Nice Financing Cash Flow Definition

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

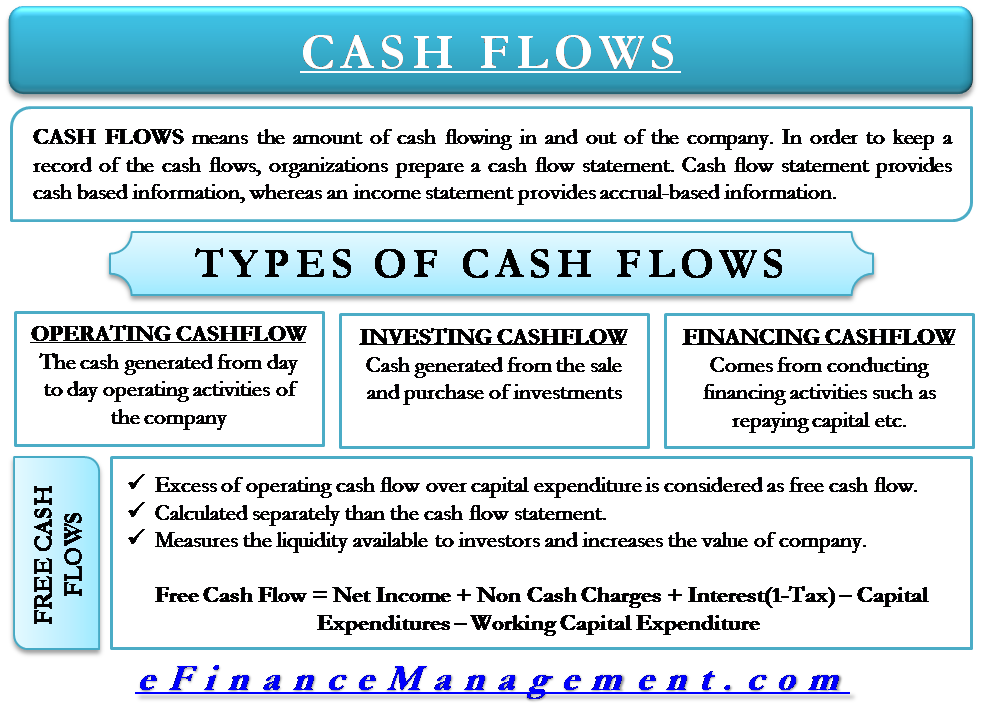

These flow changes are the daily life of every business and cash flow management ensures the financial security of a company.

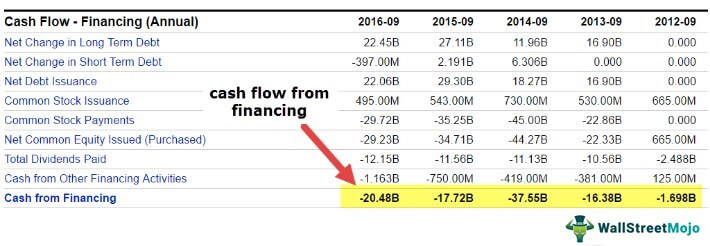

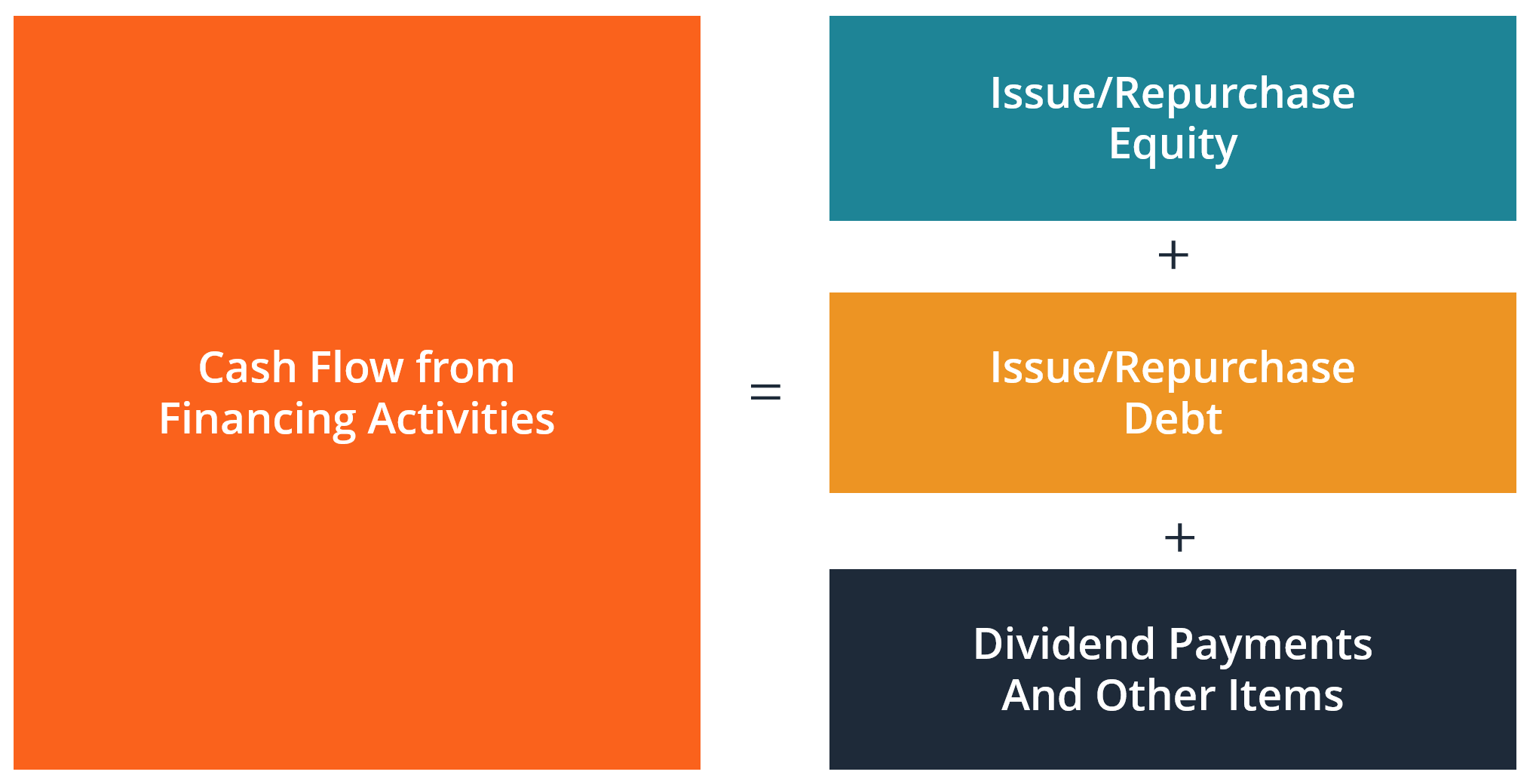

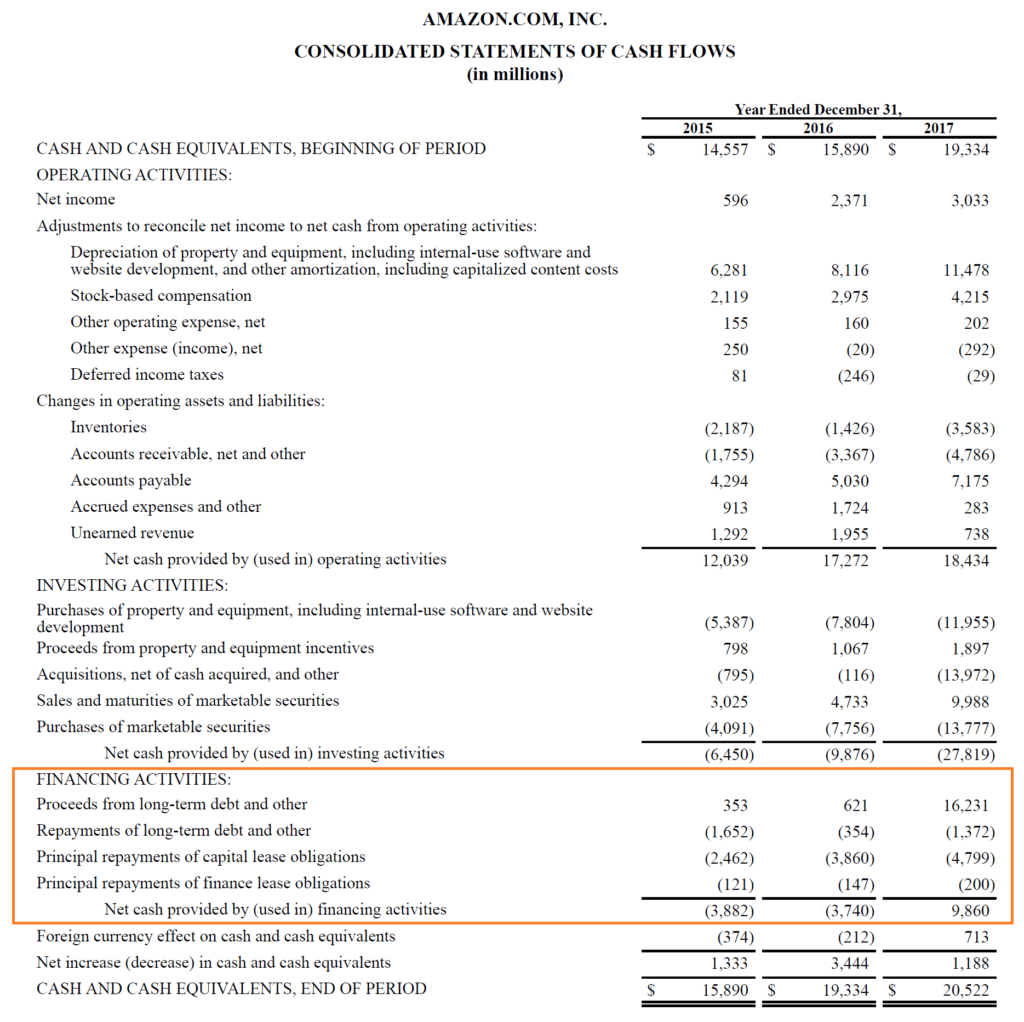

Financing cash flow definition. Cash flows from financing activities are defined as cash receipts from the getting hold by securities third parties issued by the company or resources granted by financial or third entities in the form of loans or other financial instruments as well as payments made by redemption or repayment of the amounts contributed by them. Cash flow management refers to the process by which an organization maintains control over the inflow and outflow of funds. Cash outflows include cash payments to repurchase stock and to repay bonds and other borrowings.

Cash inflows in this category include cash receipts from issuing stock or bonds and from borrowing through long term loans. Alternatively interest paid and interest and dividends received may be classified as financing cash flows and investing cash flows respectively because they are costs of obtaining financing resources or returns on investments. The fundamental goal of cash flow management is to ensure that the incoming flow of funds is always greater than the outgoing so that the business sits on a surplus.

Operating cash flows are those that are derived from the principal revenueproducing activities of the entity. Sales of debt- instruments equity instruments interests in joint ventures and certain other. A positive level of cash flow must be maintained for an entity to remain in business while positive cash flows are also needed to generate value for.

One measure of cash flow is earnings before interest taxes depreciation and amortization. Cash flow management defines precisely how large are the funds available at any moment in the evolution of a corporation to estimate the potential losses that could arise. This is what the Finanscapes forecasting software has been specifically design for.

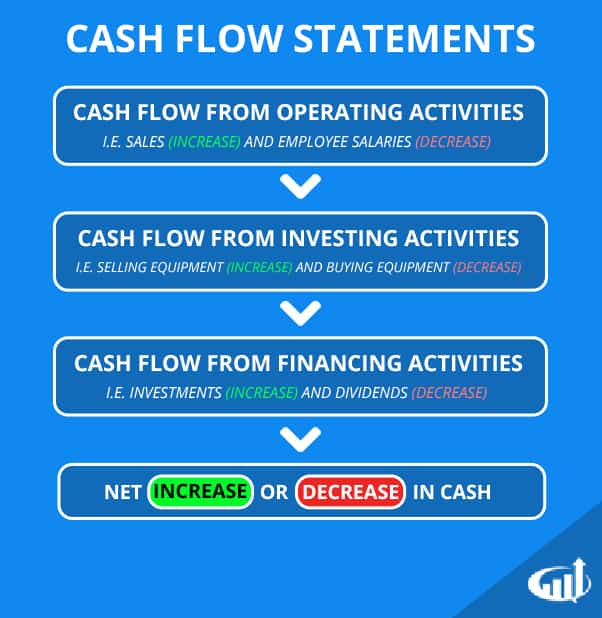

Cash flow varies depending on the activity of. When the company raises cash by issuing shares or by getting a loan from the bank it is shown in the financing cash flow section. A cash flow statement is a financial statement that summarises the amount of cash that enters and leaves your business giving you more information about the amount of working capital thats available over a given period.

Operating cash flow definition. Cash flow is the net amount of cash that an entity receives and disburses during a period of time. The amount of net cash generated by an investment or a business during a specific period.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)