Supreme Define Trial Balance In Accounting

To run the trial balance you will need to select the period.

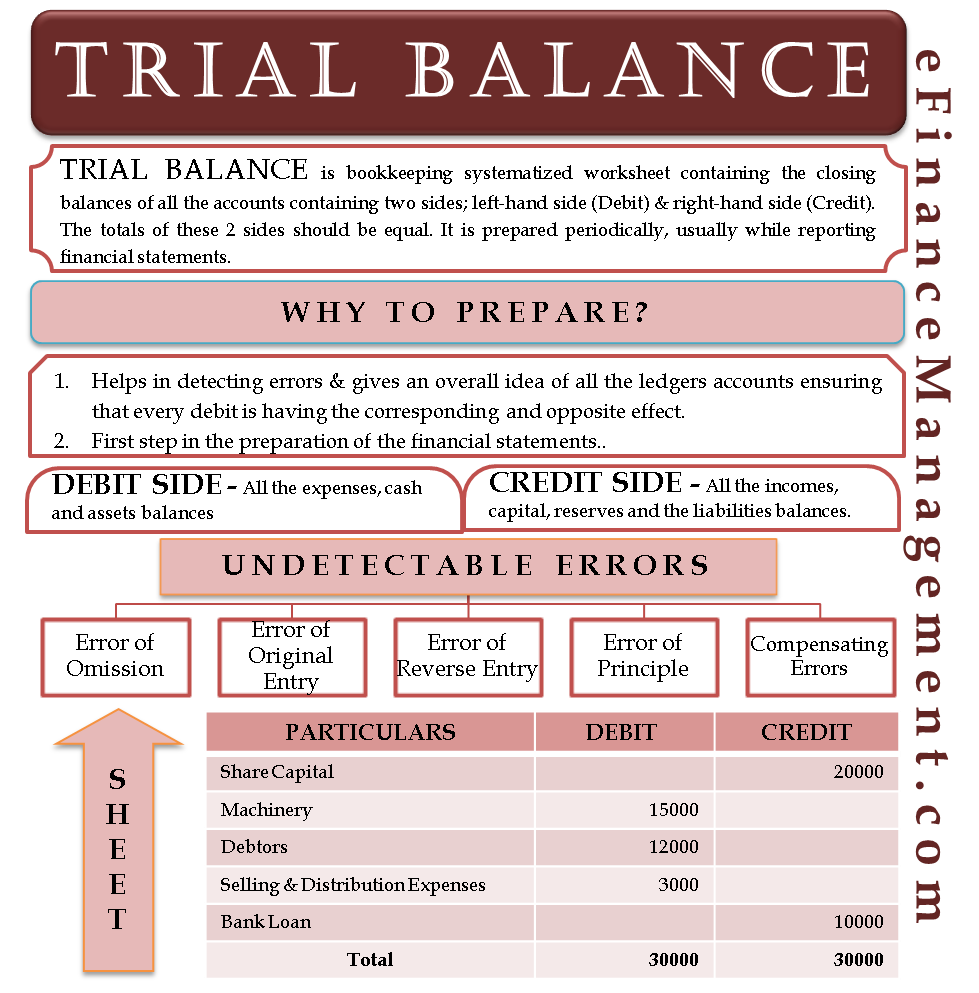

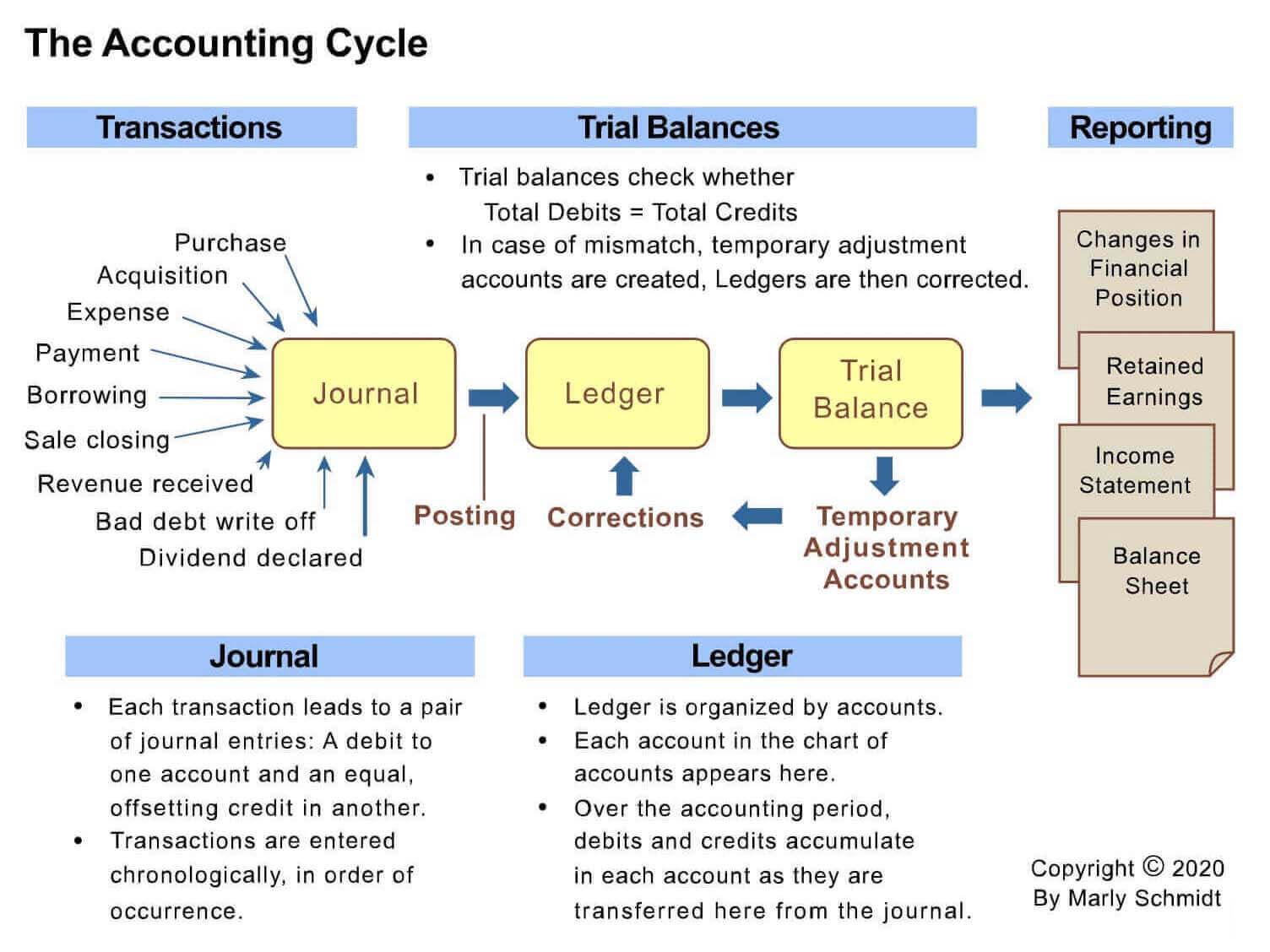

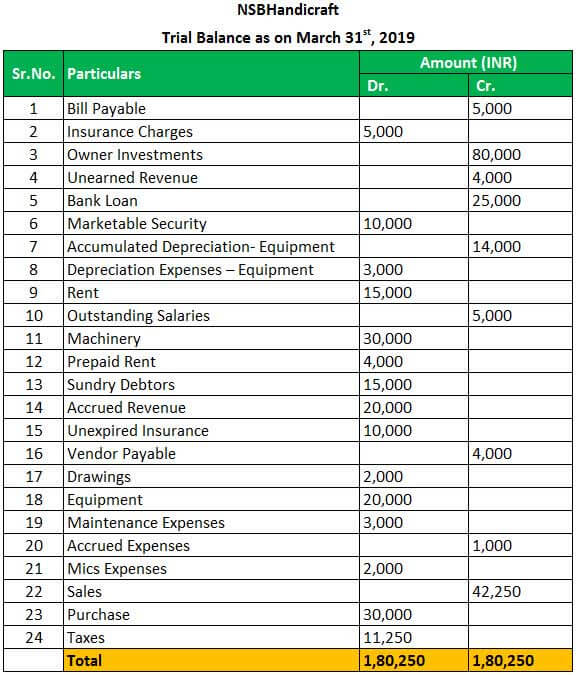

Define trial balance in accounting. In essence its summary of all of the t-account balances in the ledger. The trial balance sums up all the debit balances in one column and all the credit balances in another column. Trial Balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements.

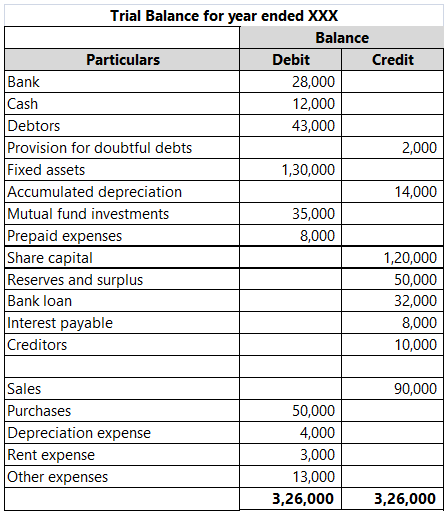

Purchase of Raw Material in cash 2500000. Often the accounts with zero balances will not be listed The debit balance amounts are listed in a column with the heading. What Is a Trial Balance.

The zero items are not usually included. Trial balance is a bridge between accounting records and financial statements. A trial balance lists the ending balance in each general ledger account.

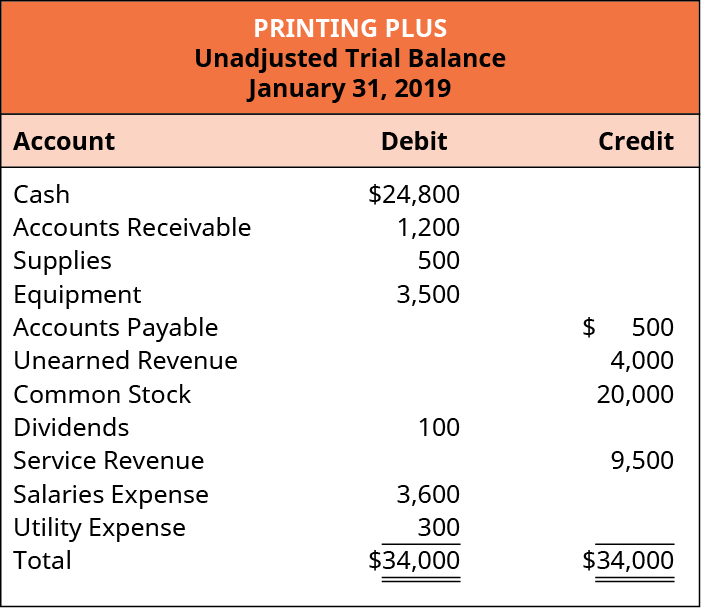

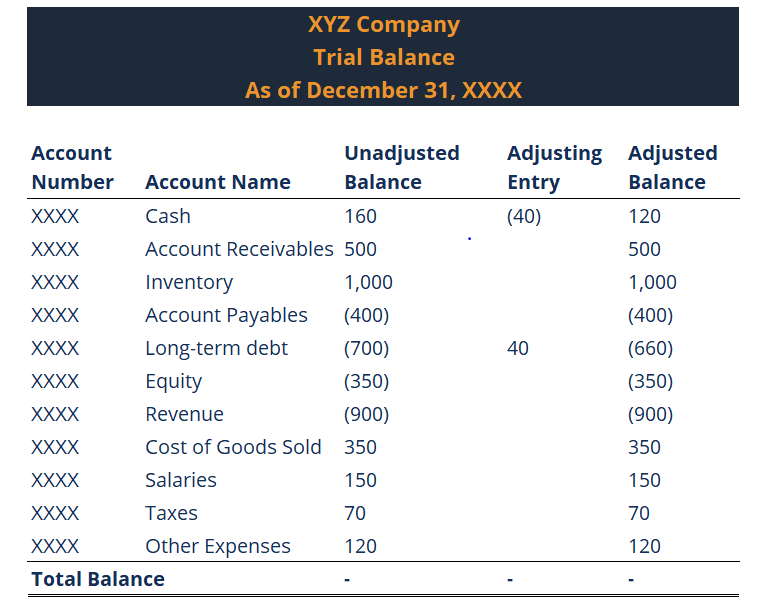

In other words its a trial balance that is prepared at the end of the year to reflect the year-end adjustments. Trial balance is the records of the entitys closing ledgers for a specific period of time. Trial Balance Example 2.

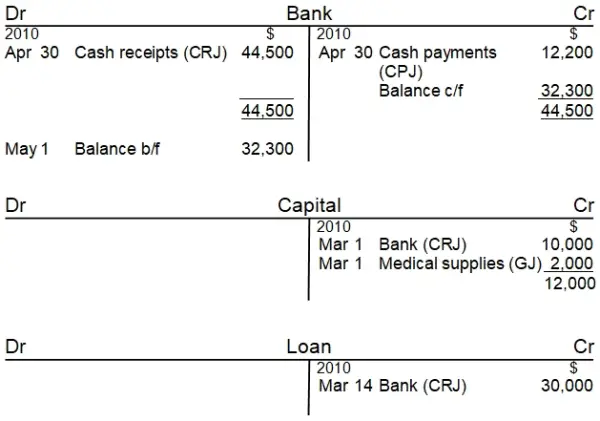

Purchase of Raw Material on credit 2500000. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Ledger balances are segregated into debit balances and credit balances.

The trial balance is a report run at the end of an accounting period listing the ending balance in each general ledger account. At the end of the period the ledgers are closed and then move all of the closing balance items into trial balance. An adjusted trial balance is a list of accounts and their balances at the end of an accounting period after the adjusting journal entries have been posted.