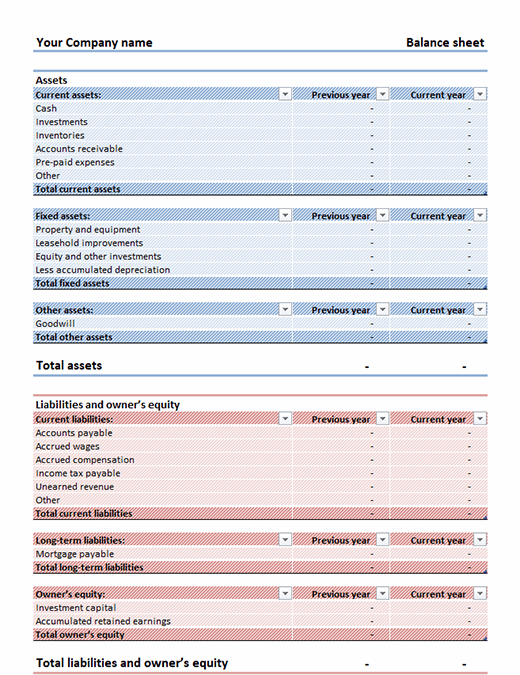

Top Notch Accounts Receivable Is Classified On The Balance Sheet As A Google Sheet Balance Sheet Template

All values USD Millions.

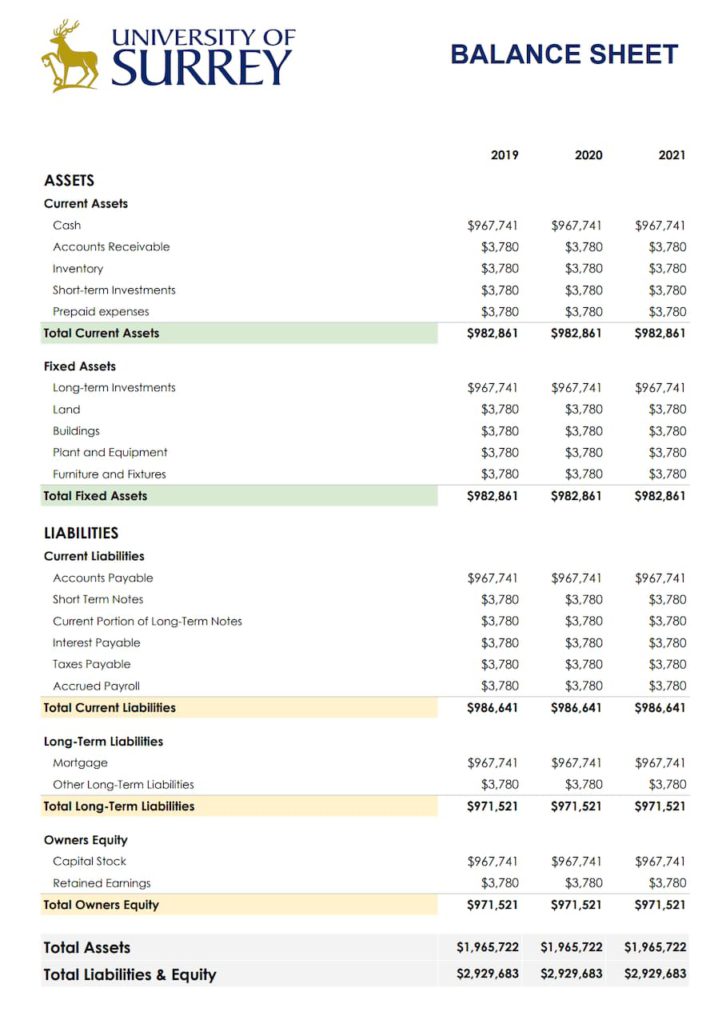

Accounts receivable is classified on the balance sheet as a google sheet balance sheet template. A classified balance sheet also provides a clear and crisp view to the user. On the other hand accounts payable are considered current. The balance sheet is one of the three main financial statements along with the income statement and cash flow statement.

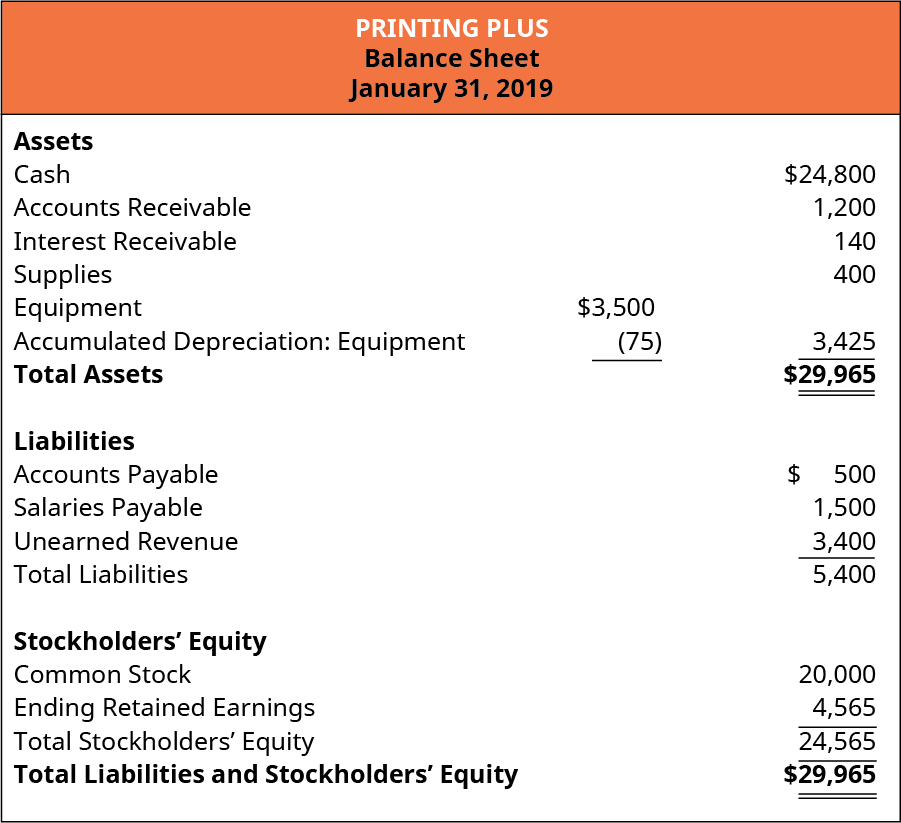

Accounting balance sheet analysis. The receivable is recorded as a debit to accounts receivable classified on the balance sheets as a current asset and normally collected within a short period such as 30 or 60 days. The most common transaction creating a receivable is THE selling merchandise or services on account.

Not only will this save you from creating calculation. This Cash flow statement template lets you track accounts receivable and accounts payable and automatically generates a monthly cash flow report. Current assets investments property plant and equipment and other assets.

The nature of a firms accounts receivable balance depends on the sector in which it does business as well as the credit policies the corporate management has in place. You can find accounts receivable under the current assets section on your balance sheet or chart of accounts. An accounts receivable credit balance is the opposite of a debit balance even though both are included on the balance sheet since only the debit balance will.

Liabilities are classified as either current or long-term. ST Debt Current Portion LT Debt. A balance sheet gives a snapshot of your financials at a particular moment incorporating every journal entry since your company launched.

There is no room for mistakes when it comes to your balance sheet. Classified balance sheet groups assets into the following classification. Accounts receivable fall under a companys assets section on the balance sheet.

:max_bytes(150000):strip_icc()/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)