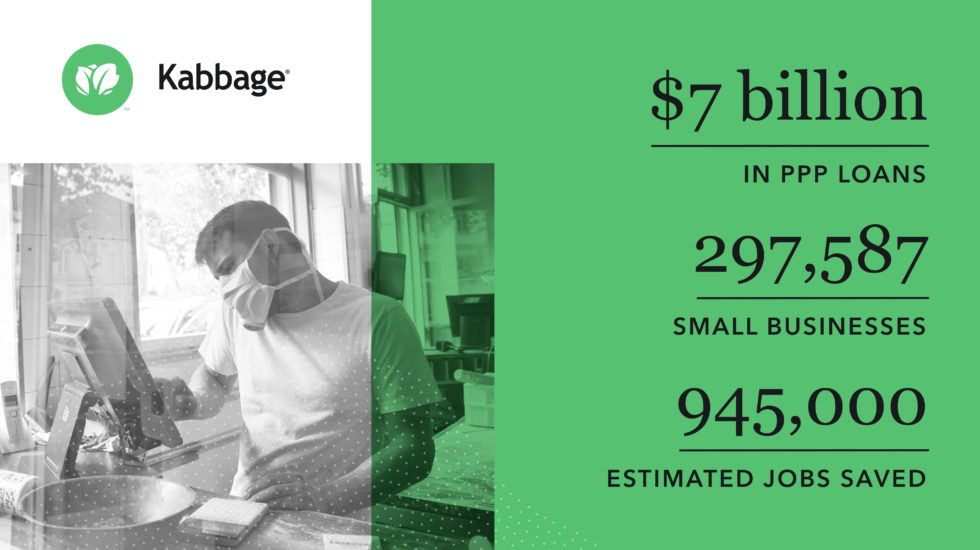

While less than what small businesses borrowed from banks before the. 42 percent of total revenue. Provides working capital advances for online merchants.

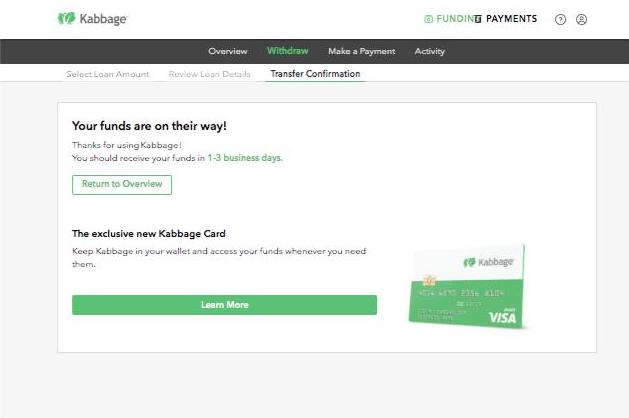

Qualify in 10 minutes. Kabbage Checking account funds are FDIC-insured up to the allowable limits through Green Dot Bank Member FDIC upon verification of Cardholders identity. Get detailed data on venture capital-backed private equity-backed and public companies.