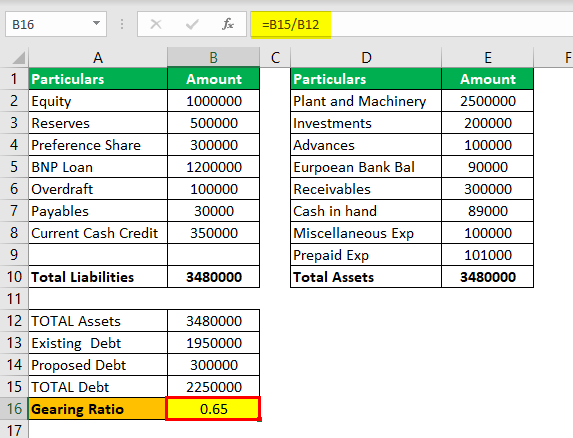

Neat Balance Sheet Gearing

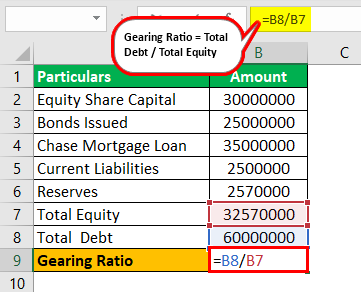

Gearing Ratio Formula Debt is given in the balance sheet and includes loans overdrafts hire purchase and any other borrowings.

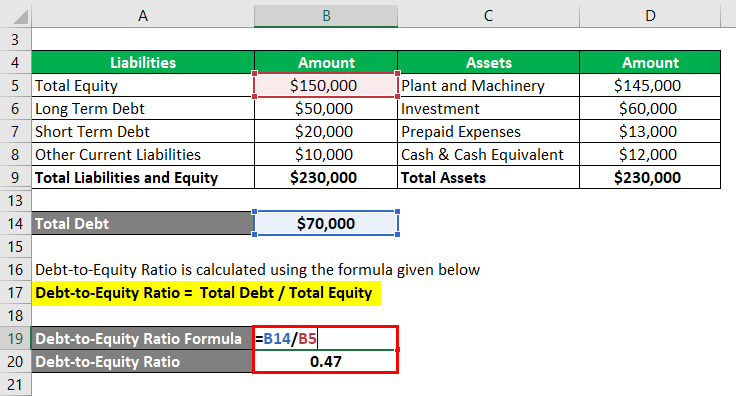

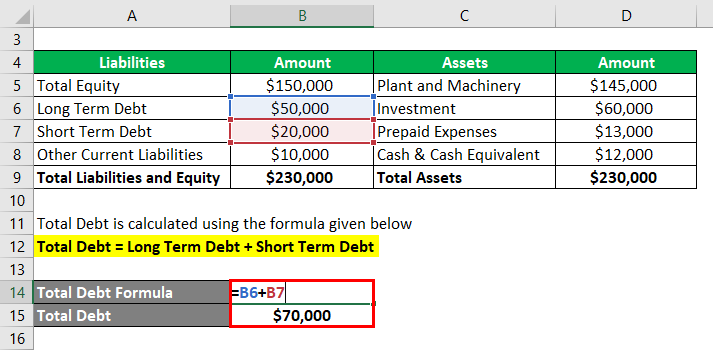

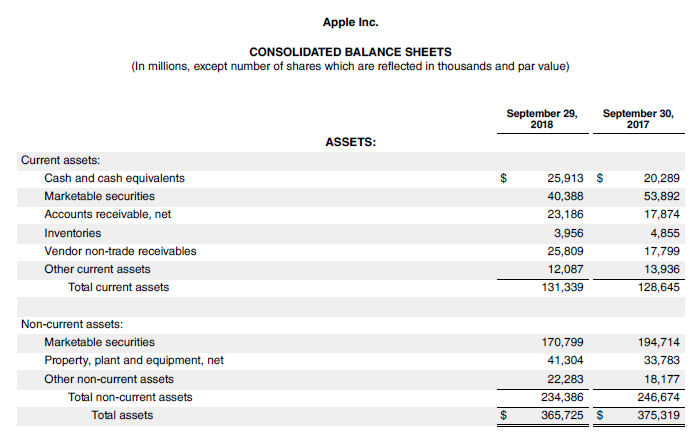

Balance sheet gearing. Assets or the value of what the company has owns or is owed. Balance Sheet Ratiosxls Author. Balance sheet ratios compare the various line items on a balance sheet in order to infer the liquidity efficiency and financial structure of a business.

This raw simplicity lies in the fundamental accounting equation also called the balance sheet equation which states the sum of all assets must balance to the sum of all liabilities and equity in the business. Liabilities debts are what the business owes and shareholders equity is the value that is owned by shareholders. Balance Sheet Ratios Created Date.

The gearing ratio measures the proportion of a companys borrowed funds to its equity. Balance sheet with financial ratios. Owners Equity is found in the balance sheet and includes amounts invested by the owners and any retained earnings.

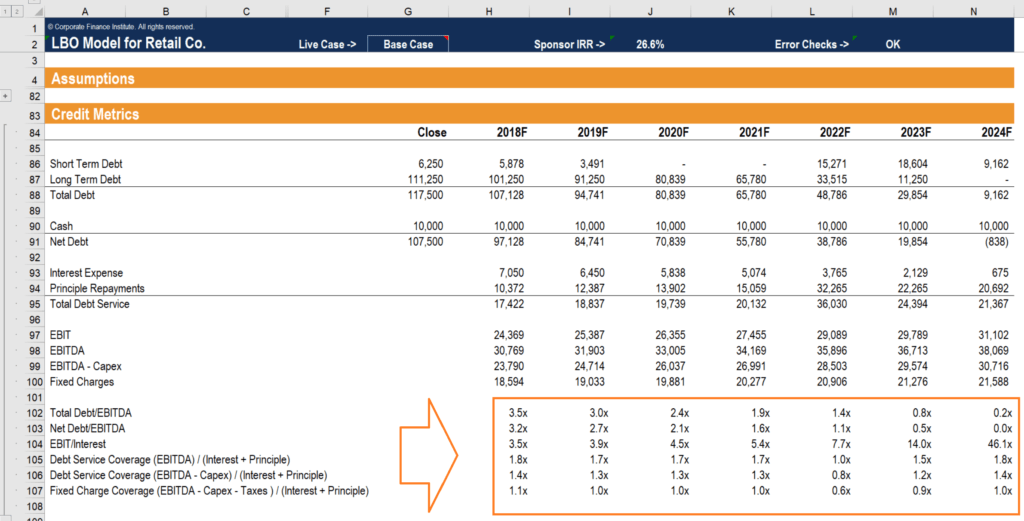

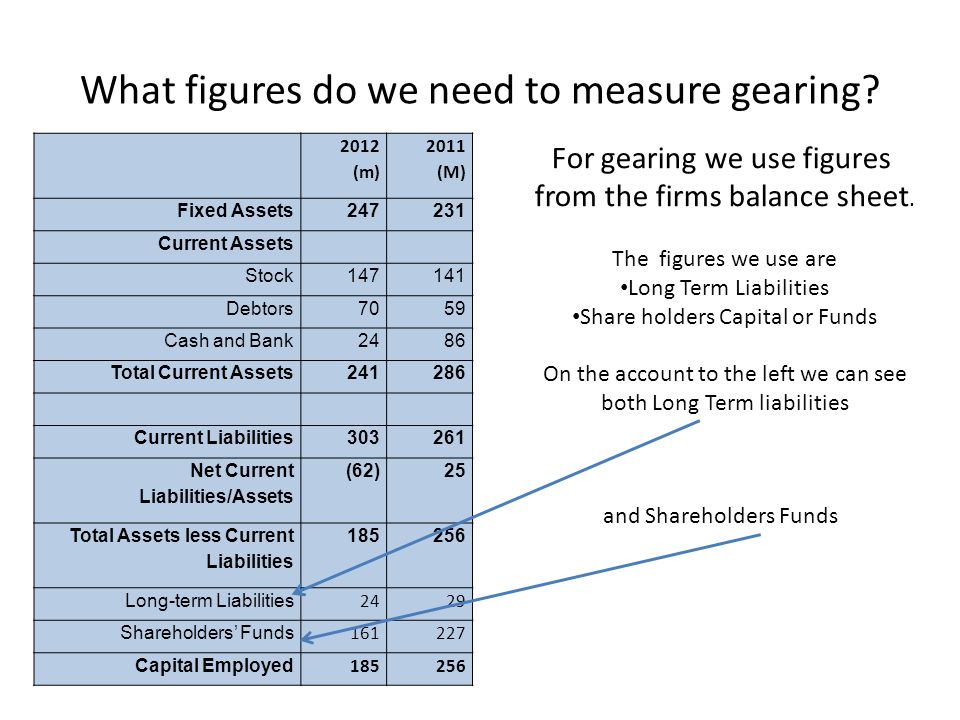

What are the Ratios for Analyzing a Balance Sheet. The following list includes the most common ratios used to analyze the balance sheet. The bank may include leasing when calculating the gearing ratio as they take a stricter approach.

There are three major gearing ratios. This video explains how balance sheet can be prepared using ratios. A gearing ratio is a general classification describing a financial ratio that compares some form of owner equity or capital to funds borrowed by the company.

In other words the metrics signify the mix of funding from lenders and from the shareholders. The ratio indicates the financial risk to which a business is subjected since excessive debt can lead to financial difficulties. The term gearing refers to the group of financial ratios that demonstrate to what degree are the operations of a company funded by debt financing vs equity capital.