Unbelievable Ifrs 10 Summary

IFRS 9 Financial Instruments excluding Hedge Accounting Snapshot.

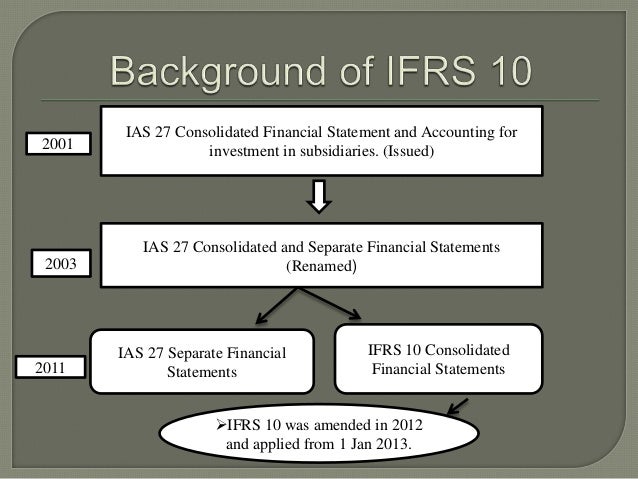

Ifrs 10 summary. IFRS 10 replaces the part of IAS 27 Consolidated and Separate Financial Statements that addresses accounting for subsidiaries on consolidation. In order to prepare consolidated financial statements IFRS 10 prescribes the following consolidation procedures. Combine like items of assets liabilities equity income expenses and cash flows of the parent with those of its subsidiaries.

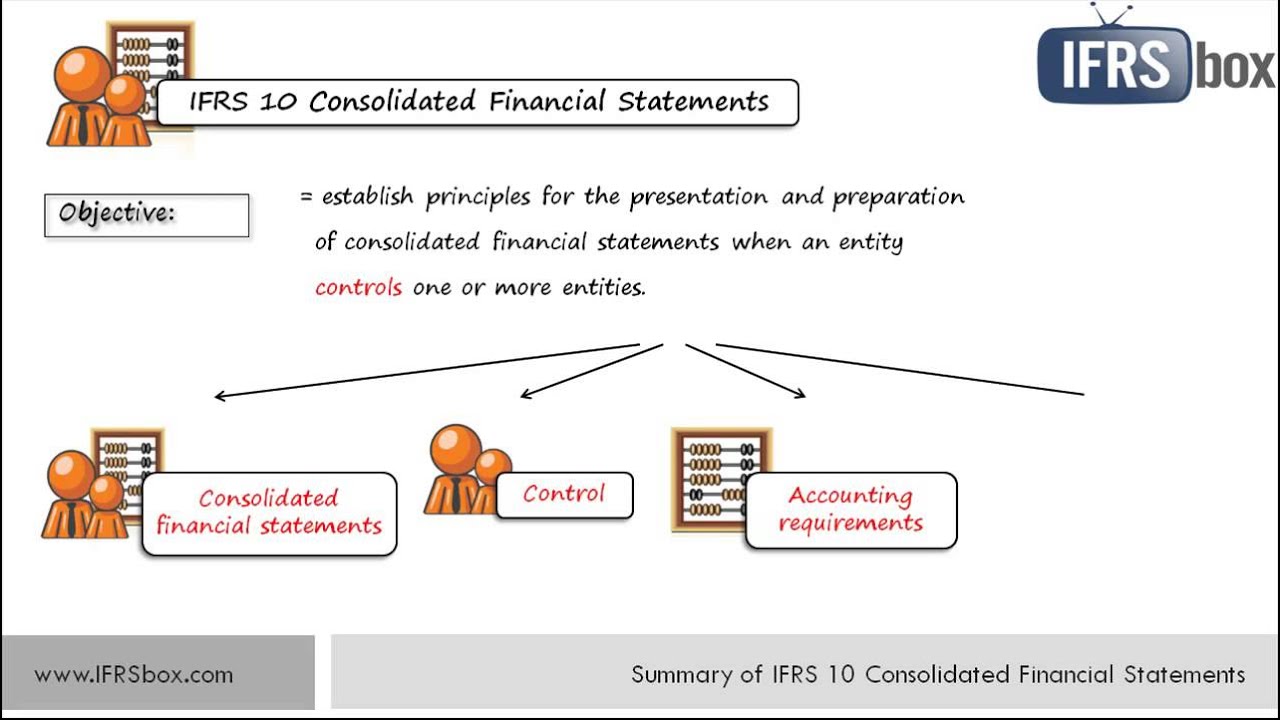

IFRS 10 Consolidated Financial Statements Adeel November 22 2016 November 22 2016 No Comments on Summary Notes. IFRS 10 Consolidated Financial Statements outlines the requirements for the preparation and presentation of consolidated financial statements requiring. IFRS 9 Financial Instruments Summary.

IFRS 10 Consolidated Financial Statements Download PDF 394KB. One-page summary of each IFRS A basic guide 2019. A summary of IFRS 10 Consolidated Financial Statements including information on current proposals and a timeline of past amendments announcements exposure drafts and consultations.

In addition IFRS 10 provides an exemption from consolidation for an entity that meets the definition of an investment entity such as certain investment or mutual funds. IFRS 10 Consolidated Financial Statements outlines the requirements for the preparation and presentation of consolidated financial statements requiring entities to. IFRS 10 Consolidated.

IFRS 5 Non-Current assets held for sale and Discontinued operations Summary. Compiled by Usidamen Israel 3 P a g e Accounting Yard AY Accounting Yard AY is a professional accounting movement with. What remains in IAS 27 after the implementation of IFRS 10 is the accounting treatment for subsidiaries jointly controlled entities.

Consolidated Financial Statements IFRS 10 Last updated. IFRS 10 Consolidated Financial Statements Summary. Summary of IFRS 10s main requirements IFRS 10 includes additional guidance on the elements of the control definition and their interaction including.