Formidable Restructuring Cost On Income Statement

Primary financial statement caption encompassing revenue from sale of goods and services rendered in the normal course of business.

Restructuring cost on income statement. What is a goodwill impairment charge. These charges involve asset write-downs and liability accruals that will be paid off in future years. Location in the income statement.

Excludes expenses associated with a discontinued operation or an asset retirement obligation. Restructuring costs involve either the costs in writing down the cost of assets because the assets have lost value or the costs of closing a business and letting people go. A restructuring charge will be written in financial analysis as decreasing a companys operating income and diluted earnings.

Other Restructuring Costs duration. Restructuring costs are in the scope of IAS 37 1 with the exception of employee termination benefits which are accounted for under IAS 19. Restructuring charges may cost the company immediately but are beneficial in the long run.

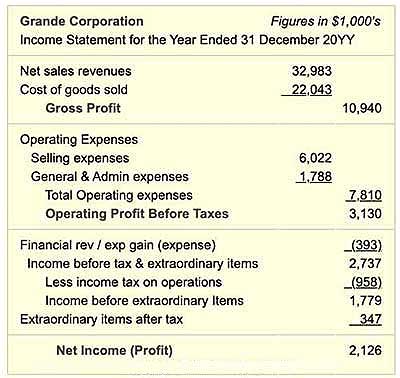

Restructuring expense is defined as the cost a company incurs during corporate restructuring. Reporting entities are also permitted to separately present in income from continuing operations exit or. Restructuring fees are nonrecurring operating expenses that show up as a line item on the income statement and factor into net income.

These costs are usually not part of the normal operations of a business and analysts exclude them from their earnings number because of that. Restructuring charges in the financial statements Income Balance Statement Sheet An operating Creates a expense when restructuring the charge is liability when the taken charge is taken Liability is No expense reduced by when future cash amount of cash outlays are made outlays when made Tuesday February 10 2009 13. ASC 420-10-S99-2 SAB Topic 5P Restructuring Charges requires reporting entities to present restructuring charges and related asset impairment charges as a component of income from continuing operations separately disclosed if material.

Many of the nonrecurring expense or loss items involve declines in the value of specific assets. They are considered nonrecurring operating expenses and if a company is undergoing restructuring they show up as a line item on the income statement. Recognise a provision only if there is an obligation at acquisition date IFRS 311 Restructuring provisions should include only direct expenditures necessarily entailed by the restructuring not costs that associated with the ongoing activities of the entity.