Recommendation Treatment Of Prepaid Expenses In Profit And Loss Account

The calculation of profit follows the following formula Revenues - Expenses Profit or Loss.

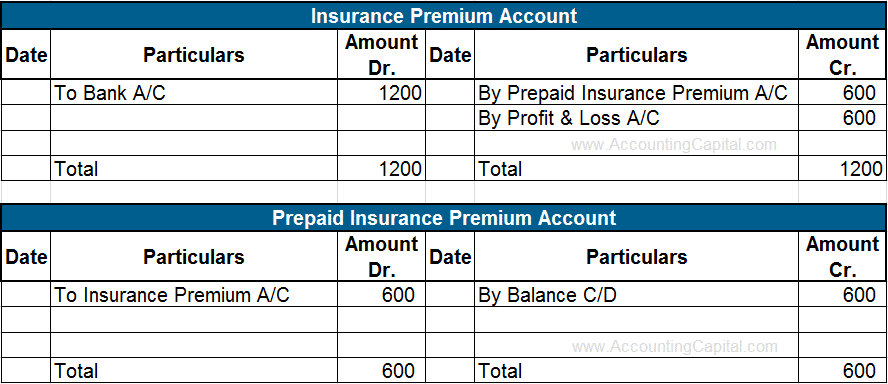

Treatment of prepaid expenses in profit and loss account. Adjustment is done in profit and loss accountand balance sheet. By crediting the Insurance Premium Account by Rs. Depreciation on fixed Assets refers to Decrease in the value of fixed assetsdue to their use wear and tear.

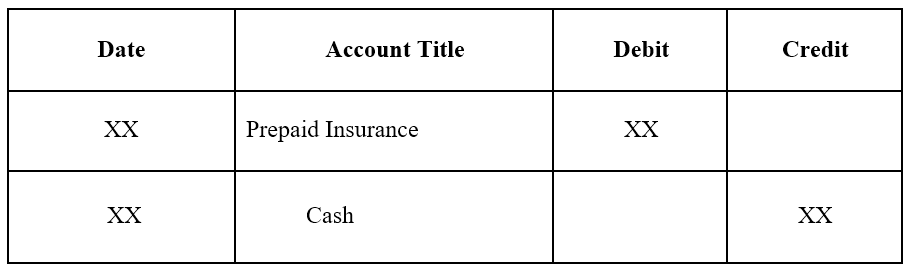

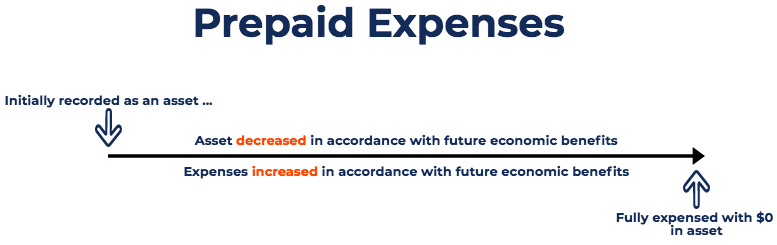

The adjusting journal entry for a prepaid expense however does affect both a companys income statement and balance sheet. Prepaid Expense Journal Entry At the end of January one third of the prepaid rent expense will have been used up as the business has used the premises. What is the Profit and Loss Statement PL.

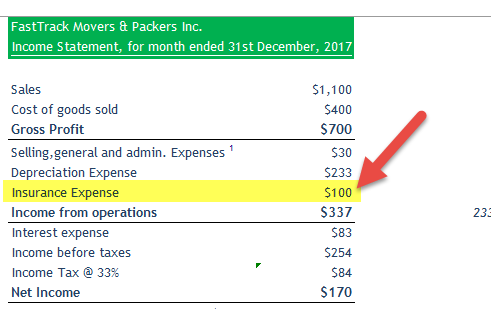

Expenses Income Statementsay 10000. Inventory of materials in hand Ac. Being 100 take up of prepaid expenses as expenses in the Income Statement.

Dr Expense Ac Being expense paid in advance is adjusted over the respective period by adjustment entry 4. While preparing the Trading and Profit and Loss Ac we need to add the amount of outstanding expense to that particular expense. 3000 at which figure it will appear in the Profit and Loss Account.

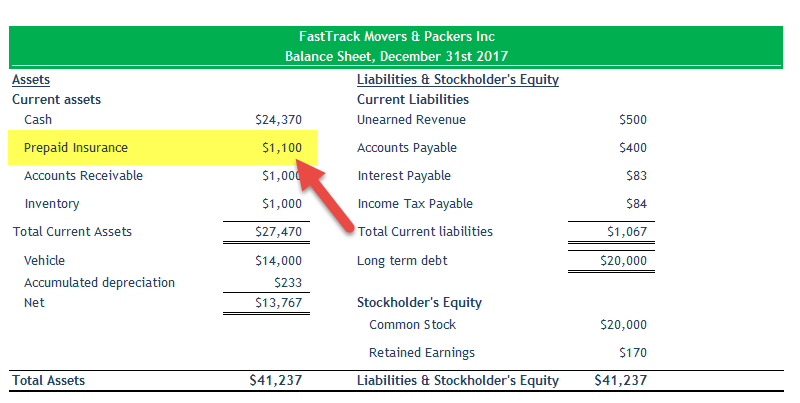

The prepaid expense is shown on the assets side of the balance sheet under the head Current Assets. If consumed over multiple periods there may be a series of corresponding charges to expense. Adjustments is done in trading account profit lossaccount and balance sheet.

The prepaid expense is deducted from the particular expense while preparing a profit and loss statement. Treatment of Prepaid Expenses in Final Accounts or Financial Statements. The prepaid portion of the expense unexpired is reduced from the total expense in the profit loss account.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)