Supreme Sba 7a Personal Financial Statement

Request A Demo And Speak To A FactSet Specialist About Our Flexible Data Solutions.

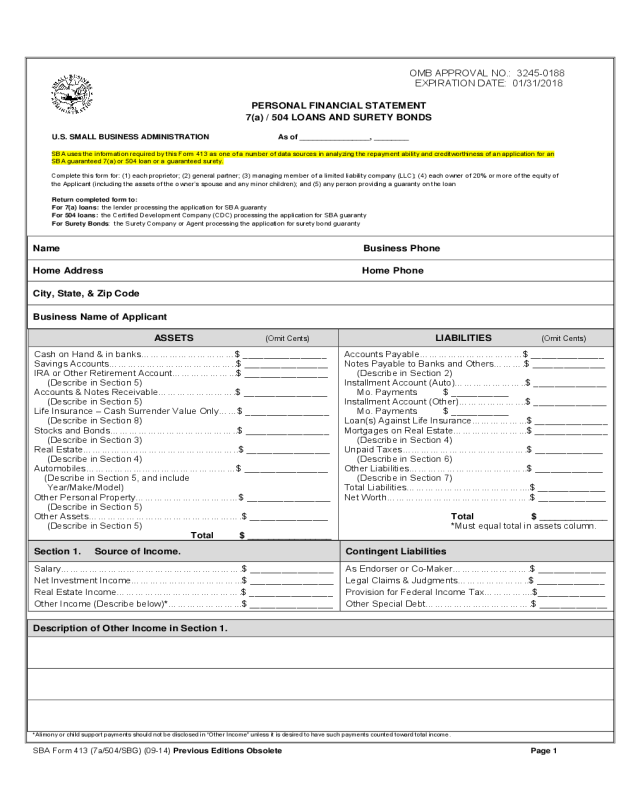

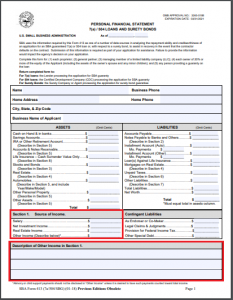

Sba 7a personal financial statement. In addition to required forms that the SBA supplies you and your business affiliates need to provide financial statements for your business. This form has to be provided either by an individuals lender. SBA Form 413 is the Personal Financial Statement a required part of the SBA 7a or 504 loan application that business owners must submit.

This helps demonstrate your ability to repay the loan. All aspects of writing the college admissions essays covered online for a nominal fee. SBA 7 a Paperwork Explained.

SBA 7 a Paperwork Explained. SMALL BUSINESS ADMINISTRATION As of _____ _____ SBA uses the information required by this Form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of. PERSONAL FINANCIAL STATEMENT 7a 504 LOANS AND SURETY BONDS.

SBAs primary program the 7a loan program helps finance startup and existing small businesses when they cant get financing from other sources or from a lender who wont make a loan without an SBA guarantee its the SBAs most basic and popular loan program offering flexibility longer terms and potentially lower down payments compared to other financing options these loans are not funded by the SBA. All aspects of writing the college admissions essays covered online for a nominal fee. SBA Form 413 Personal Financial Statement - 7 a504 Loans and Surety Bonds is a form used to submit personal financial information.

Ad College admissions essay online course. Get A Free quote. Personal Financial Statement - 7a 504 SBG WOSB 8a Download pdf The SBA uses this form to analyze the repayment ability and creditworthiness of an application for all 7a 504 SBG WOSB and 8a program offices.

Business and Affiliate Financial Statements. In your paperwork you should include a current dated. The lender uses this form to ensure eligibility for an SBA loan based on their finances.