Out Of This World Ifrs 16 Rules

Lessors continue to apply a two-model approach.

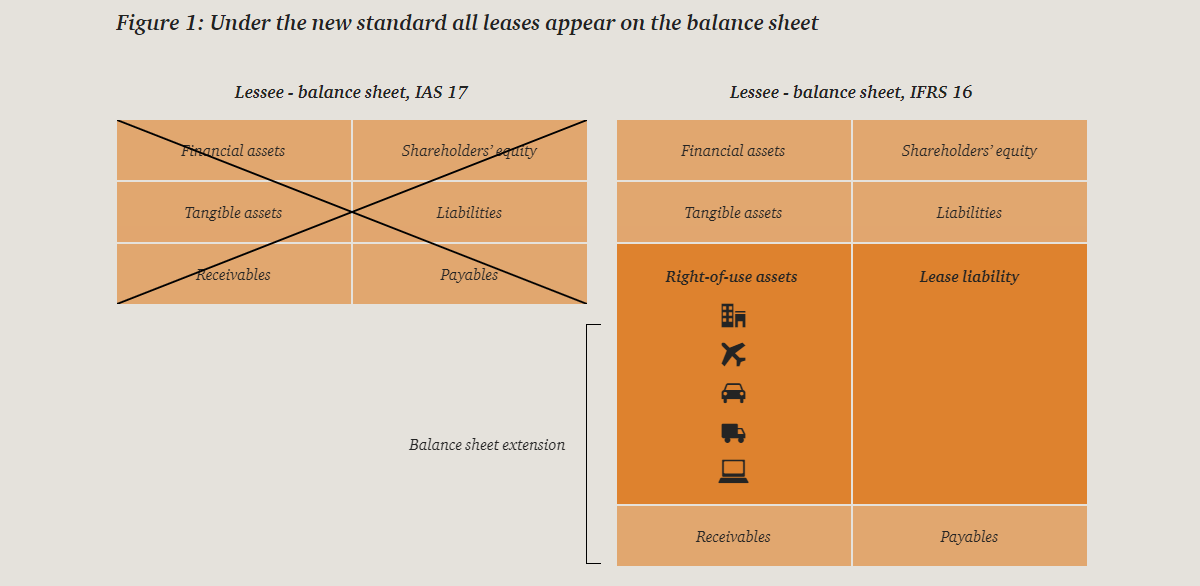

Ifrs 16 rules. The new standard. However there are still some companies that have yet to adopt the standard as well as those who may be struggling with how to handle leasing processes post-adoption in order to maintain compliance with IFRS 16. The IASB published IFRS 16 Leases in January 2016 with an effective date of 1 January 2019.

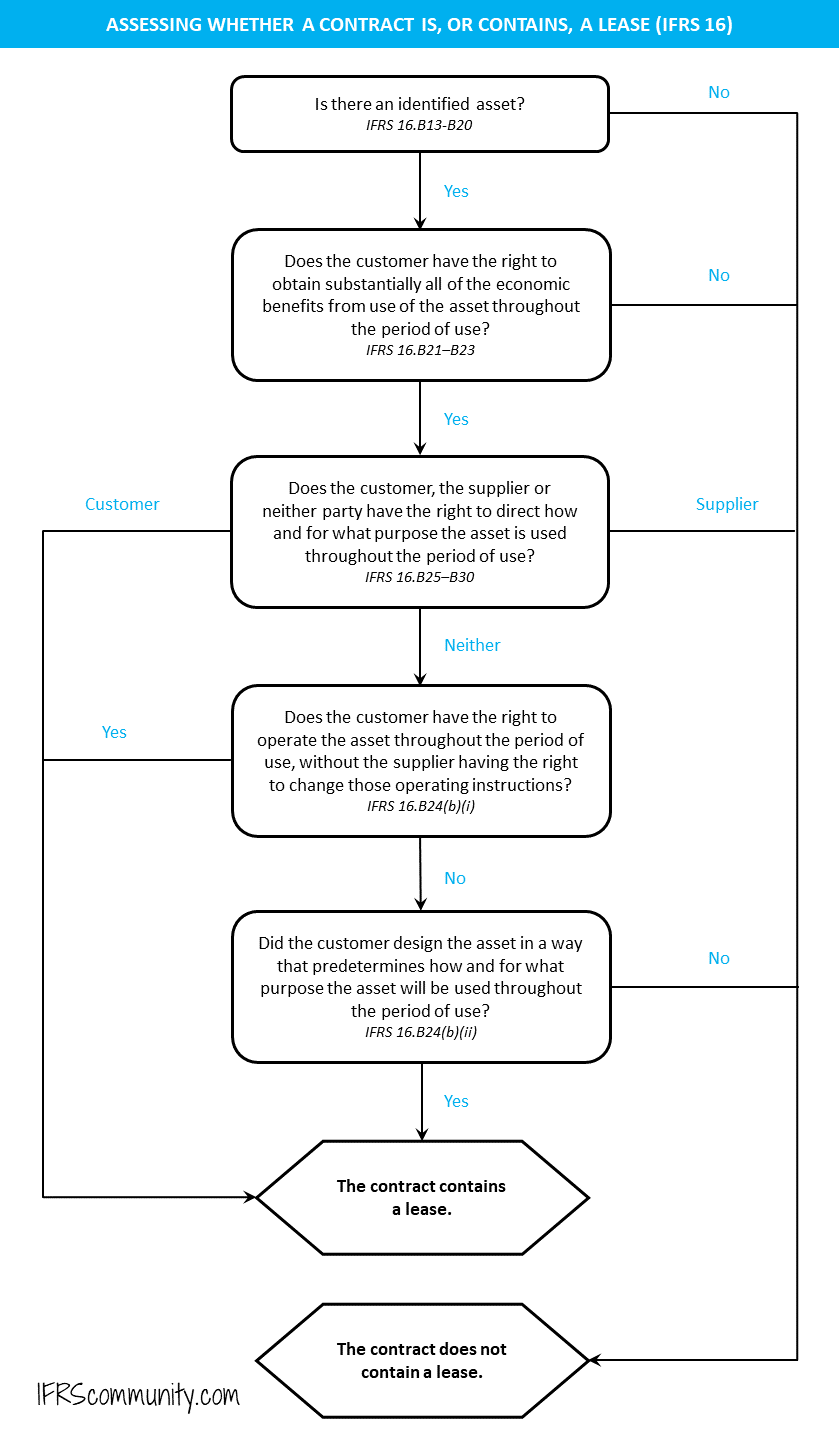

In contrast IFRS 16 includes specific requirements for the presentation of the ROU asset and lease liability and the corresponding effects on the results and cash flows in the primary financial statements. IFRS 16 applies a control model for the identification of leases distinguishing between leases and service contracts on. Whether to classify in accordance with IAS 40 Investment Property or IAS 16 Property Plant and Equipment Sale and Lease Back Transactions for Both Seller-Lessee and Buyer-Lessor.

IFRS 16 contains both quantitative and qualitative disclosure requirements. To determine whether a contract grants control of the asset to the lessee the agreement must provide the following to the lessee. In 2019 the IASB lease accounting standard IFRS 16 began to go into effect for companies worldwide.

The standard was published in January 2016 and is effective from 1 January 2019. Entities should focus on the disclosure objective not on a fixed checklist. The depreciation period of RoU should not exceed the lease term unless the lease contract transfers ownership of the underlying asset to the customer lessee by the end of the lease term or if the cost of the right-of-use asset reflects that the lessee will exercise a purchase option IFRS.

Deciding whether a transfer of asset is a sale Application of SB-FRS115 Revenue from contracts with customers. The right-of-use RoU asset is depreciated in accordance with IAS 16 requirements IFRS 1631. Criteria in paragraph 433 of IFRS 9 Financial Instruments.

The new IFRS 16 standard IFRS 16 sets out a model for the identification of lease arrangements and their treatment in the financial statements of both lessees and lessors. The objective of the disclosure requirements is to give a basis for users of financial statements to assess the effect that leases have on the financial statements. IFRS 16 sets out a comprehensive model for the identification of lease arrangements and their treatment in the financial statements of both lessees and lessors.